S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Jan, 2021

By Justin Horwath

| Scout Clean Energy is trying to build what could be the first wind farm in Arkansas. Source: Scout Clean Energy |

Scout Clean Energy LLC, a Colorado developer that specializes in unique renewable energy projects, made a bet in 2016 that a 9,000-acre slice of hilly countryside in Carroll County, Ark., could host the first wind farm in the state — and one of the few in the U.S. Southeast.

Pete Endres, who manages the proposed 180-MW Nimbus project, said the site had been looked at as far back as 2008, but standard turbines were not yet large enough then to capture the higher-flying winds typical of the area. Now, Scout is in the advanced stages of development on the project, he said, and it could come online by 2022. The company is still trying to secure a market for its output.

"It is improving and opening up the potential for more areas," Endres said of advanced turbines that reach higher altitudes. But developing wind projects in the Southeast remains a challenge, "especially with the competitiveness with solar in the area."

There are only a few wind power projects, totaling just over 300 MW of capacity, scattered across the Southeastern U.S. They are located in four states: Virginia, West Virginia, North Carolina and Tennessee.

The reasons are clear. For one, the Southeast is not home to the strong, low-altitude gales that developers prize, like those in the central plains, nor does it have the sprawling farm and ranch land of Texas and the Intermountain West, where landowners supplement their incomes by leasing land for wind projects. Also, policymakers in the region have at times been resistant to wind power.

A few wind power projects have crossed the finish line to date. Invenergy LLC's 27-MW Buffalo Mountain Energy Center, located in Andersen County, Tenn., sells power to the Tennessee Valley Authority. In 2019, it operated at a capacity factor of 16.06% at $30.56/MWh, according to S&P Global Market Intelligence data. Iberdrola SA subsidiary Avangrid Inc. owns the 208-MW Amazon Wind Farm US East (Desert Wind Power) in Pasquotank County, N.C., which is within the PJM Interconnection. Power from the facility, which came online in February 2017, is sold to Amazon Web Services Inc. Invenergy and Southern Power Co. in 2020 put into service the 56.2-MW Beech Ridge II Wind Project in Greenbrier County, W.Va. Southern Power is the competitive generation subsidiary of regulated utility giant Southern Co.

Off Virginia's coast, Dominion Energy Inc. subsidiary Virginia Electric and Power Co. built the 12-MW Coastal Virginia Offshore Wind pilot project, which came online in 2020. The utility, which operates as Dominion Energy Virginia, filed in December for approval to build the 2,640-MW Virginia Beach Offshore Wind Project (Coastal Virginia Offshore Wind), which it says will be the largest such project in the U.S.

Several southeastern utilities, meanwhile, are seeking to import wind resources from states further west. Southern subsidiaries Alabama Power Co. and Georgia Power Co. said they plan to purchase more than 900 MW of wind generation from Oklahoma and Kansas, while the TVA has 1,250 MW of wind power under contract and is searching for more renewable energy projects, according to a spokesperson.

Simon Mahan, executive director of the Southern Renewable Energy Association, said, "We are buying a significant amount of wind energy from other regions — we just haven't built a lot yet."

Diverse grid

As more utilities propose massive build-outs of solar power in the region in bids to reduce carbon emissions, some are questioning whether the region can build a carbon-free grid without wind power complementing solar — even if that solar power is backed by battery storage.

When Duke Energy Corp. in August filed integrated resource plans with regulators in the Carolinas, it proposed six scenarios that all add significant amounts of wind power. Regulators will scrutinize the plan this year.

One scenario would add 750 MW of onshore wind. A second would add 2,850 MW of onshore wind and 2,650 MW of offshore wind. And a scenario with no new gas generation calls for 3,150 MW of onshore wind and 2,650 MW of offshore wind. Much of those new wind projects would be added toward the end of the 2020s.

"Is it possible to get to at least 50% [carbon reduction] by 2030 without wind and rely on increasing our solar and our storage?" asked Glen Snider, director of integrated resource planning and analytics at Duke Energy, in an interview. "That is possible. I think it becomes much more challenging when you move beyond 2030 when you get to the much more aggressive carbon-reduction goals."

Katharine Kollins, president of the Southeastern Wind Coalition, a Raleigh, N.C. nonprofit, said wind power is going to be an "absolutely critical" supplement to solar power and battery storage.

"Diversity is key; it's just like a good financial portfolio," she said. "You don't want to be overly reliant on only one generating source when you're talking about a carbon-free grid."

Opening up

On Dec. 11 a coalition of southeastern utilities filed a proposal with Carolina regulators to establish an energy exchange market that advocates say could help the region integrate more renewable energy. The potential market participants commissioned a study that envisioned a renewable energy-based future in the region. The study foresaw up to 3,600 MW of new offshore wind and 4,700 MW of new onshore wind additions through 2040. A baseline outlook, which used the market participants' existing integrated resource plans, found only 631 MW of new wind power additions.

The utilities involved in this effort have said the market they seek to establish would not operate in precisely the same way as an energy imbalance market, nor would it prevent the establishment of an RTO.

Such cooperation "would help to further open the markets to independent wind developers," said Jennifer Chen, president of energy policy consulting firm ReGrid.

"The degree to which wind investments occur depends on interconnection and transmission, and the transmission-owning utility cannot have incentives to favor its affiliate generation-owning companies," Chen said in an email. "The RTO region would also need access [to] wind rich areas, such as offshore and Appalachia, but with near-future technologies this includes much of the Southeast."

An Energy Innovation: Policy and Technology LLC study released in August modeled resource plans for utilities in seven Southeastern states against the benefits of establishing a regional transmission organization. The study, produced with GridLab and Vibrant Clean Energy LLC, found that establishing an RTO could lead to the installation of 41 GW of onshore wind capacity by 2040 in the region.

"Defying the traditional notion that wind power is not a viable generating resource for the Southeast, the model builds a substantial amount of onshore wind throughout the region, owing to both the rapidly declining cost and increasing hub heights and rotor diameters of new wind turbines," the study said.

|

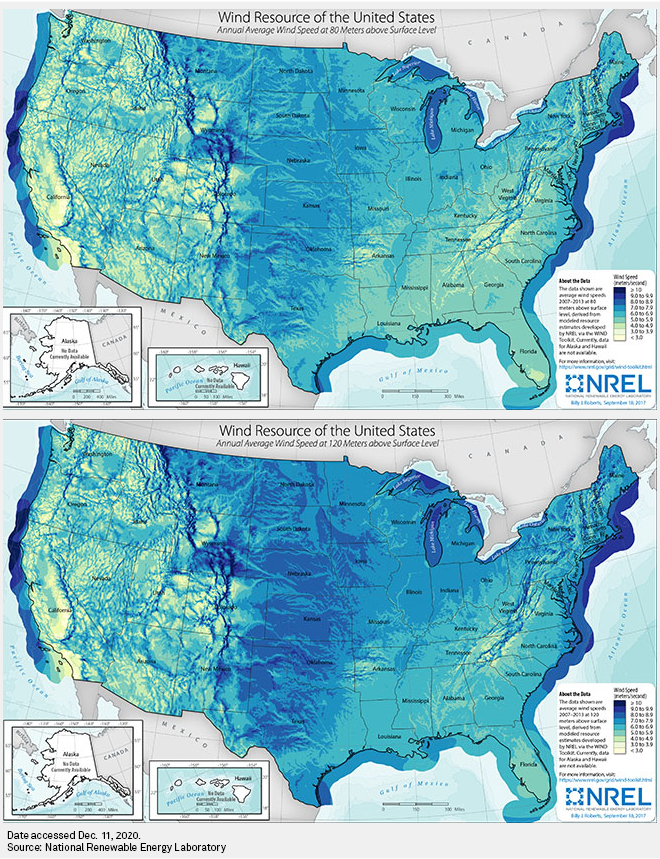

Wind projects in the Southeast will become more viable as turbines grow larger. The top map shows wind speeds at 80 meters, and the bottom map shows wind speeds at 120 meters. |

Taller turbines

In its 2019 annual report, the American Wind Energy Association found the average hub height of installed wind turbines was 90 meters, up from 82 meters in 2015. Wind power proponents hope turbine heights north of 100 meters can better capture wind speeds in the Southeast.

The National Renewable Energy Laboratory in a May 2019 study found an increase in annual average wind speed of 0.5 to 1 meters per second when moving from 80 to 110 meters in height. Broadly speaking, that can translate into median capacity factor gains of two to four percentage points, the study said. But cost reductions for building taller towers are critical for "increasing the viability of wind power in all regions of the country," the study said.

While the Southeast lacks many of the open highways of the Midwest and West that make easier trucking turbine components to sites, it does have one logistical advantage: The region is home to more than 100 factories that produce parts and components for the industry, according to AWEA. General Electric Co. subsidiary GE Renewable Energy's main turbine manufacturing hub is located in Pensacola, Fla.

Referring to hub heights, Snider, of Duke Energy, said, "Our hope is that as the technology evolves and as we move forward that we can overcome some of these challenges and start to introduce" wind power projects in the region.

Offshore opportunities

But wind projects also face state and local policy barriers in the region. Apex Clean Energy Inc. has made bets on wind in the Southeast to frustrating outcomes.

Apex's proposed 189-MW Timbermill Wind Farm hit a roadblock in August 2017 after it failed to obtain a permit in North Carolina's Perquimans County, where officials said it would harm property values. It scaled back the project and proposed to build in adjacent Chowan County, but the project's status is unclear. The company did not respond to a request for comment.

In June 2017, Apex suspended its proposed 71-MW Crab Orchard Wind Project in Cumberland County, Tenn., after Republican Gov. Bill Haslam signed into law a one-year freeze on wind farm development. Apex's 200-MW Volunteer Wind Farm was reportedly exempt from the freeze, and Apex argued on its website that such wind projects would complement solar power in the Southeast during on-peak energy hours in the winter. The project is now terminated, according to S&P Global Market Intelligence data.

Given those barriers, offshore wind farms may be the best avenue for coastal states to develop new projects.

Snider, of Duke Energy, pointed to the myriad barriers to building onshore wind in the Carolinas. Where the wind blows the strongest, on the coasts and the mountains, there are tourism, military, viewshed and environmental roadblocks to development.

"We're more and more looking at offshore," he said.

Avangrid in 2017 paid roughly $9 million for a 122,405-acre wind energy lease area 24 miles off the shores of North Carolina. Avangrid believes its Kitty Hawk Offshore Wind Farm has the potential for 2,500 MW of capacity. In April, the Bureau of Ocean Energy Management approved the project's site assessment plan, which allows Avangrid to collect data on the lease site as a precursor to a construction and operations plan.

In May 2020, North Carolina — which ended a moratorium on wind power projects in December 2018 — issued a request for proposals to study the state's ports and manufacturing supply chain for offshore wind. The request "marks an exciting milestone in North Carolina's efforts to seize on the economic development potential of the offshore wind industry," said Chris Chung, executive director of the Economic Development Partnership of North Carolina, in a statement.