Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Mar, 2021

Major U.S. retailers are launching new experiences to lure consumers back to physical stores in the coming months as the economy reopens, and pandemic-fueled digital sales growth is expected to slow down faster as a result, analysts say.

U.S. e-commerce sales are expected to grow to $908.7 billion in 2021, up 13.7% from $799.20 billion in 2020 when the pandemic took hold, according to eMarketer. That compares to a 33.6% spike in 2020 as Americans increasingly moved to shopping online during COVID-19 lockdowns.

Garrett Nelson, senior equity research analyst at CFRA, said retailers are working to drive foot traffic with sales, promotional activity and brand partnerships after a year in which the pandemic-induced online gains buoyed growth for companies such as Walmart Inc., Target Corp. and Costco Wholesale Corp.

"E-commerce has been moderating for a couple quarters now; we think that continues more drastically as the vaccine is distributed and the pandemic gradually fades," Nelson said. "It's going to be more balanced between physical store sales and e-commerce."

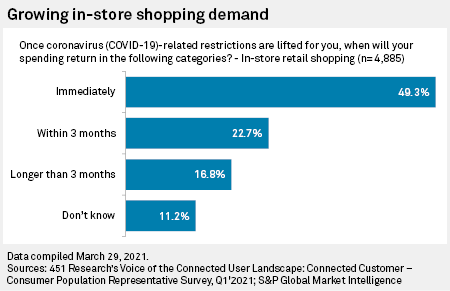

Pandemic-weary consumers appear ready for some in-store shopping: Nearly 50 percent of consumers surveyed by 451 Research in the first quarter said they plan to "immediately" start shopping at retail stores once COVID-19 restrictions are lifted. Another 22.7% said they will start spending in stores within three months after restrictions lift, and 16.8% indicated it would take longer than three months for them to begin spending in stores, according to 451 Research's first-quarter "Voice of the Connected User Landscape: Connected Customer – Consumer Population Representative Survey."

"People still like to have that personal touch, that human exchange," said Sheryl Kingstone, head of Customer Experience & Commerce at 451, an offering of S&P Global Market Intelligence. "There's still the 'I want to try it on, I want to look at it, I want to browse.'"

Retailers are hoping to offer consumers that personal touch they crave along with unique experiences that will keep them lingering in stores longer. For example, DICK'S Sporting Goods Inc. is hoping to draw traffic with a new prototype store that features a rock-climbing wall and an outdoor field for sporting events. Beauty retailer Sephora USA Inc. is allowing consumers to book appointments in select stores where beauty advisers apply eye shadow, liner and mascara. Target has partnerships with Apple Inc., Ulta Beauty Inc. and The Walt Disney Co. to showcase exclusive merchandise from those brands in hundreds of mini shops within Target locations.

|

Nordstrom is displaying Tonal fitness systems in 40 Nordstrom locations nationwide. |

Meanwhile, Nordstrom Inc. has partnered with home gym company Tonal to install Tonal workout stations at 40 of its U.S. department stores where consumers can demo full-body exercises in-person.

The goal, Kingstone said, is to test the new experiences with a smaller group of shoppers, in anticipation of luring a more fully vaccinated population in the coming months. "They are making the necessary changes in store over the long haul," Kingstone said. "I do think that retail is going to be completely reimagined in the future to be much more experiential than it ever was in the past."

But a population of newly enthusiastic online shoppers is also expected to remain intact long after the pandemic is over. Camilla Yanushevsky, senior equity research analyst with CFRA, said digital-led retailers like Dick's Sporting Goods, Best Buy Co. Inc. and Williams Sonoma stand to benefit from the acceleration of online shopping long-term while utilizing physical stores as showrooms for items like furniture and electronics.

Lululemon Athletica Inc. also will continue to thrive as the company's product mix has been favorable through COVID-19 as consumers stay home but remain active, Yanushevsky said. Lululemon also has a high customer satisfaction rate, which has resulted in a low level of returns, as well as an efficient distribution network that does not chip largely into margins, she said.

Bottom line: Retailers will have to walk the tightrope between serving customers both digitally and physically in a post-COVID-19 world, 451's Kingstone said. "The ability to do things like search online, look for things online, and then potentially go pick up in store, try on in store, reserve in store, is still an extremely important part of that overall consumer experience," she said.