S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Nov, 2022

By Garrett Hering and Susan Dlin

U.S. solar panel imports spiked in the third quarter, at least temporarily reversing a trend of plummeting shipments from abroad.

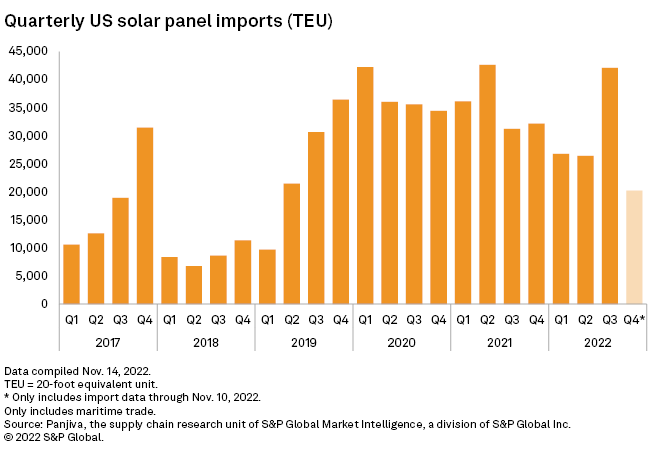

The number of shipping containers carrying solar photovoltaic, or PV, panels to American ports during the quarter jumped 59% quarter over quarter and rose 35% from a year ago, according to research firm Panjiva.

The rebound came after U.S. President Joe Biden in June waived certain import tariffs on PV cells and panels from Cambodia, Malaysia, Thailand and Vietnam. However, a U.S. Commerce Department investigation has continued into whether crystalline solar manufacturers relied on factories in Southeast Asia to circumvent American tariffs on imports from China.

A preliminary determination in the probe, requested by small California-based PV panel maker Auxin Solar Inc., is anticipated Dec. 1. More than 240 solar and storage companies have called on Commerce Secretary Gina Raimondo to reject new anti-circumvention tariffs and to issue a negative preliminary determination.

An affirmative determination "would create new uncertainty for American solar businesses, stifle deployment and limit American solar jobs," the Solar Energy Industries Association said in a Nov. 28 letter to Raimondo, signed by the companies. Imposition of new import tariffs would be "entirely counterproductive" to the Biden administration's ambitious decarbonization goals and efforts to unlock investment in U.S.-based solar manufacturing with incentives in the Inflation Reduction Act, the letter said.

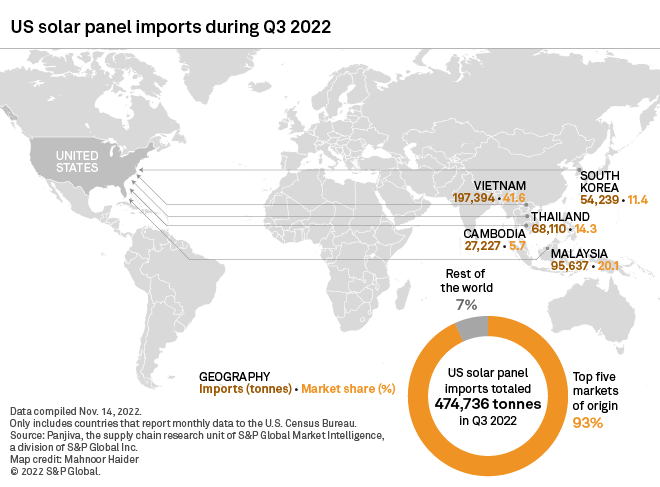

The four Southeast Asian countries at the center of the Commerce Department investigation accounted for roughly 82% of the 474,736 tonnes of solar panels imported into the U.S. in the third quarter, according to Panjiva. Vietnam accounted for 41.6% of imports during the period, followed by Malaysia with 20.1%, Thailand with 14.3% and Cambodia with 5.7%.

Another 11.4% of imports came from South Korea, while China accounted for only 0.1%.

The import resurgence comes as U.S. developers race to complete delayed solar projects and several domestic producers, including First Solar Inc. and Hanwha Q Cells Americas Holdings Corp., an affiliate of South Korea's Hanwha Solutions Corp., expand their U.S. manufacturing footprints.

Panjiva is the supply chain research unit of S&P Global Market Intelligence, a division of S&P Global Inc.