S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Aug, 2022

By Karl Angelo Vidal and Annie Sabater

Investments by U.S.-based private equity and venture capital firms in mainland China have declined this year amid concerns about the country's macroeconomic picture.

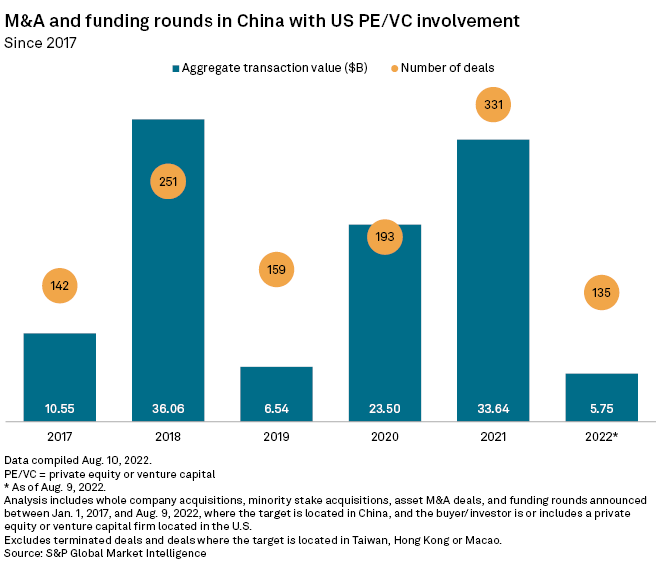

S&P Global Market Intelligence data shows a downward trend in M&A and new funding rounds in mainland China involving U.S. private equity companies, with second-quarter deal values dropping 78.5% year over year. By comparison, private equity deals worldwide experienced a more modest decline of 29.4% year over year during the same period.

Through Aug. 9, transactions involving U.S. private equity and venture capital firms in mainland China recorded an aggregate deal valuation of $5.75 billion, compared to $33.64 billion for all of 2021.

China outlook 'concerning'

In a survey among investors conducted by Preqin in July, more than 30% of respondents expect China to provide the best opportunities in private equity, down from about 60% of those surveyed in 2021.

"China's macro picture remains concerning in our view," Preqin said in a report focused on alternative assets for the second half of the year. "The [People's Bank of China] effectively pegged the [yuan] against the dollar and is reluctant to facilitate a material devaluation of the currency against it, despite the latter's strength ... Instead, the authorities in China have had to tighten domestic financial conditions considerably over recent months, dampening domestic economic activity."

The report cited a "deteriorating" exit environment, as well as asset valuations as the top concerns of private equity investors.

*Click here to download a spreadsheet with data featured in this story.

*Click here to read about global private equity deals in July.

*Click here to explore more private equity coverage.

Tech remains top of mind

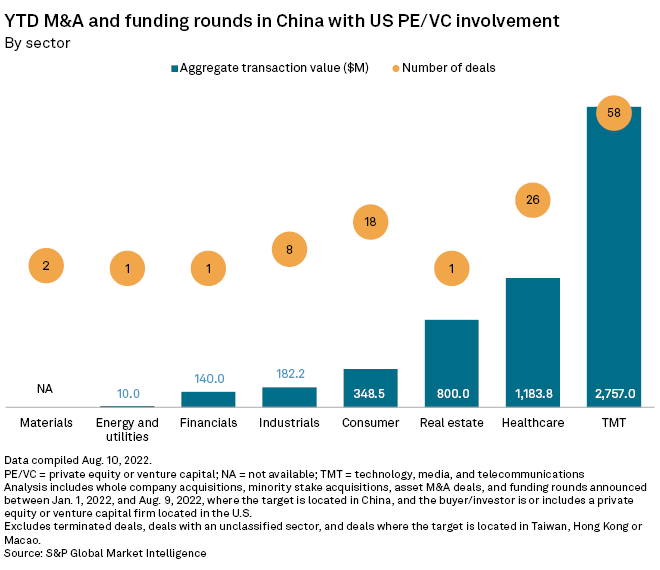

Despite ongoing regulatory scrutiny of technology deals by both the U.S. and China, the technology, media and telecommunications sector recorded the largest number of M&A and funding rounds with U.S. private equity involvement through Aug. 9 at 58 transactions, worth a total of around $2.78 billion. The biggest transaction in the sector thus far is the $671.7 million growth funding round of Guangzhou Cansemi Technology Inc. U.S.-based Walden International and SAIC Venture Capital participated in the round.

The biggest U.S. private equity-backed deal so far in 2022 is the $800.0 million series B investment round of JD Property, in which Warburg Pincus LLC participated.