Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Sep, 2021

By Justin Horwath and Susan Dlin

Solar power capacity additions in the second quarter of 2021 dipped compared to the year-ago period as developers encountered supply-side headwinds. However, demand remained strong, with a robust pipeline of projects totaling 17,428 MW under construction.

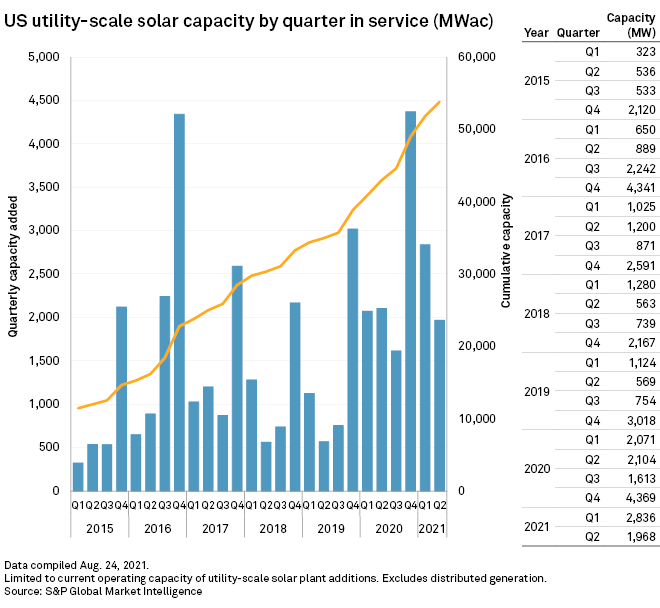

Developers put into service 1,968 MW of utility-scale solar power capacity from April to June, according to newly compiled S&P Global Market Intelligence data. That is 31% less than the amount installed in the first quarter, when 2,836 MW went into service. In the first half of 2021, 4,804 MW of solar power went online, a 15.1% increase from the year-ago period and nearly halfway to the 10-GW total from all of 2020.

The U.S. now has 53,792 MW of total solar power capacity, a figure that excludes distributed generation.

Typically the second and third quarters are the slowest for solar power capacity additions. But the second quarter of 2021 saw fewer capacity additions than the year-ago period, when 2,104 MW was connected to U.S. power grids. Developers  in 2021 have been hit with supply chain constraints and rising prices.

in 2021 have been hit with supply chain constraints and rising prices.

Despite the 6.5% year-over-year dip in capacity additions, demand remains strong from corporations and governments. Two of the largest solar farms built in the quarter serve the fossil fuel industry in the West Texas oil fields. The U.S. military is using electricity from the third-largest solar farm built in the quarter, Southern Co.'s 128-MW Robins Air Force Base Solar Project in Georgia.

Big capacity additions on horizon

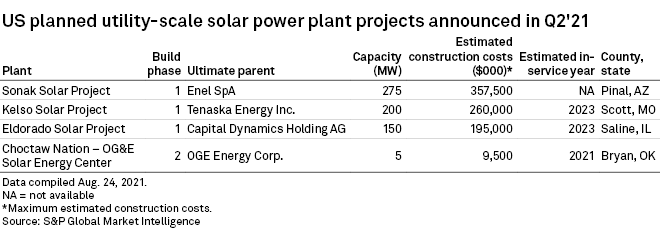

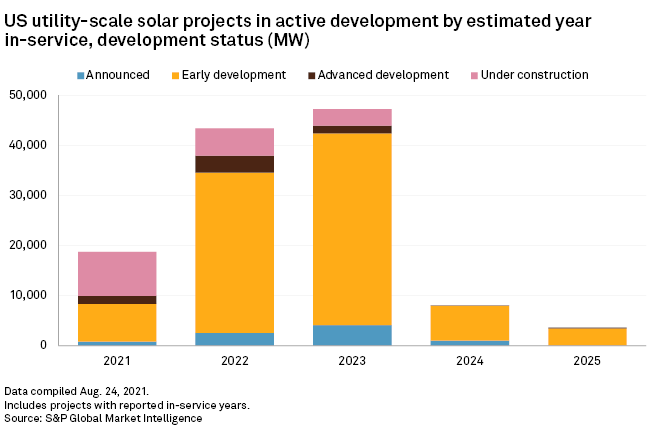

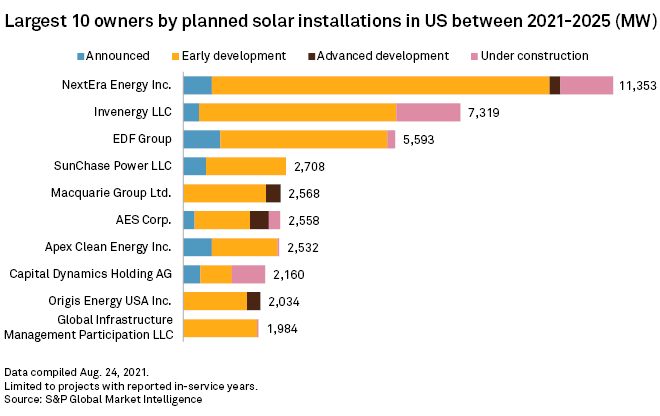

Looking ahead, the U.S. has a development pipeline totaling more than 120,850 MW of solar power capacity to be built through 2025. In addition to projects under construction, that includes 6,778 MW in advanced development, 88,210 MW in early development and 8,443 MW of announced projects. Developers in the second quarter announced four new solar projects totaling 630 MW, the largest being Enel SpA subsidiary Enel Green Power's proposed 275-MW Sonak Solar Project in Pinal County, Ariz. Combined, the four projects will cost $822 million to construct, according to the data.

NextEra Energy has the largest pipeline of U.S. solar developers, with 11,353 MW of projects underway, including 1,394 MW of projects under construction. The Juno Beach, Fla., power company completed four solar projects totaling nearly 300 MW in Florida in the second quarter as its subsidiary Florida Power & Light Co. proceeds with its plan to build 30 million solar panels in the state by 2030. Aggressive state solar policy has helped move forward the plan, which NextEra has said is 40% complete.

NextEra's second-quarter additions in Florida include the Discovery Solar Energy Center, FPL Orange Blossom Solar Center, FPL Willow Solar Energy Center and Sabal Palm Solar Energy Center, each of which has just under 75 MW of capacity in order to avoid a rigorous state certification process for power plants 75 MW or larger.

Business booming in Texas

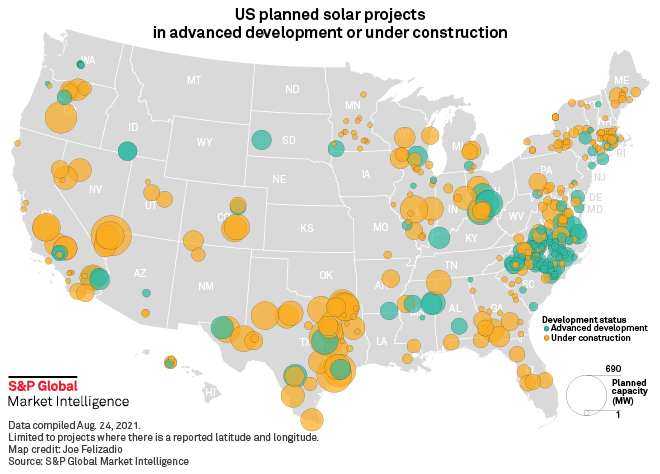

Texas leads the nation in solar projects in advanced development or under construction, with 7,416 MW of capacity in the late-project phases. The majority of that capacity, 6,626 MW, is under construction. North Carolina has 2,625 MW of capacity in advanced development or under construction. California came in third, with 2,187 MW of such projects.

Attracted by the cheap costs of solar power, fossil fuel companies are helping drive demand in West Texas. In April, the U.S. Energy Information Administration projected Texas will add a record 10 GW of utility-scale solar power capacity by the end of 2022, with 30% of the additions in the sun-soaked Permian Basin.

Danish energy giant Ørsted A/S, through its U.S. subsidiary Ørsted, completed the 420-MW Eunice Solar Project (Permian Energy Center) near Midland, where Permian Basin oil drillers have been thirsting for more electricity. The solar plant, the largest finished in the second quarter, features 40 MWac of battery storage on a 3,600-acre site to store power produced by its 1.3 million solar panels. Oil and gas major Exxon Mobil Corp. contracted for 250-MW of capacity from the project, according to S&P Global Market Intelligence records. Exxon, which has resisted investments in wind and solar power, plans to boost its Permian Basin output in the near term.

The 250-MW RE Maplewood Solar Project, the second-largest solar project completed in the quarter, also serves the fossil fuel industry in the Permian Basin. Canadian Solar Inc. subsidiary Recurrent Energy LLC developed the project and sold it in July to an unnamed U.S. annuity and life insurance company. The Pecos County solar farm has two power purchase agreements in place, one with brewer Anheuser-Busch InBev SA/NV and the other with oil and gas company Energy Transfer LP. David Coker, a vice president for Energy Transfer, in 2019 said, "While we mainly rely on electrical energy powered by natural gas, we do use a diversified mix of energy sources when it makes economic sense to do so."