Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Mar, 2023

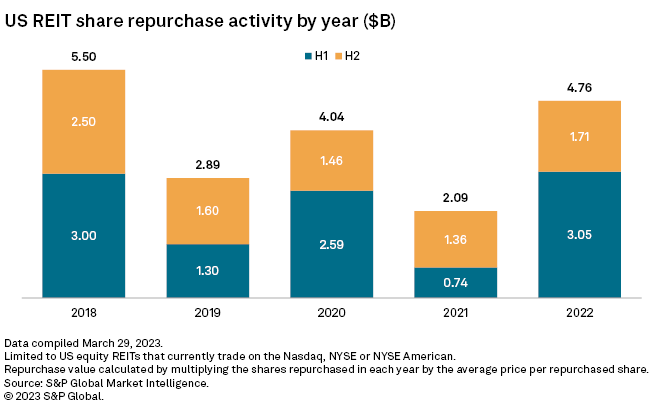

Stock buyback activity by US equity real estate investment trusts hit a four-year high in 2022, with $4.76 billion worth of common shares repurchased, according to an analysis by S&P Global Market Intelligence.

Approximately $3.05 billion of the shares were repurchased in the first half of 2022, while $1.71 billion were bought back in the second half.

The analysis included US equity REITs that trade on the Nasdaq, NYSE or NYSE American.

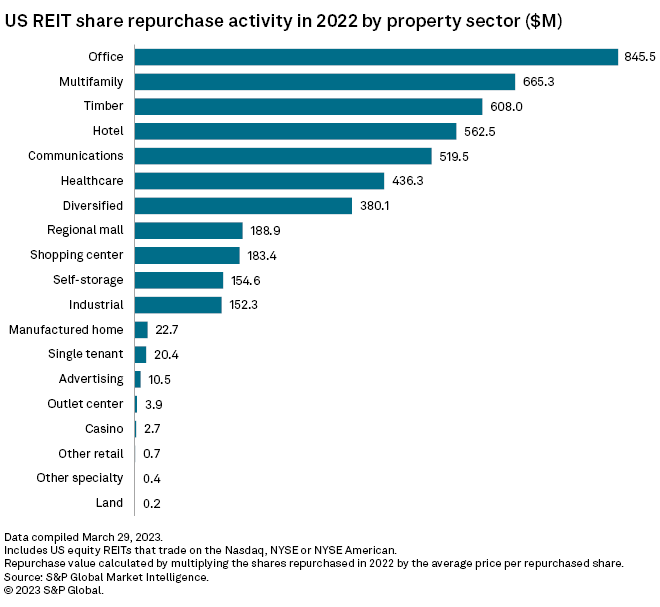

Office, multifamily REITs buy back the most shares in 2022

Office REITs repurchased $845.5 million of shares, the most in 2022 among all property sectors. Within the office sector, Hudson Pacific Properties Inc. bought back the most with $255.3 million of repurchases, followed by Equity Commonwealth at $154.7 million. Additionally, City Office REIT Inc. bought back about 9.2% of its shares outstanding during the year, or approximately $50 million in value.

– Download the Excel file with individual company repurchases.

– Set email alerts for future Data Dispatch articles.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

The multifamily sector had the second-highest value of buybacks at $665.3 million in 2022. Apartment Income REIT Corp. led the sector last year with $316.7 million in buybacks, while Essex Property Trust Inc. was second with $189.7 million in repurchases.

Other prominent share repurchasers during the year included JBG Smith Properties, which bought back $360.7 million worth of common shares, or about 11% of its shares outstanding.

Timber-focused Weyerhaeuser Co. repurchased $550 million worth of common shares in 2022, while communications REIT SBA Communications Corp. bought back $431.6 million of shares during the year.

Meanwhile, hotel REIT Park Hotels & Resorts Inc. repurchased 5.4%, or $229.3 million, of its common shares outstanding in 2022.

New share repurchase programs in 2022

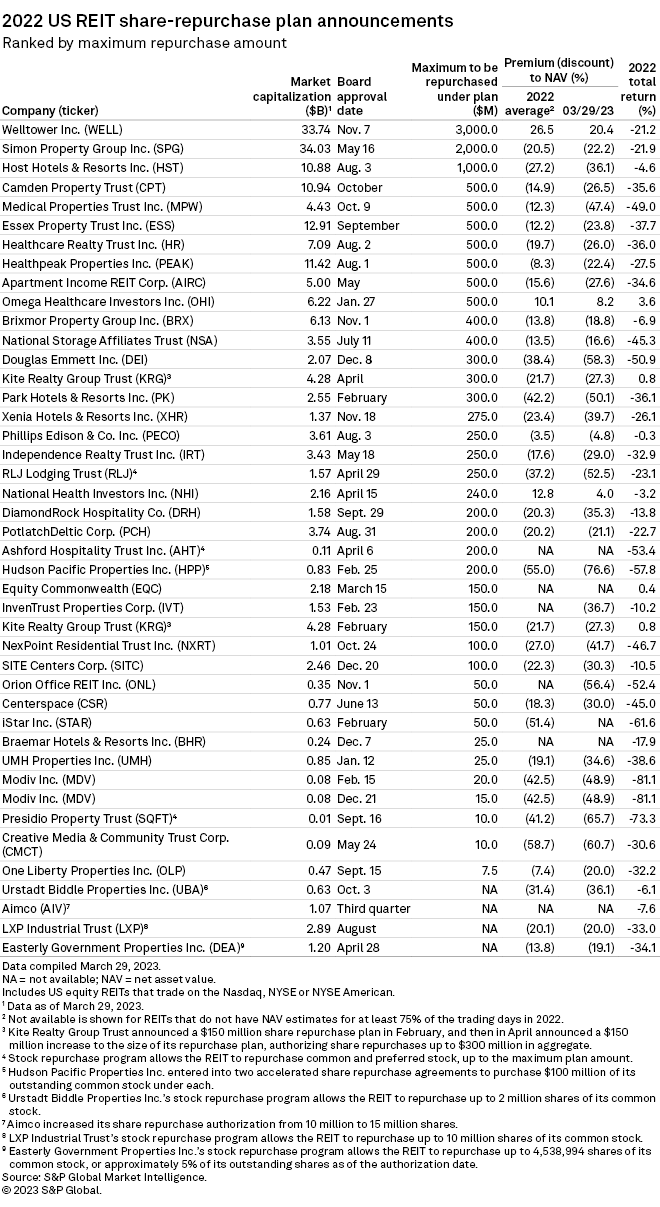

Healthcare REIT Welltower Inc. announced the largest share buyback program for the year, allowing up to $3 billion worth of common shares to be repurchased with no expiration date.

The board of regional mall REIT Simon Property Group Inc. authorized its new share repurchase plan on May 16, 2022, allowing up to $2 billion worth of common stock to be repurchased over a two-year period ending May 16, 2024.

On Aug. 3, 2022, the board of Host Hotels & Resorts Inc. approved an increase to the hotel REIT's share repurchase program, expanding the existing capacity to $1 billion from $371 million.

Four repurchase plans announced in 2022 set a limit on the number of shares to be repurchased, as opposed to a dollar amount.

From the shopping center sector, Urstadt Biddle Properties Inc.'s stock repurchase program allows the REIT to repurchase up to 2 million shares of its common stock, while industrial REIT LXP Industrial Trust's repurchase program allows for the repurchase of up to 10 million shares.

Similarly, office-focused Easterly Government Properties Inc.'s repurchase program allows the REIT to repurchase up to 4,538,994 shares of its common stock, or approximately 5% of its outstanding shares as of the authorization date of April 28, 2022.

Aimco increased its share repurchase authorization to 15 million from 10 million shares in the third quarter.