S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Nov, 2022

As U.S. shopping trends normalize after two-plus years of pandemic-driven disruption, retailers including Amazon.com Inc. and Walmart Inc. are preparing for slower online growth and more pricing competition in 2023.

Amazon is looking to offset softer e-commerce demand by cutting fulfillment and transportation capital expenditures, which ballooned during the early stages of the pandemic. Target Corp. and Walmart, meanwhile, will be balancing efforts to improve customers' experiences with brick-and-mortar stores with continued support for their e-commerce businesses, retail experts said.

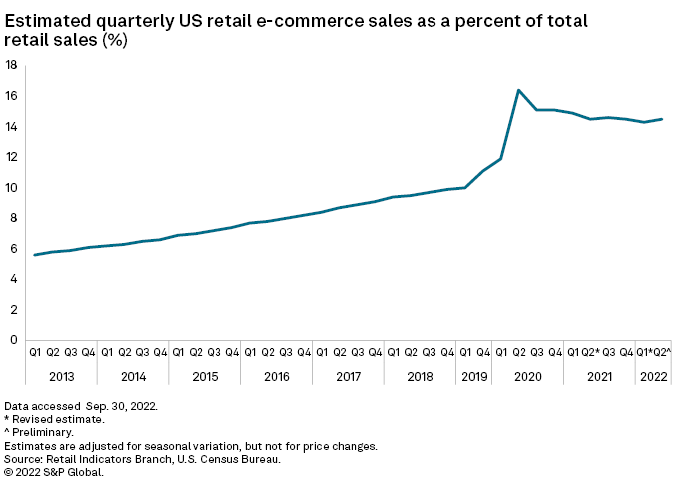

Online retail sales spiked to more than 16% of total U.S. retail sales in the second quarter of 2020 but have since tapered off to about 14.5% of total retail this year, according to estimates by the U.S. Census Bureau.

Holiday shopping and high gas prices may lead to a temporary spike in e-commerce followed by a drop off next year, said Theresa Sheehan, economic analyst with Econoday.

"I think it's entirely probable that [online] sales will exceed 15% in the fourth quarter 2022, but fall off again in the first quarter [of 2023]," Sheehan said.

Inflationary concerns

Stubbornly high inflation is expected to cut into businesses' ability to raise prices without consumer pushback, leading to more deals and promotions in the fourth quarter and into 2023.

"Going forward, every incremental dollar of higher prices will be harder to implement because consumers are pushing back and the competitive environment is intensifying," said Arun Sundaram, senior equity research analyst with CFRA.

According to 451 Research's "Voice of the Customer: Macroeconomic Outlook, Consumer Spending (Population Representative), Holiday Spending Preview 2022," 40% of respondents said they would spend about the same amount of money online during the holidays compared to a year ago, while 17% said they would spend somewhat more online and 14% said they would spend significantly more.

Inflation was cited as the most important factor driving down holiday spending plans among respondents who expected to decrease their spending.

"Shoppers right now are kind of at a record period of disloyalty to retailers and brands. They will shop wherever they think they can get the best deal," said Tim Campbell,

Amazon on Oct. 28 warned of weaker holiday sales for the fourth quarter, largely due to high inflation and weak consumer sentiment. Walmart and Target, both of which report quarterly earnings next week, are also expected to warn of weaker holiday demand.

Amazon's moves to scale back its capital expenditures will help the company weather slowing e-commerce demand, said CFRA's Sundaram.

"They are improving their cost structure ... that is going to help profitability and margins in 2023," the analyst said.

Omnichannel strategies

Walmart and Target will be looking to retain their respective positions in the e-commerce market while investing in store remodels and offering more promotions to lure shoppers in, retail experts said.

"It really goes back to omnichannel — the ability to use stores as distribution facilities, and the ability to offer ship-from-store," said Michael Baker, managing director for D. A. Davidson.

Walmart, whose supply chain is much older than Amazon, is expected to continue investing in automation and other technology; while Target, the smallest of the three, will lean into its popular DriveUp service, in-store pick up and ship-from-store service, retail analysts said.

Brick-and-mortar stores can highlight a multitude of convenient shopping opportunities, while online players leverage subscriptions and seasonal sales events, said Commerce IQ's Campbell.

"Different shoppers want to shop in different ways," Campbell said. "The more platforms you are on, the more ways you allow them to shop, the greater your share."

451 Research is part of S&P Global Market Intelligence.