S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Apr, 2023

The recent tumult in the banking sector rippled through US stock market flows in March, causing the biggest players in equities to shift positions going into April.

Institutional investors initially sold off stocks as Silicon Valley Bank collapsed and additional turmoil spread throughout the banking sector, then moved to buy as the risk of economic contagion eased, according to the latest S&P Global Market Intelligence data. Hedge funds used the bank stress as an early buying opportunity, dismissing speculation that a significant crisis was at play.

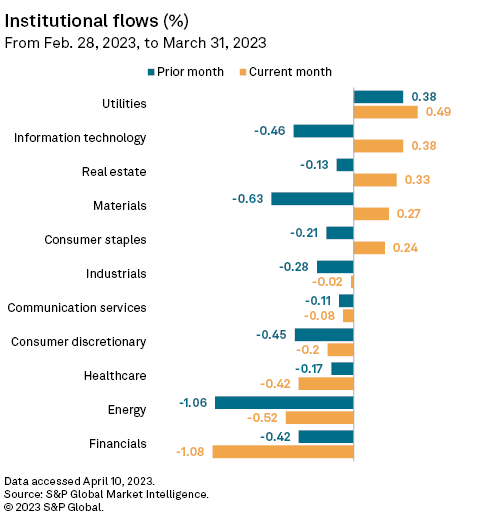

Institutions sold off about $17.82 billion of stocks in the first two weeks of March. The following week, institutions became net buyers and increased positions by more than $1.93 billion. For the month, the group sold a net of $20.17 billion in equities.

"For the month of March specifically, we really saw two different narratives in the first versus second half of the month," Christopher Blake, executive director of S&P Global Issuer Solutions, said in an email.

Institutions reduced exposure to financials by 1.1% in March, compared to 0.4% in February. The group increased exposure to consumer staples, materials, real estate, information technology and utilities during the month, the data shows. Institutions reduced exposure to every sector except utilities in February.

"This would suggest the group's concerns about contagion were alleviated in the latter part of the month as the market recovered, though they still generally avoided the financials space," Blake said.

Hedge funds buy

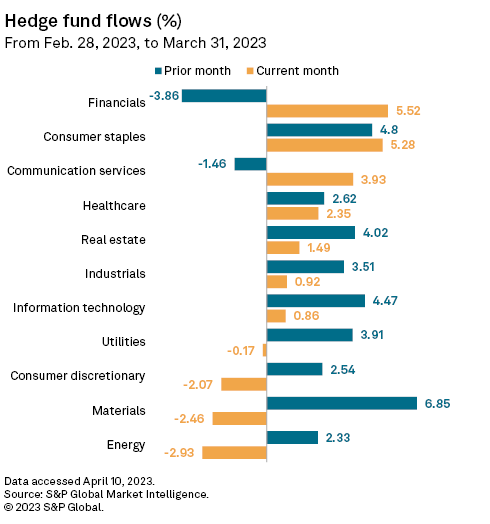

Hedge funds boosted exposure to financials by 5.5% in March after reducing exposure by 3.9% in February. The group increased exposure to financial stocks more than any other sector.

Hedge funds, which tend to be more risk-prone than institutions or retail investors, "viewed the banking 'crisis' as overblown and took advantage to pick up discount stocks," Blake said.

Overall, hedge funds bought a net $13.49 billion of stocks in March.

Hedge funds reduced their exposure to the materials sector by 2.5% in March after increasing it by 6.9% in February. This was likely to free up funds to buy financials stocks, Blake said.

"The group saw an opportunity to pick up banking names at a significant decline and, in order to do so, sold down holdings in the better-performing materials and energy sectors," Blake said.

Retail selling

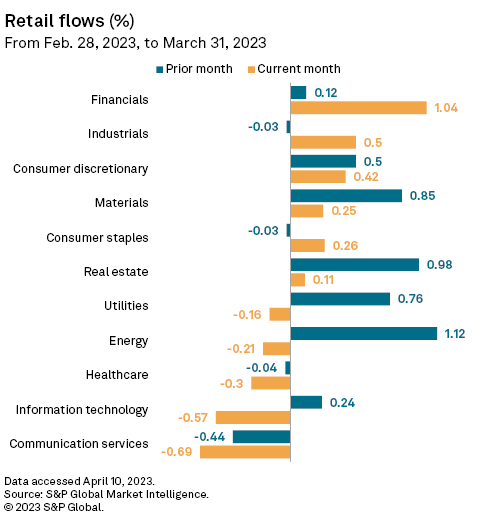

Retail investors also boosted exposure to financials by 1%, up from 0.1% in February. The group reduced exposure to communication services stocks by 0.7% in March after a 0.4% decline in February.

Overall, retail investors were net buyers of stocks in March at $6.40 billion.

Index, exchange-traded funds

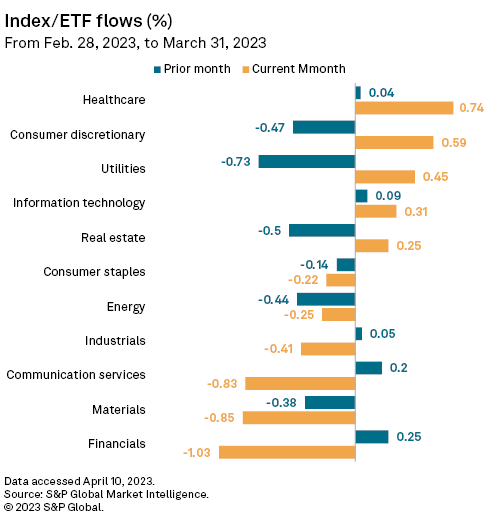

Index and exchange-traded funds reduced their exposure to financials by 1% while selling a net $3.2 billion in stocks in March.

Cumulative activity

Over the last 12 months, institutional investors have shed $338.48 billion in stocks, extending a streak as the leading source of market outflows.

Index and exchange-traded funds were the leading buyers at nearly $71 billion in the year through March 31.

This article highlights capital flows data available from S&P Global Issuer Solutions. Data and insights for this article were compiled by Matthew Albert, Mark Buckles and Christopher Blake.

For more information on this product, please contact Christopher Blake, executive director, at christopher.blake@spglobal.com.