S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Apr, 2022

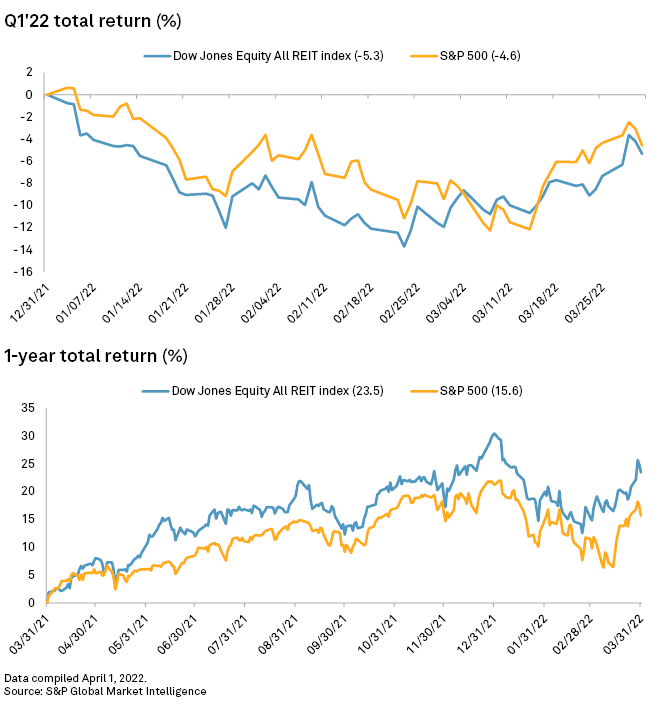

US equity real estate investment trusts share prices dropped alongside the broader market during the first quarter of 2022. The Dow Jones Equity All REIT index logged a total return of negative 5.3% for the period, compared with negative 4.6% for the S&P 500, according to S&P Global Market Intelligence data.

On a one-year basis, REIT stocks outperformed the broader market, with the Dow Jones Equity All REIT index generating a 23.5% return, compared with a 15.6% return for the S&P 500.

Hotel REITs were the best performers in the 2022 first quarter, and the Dow Jones U.S. Real Estate Hotels index finishing the period with a total return of 6.6%. The healthcare and office sectors followed, logging returns of 5.3% and 1.9%, respectively.

On the flip-side, the regional mall REIT index closed the quarter with a return of negative 16.1%, the largest drop of any property sector index. The manufactured homes and industrial REIT indexes followed at negative 14.5% and negative 8.8%, respectively.

Top-performing REITs

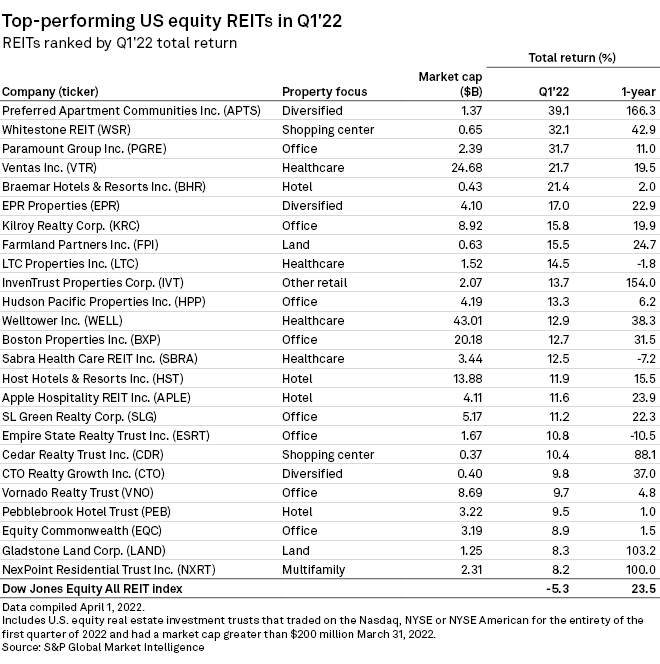

Preferred Apartment Communities Inc. finished the quarter with the highest return of all U.S. REIT stocks, at 39.1%. The share price first spiked during Feb. 10 trading after Bloomberg News reported that the company was exploring a sale. Roughly one week later, the REIT's stock rose further after confirming an agreement to be acquired by Blackstone Inc. for $5.8 billion.

Shopping center-focused Whitestone REIT had the second-highest return of the quarter at 32.1%. The REIT's share price rose roughly 9.6% on Feb. 14 after it announced several leadership transitions. It continued to rise through the end of the quarter as the REIT increased its monthly dividend by 11.6% and reported positive earnings growth for the fourth quarter of 2021.

Office REIT Paramount Group Inc. rounded out the top-three performing REIT stocks, with a return of 31.7% for the quarter. The REIT's share price jumped more than 20% on Feb. 25 after it received an unsolicited buyout offer from Monarch Alternative Capital LP of $12.00 per share in cash.

Bottom-performing REITs

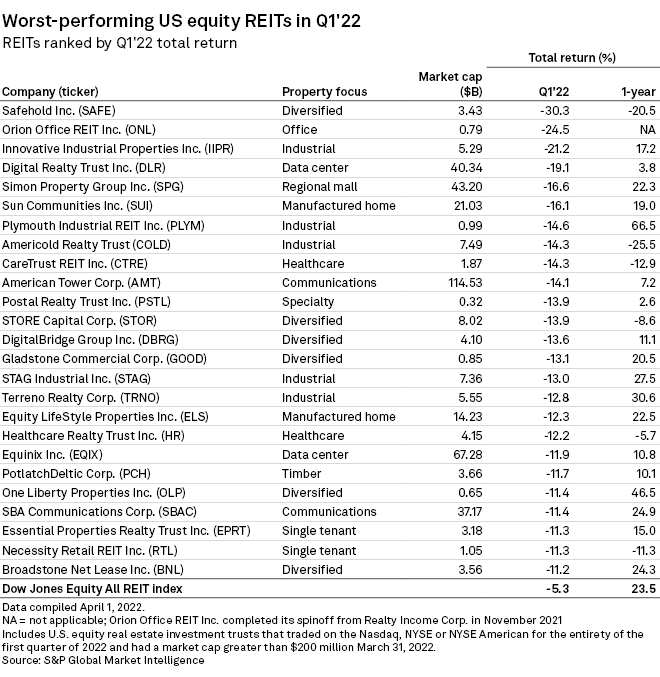

Ground-lease-oriented Safehold Inc. recorded the lowest return during the quarter, at negative 30.3%.

Office REIT Orion Office REIT Inc. and cannabis-oriented Innovative Industrial Properties Inc. followed next with returns of negative 24.5% and negative 21.2%, respectively.