S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 May, 2023

The US private auto insurance industry had a year to forget in 2022 as the business line reported its worst underwriting results in over two decades.

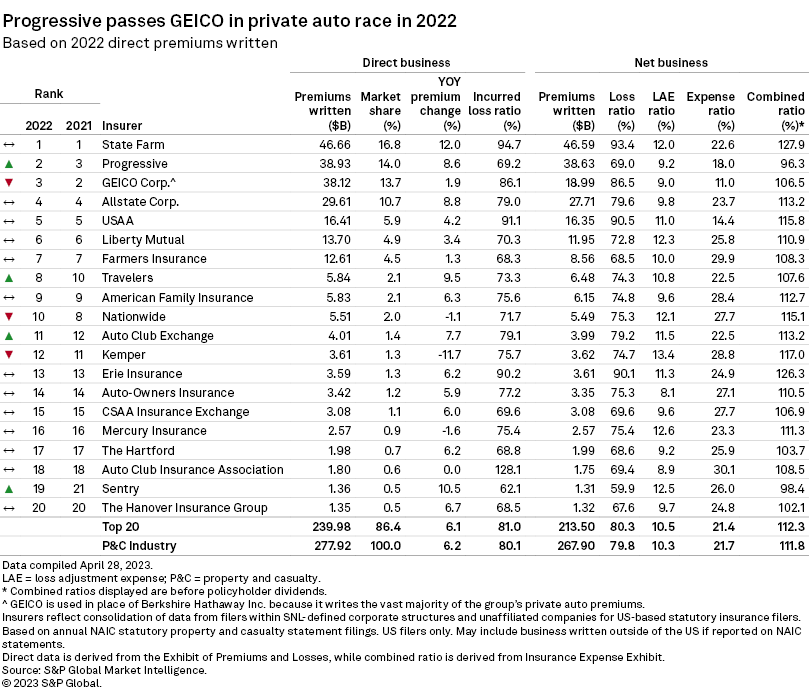

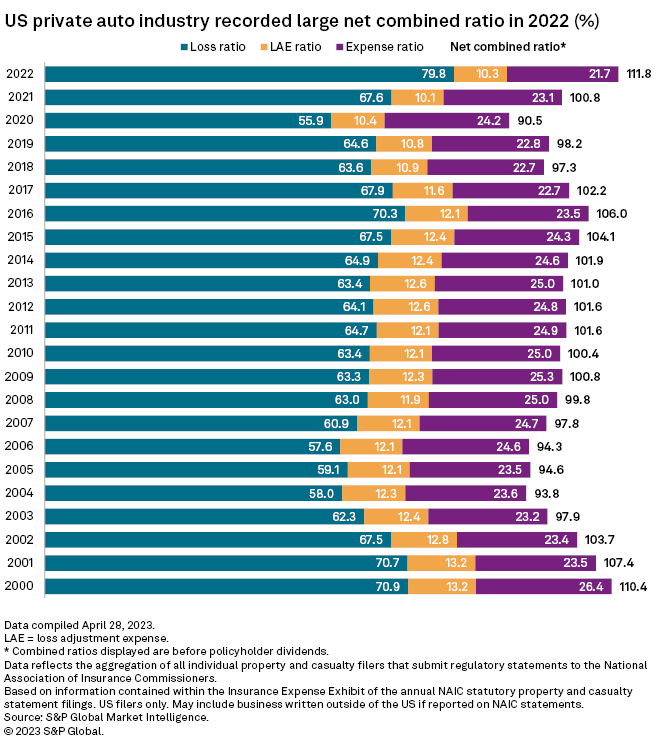

The net combined ratio for the sector, when excluding policyholder dividends, was 111.8%, topping the previous high over the past 27 years of 110.4% seen in 2000, according to an S&P Global Market Intelligence review of available annual regulatory statements. Market Intelligence's regulatory database goes back to 1996. The 2022 figure was 11 percentage points higher than 2021's ratio.

A combination of inflationary pressures, adverse prior-year development and Hurricane Ian contributed to the 111.8% figure. While rising premium rates have yet to catch up to the losses insurers are sustaining, Market Intelligence projected in October 2022 that the business line should be close to breakeven in 2024 and see a sub-100% combined ratio in 2025 and 2026. A combined ratio below 100% generally indicates underwriting profitability.

The poor underwritings results could have been worse if it was not for some cost saving measures introduced during the year. Total net underwriting expenses were down for the second year in a row to $58.05 billion in 2022, compared to $58.33 billion and $59.03 billion in 2021 and 2020, respectively. Lower expenses and higher sequential net premiums written pushed the industry’s expense ratio to 21.7%, the lowest annual expense ratio since 1996.

But the higher net premiums earned through rate increases during 2022 were not enough to overcome the increased claims cost the insurers faced during the year. The rising costs were spread across both private auto physical damage and liabilities coverages.

The total dollar amount of incurred losses for physical damage and the combined liability lines of business increased by 23.3% and 23.7%, respectively, year over year in 2022, while net premiums earned only increased by 6.4% and 3.4%, respectively. Inflation and unfavorable reserve development pushed the net incurred loss ratio to 79.8% in 2022, considerably worse than the previous high of 70.9% in 2000 and the 67.6% seen in 2021.

Unfavorable prior-year reserve development hampers results

Adverse one-year reserve development contributed to the growth in incurred losses in 2022. Prior-year reserves were strengthened by $2.43 billion within the combined private auto liability and auto physical damage coverages, marking the first time since at least the mid-1990s that the business line reported prior-year adverse development within the combined lines.

Auto physical damage includes both commercial and private auto; however, commercial accounts for a relatively small amount of the total figure. Commercial auto physical damage was roughly 9% of the total net incurred losses within the combined physical damage coverage lines in 2022.

The liability portion of the private auto business drove the substantial unfavorable development for the year with an expense of $5.04 billion in 2022. This marks the fifth time the industry has reported adverse development within the business line over the past 27 years — the previous occasion was in 2017. The business line reported adverse development for three consecutive years between 2015 and 2017, with a reserve strengthen of $1.86 billion in 2016 being the largest prior one-year unfavorable development.

The Allstate Corp.'s largest individual subsidiary, Allstate Insurance Co., reported in its annual regulatory statement that increases in its liability or injury coverage related to severity with third-party injury claims, increased claims with attorney representation, higher medical inflation and litigation cost were behind the updated assumptions.

Allstate was one of two companies, along with State Farm Mutual Automobile Insurance Co., that reported an adverse development greater than $1 billion in 2022 within its private auto liability coverage.

State Farm's combined private auto adverse development was $2.93 billion in 2022. The insurer strengthened its prior-year reserves by $3.81 billion within its liability coverages but released reserves of roughly $877 million for its auto physical damage.

State Farm's poor underwriting results

State Farm reported a private auto combined ratio of 127.9% in 2022, which was the highest ratio among the 20 largest private auto underwriters. This figure represents the worst year of underwriting performance the insurer has reported since at least 1996. Using the company's combined regulatory statement to exclude its purchase of the nonstandard auto writer GAINSCO Inc. in 2020, the combined ratio of 121.6% in 2001 was the prior worst underwriting year. State Farm's combined ratio was 107.5% in 2021.

The Illinois-based insurer remains the largest US private auto writer with $46.66 billion in direct premiums written in 2022 — an increase of 12% from the prior year.

The ranking of the 20 largest insurers in 2022 was generally stable when compared to 2021, with two notable exceptions: The Progressive Corp. finally supplanted Berkshire Hathaway Inc.'s GEICO Corp. as the second-largest private auto underwriter, and The Travelers Cos. Inc. switched places with Nationwide Mutual Group to become the eighth-largest underwriter.

Progressive and Sentry Mutual Holding Co., a new entrant among the 20 largest private auto insurers, were the only carriers with a combined ratio below 100% in 2022.