S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 May, 2022

By Brian Scheid

The S&P 500 this year is off to its worst start in 83 years and equity analysts do not see much hope for a turnaround anytime soon.

Multiple factors, including the Federal Reserve's expected push this week to rapidly hike interest rates while reducing its nearly $9 trillion balance sheet, will certainly weigh on stocks in the near term. And there are few likely scenarios to spark a rebound.

"We're probably not out of the woods yet," said John Stoltzfus, chief investment strategist with Oppenheimer Asset Management.

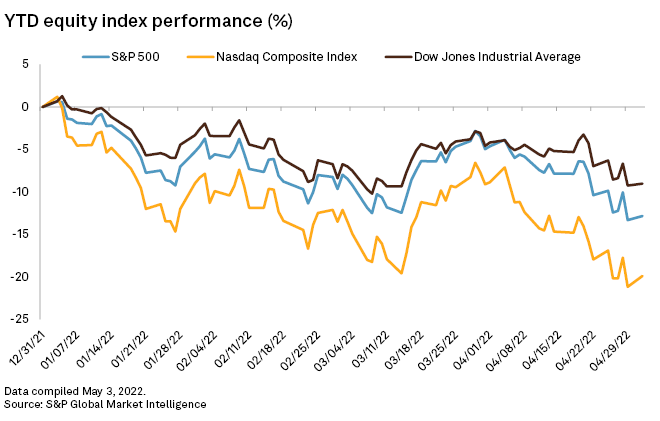

Since the start of the year, when the S&P 500 hit an all-time high, the large-cap index has fallen 12.8%, its worst yearly start since 1939. In April, the S&P 500 fell 8.8%, its worst month since March 2020 and its worst April since 1970.

The tech-heavy Nasdaq Composite Index has fared even worse, down nearly 20% since the start of the year.

Sentiment down

Last week, the Bureau of Economic Analysis estimated that U.S. gross domestic product fell 1.4% in the first quarter of this year compared to the first quarter of 2021, the economy's first contraction since the second quarter of 2020, at the start of the pandemic.

"Sentiment is putrid right now," said Paul Schatz, president of Heritage Capital. "Investors see no hope with the Fed, inflation, Ukraine and China. All that's missing is the final cathartic plunge."

With lockdowns in China boosting the likelihood of more supply constraints, inflation soaring by historic levels and geopolitical uncertainty continuing from the war in Ukraine, the odds of stagflation or the start of a recession have increased.

"Investor pessimism remains high as the short-term inflation outlook could heat up some more given all the uncertainty with the war in Ukraine and over China's COVID situation and constant strain with global supply chain issues," said Edward Moya, a market analyst with OANDA.

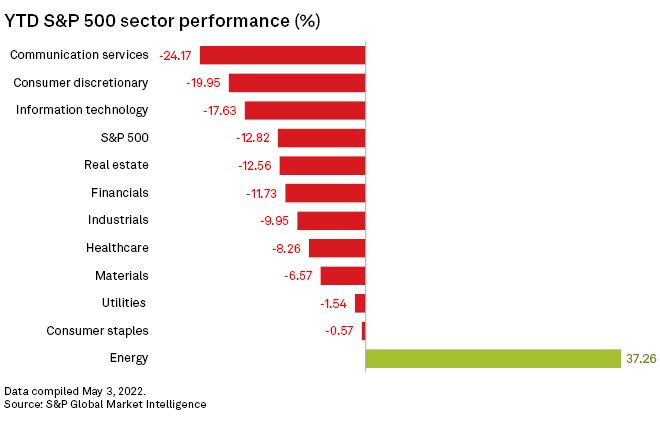

The recent decline has been relatively uneven. The S&P 500's communication services (down 24.2%), consumer discretionary (-20%) and information technology sectors (-17.6%) have been hit the hardest since the start of the year. The energy sector, bolstered by high oil prices, is up 37.3% since the start of the year.

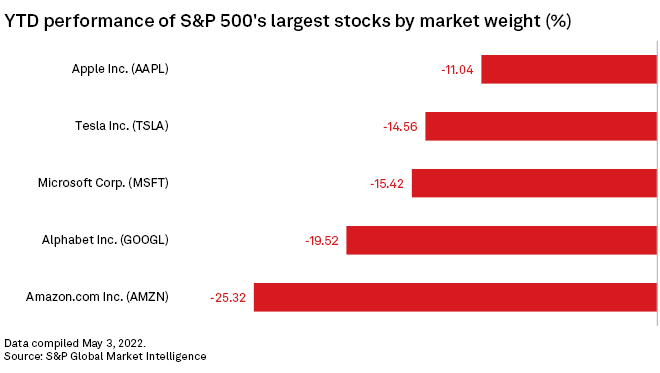

Many of the market's mega-cap stocks also have lost significant ground this year. The S&P 500's five largest stocks by market cap, Apple Inc., Microsoft Corp., Amazon.com Inc., Tesla Inc. and Alphabet Inc., have lost an average of 17.1% since Jan. 1.

"Big tech just can't live up to valuations, and many investors are worried that the bond market sell-off could overextend, and that would put added pressure on the beaten-up sector," Moya said.

Several big-name stocks have lost considerable ground since the start of the year, notably Netflix Inc., down 66.9%, and Amazon, down 23.8% in April alone.

These high-profile losses have made the current market drawdown seem far worse than the overall 12.8% decline so far, said Michael Batnick, director of research at Ritholtz Wealth Management.

"This is a weird market," Batnick wrote in a May 1 post. "Tech investors are experiencing the dot-com blowup redux, while index investors are experiencing a very normal correction."