Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jun, 2022

By Christie Moffat and Chris Hudgins

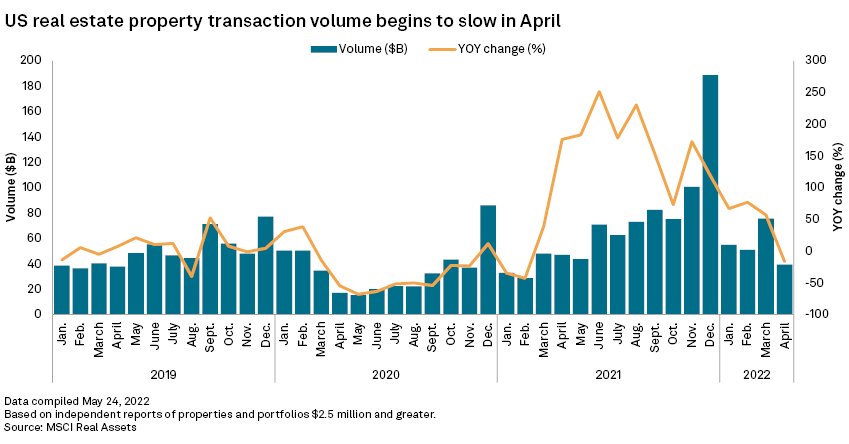

U.S. commercial property transaction volumes fell year over year in April for the first time since February 2021, prompting concerns that inflation and rising interest rates are starting to force the sector into a slowdown.

National transaction volumes equaled $39.4 billion in April, down 16% from the same month in 2021, investment research firm MSCI Inc. data showed. That figure is a steep drop from $75.5 billion in March, which was up 57% from a year ago.

The U.S. Federal Reserve raised interest rates by 0.25% in March and again by 0.75% this week to counter inflation. However, the economic slowdown will also continue to reduce demand for office, warehouse and retail space, Wells Fargo Securities LLC Research Division Senior Economist Mark Vitner commented in an email to S&P Global Market Intelligence.

"We believe the [commercial real estate] market peaked this past year … look for leasing, rents and sales to all rise less than they did last year, and look for vacancy rates to edge higher," Vitner wrote.

The April slowdown affected all property types, according to MSCI. Office transaction volumes fell 69.3% from March and were down 60.4% year over year, while hotels fell 66.7% from March and were down 76.9% from a year earlier. Industrial fell 54% from March and volumes were down 57% year over year.

Other sectors maintained higher transaction volumes than April 2021. Multifamily volumes fell 33.2% from March but remained 7.5% higher than a year ago, while retail volumes fell 36.5% from March but remained 10% higher than a year ago.

Despite the April figures, there has not been a measurable downshift in volumes across the U.S. commercial real estate space just yet, according to CoStar Group Inc. Senior Economist Abby Corbett. But looking ahead, the market is facing challenges that will significantly impact underwriting, investor sentiment and capital market trends in the medium term. Investors that rely more heavily on debt may be the first to back away from making deals.

"The types of investors that will remain active could change — private investors more sensitive to leverage consideration may be the first end of the spear to take the hit," Corbett wrote in emailed comments to Market Intelligence.

Conversely, institutional investors with billions of dollars that need to be deployed are likely to be less sensitive to changes in the debt markets, she added.

Vitner noted that higher interest rates will make riskier investments less attractive, which means prices for properties in the second-best or third-best location will suffer more than properties in prime locations.

Commercial real estate is typically considered a hedge against inflation. Most contracts are written with an inflation adjustment built in, allowing for the majority of costs to be passed on.

Capitalization rate spreads, which represent a property's return on investment, have remained relatively healthy, and there is still plenty of investor capital waiting for deployment, according to Corbett.

"Despite the impact that inflation has on U.S. [commercial real estate], capital pursuing [commercial real estate] as an attractive risk-adjusted investment asset class is still significant enough such that pricing and volumes are holding near historic highs," Corbett said.