S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Mar, 2022

By RJ Dumaual and Husain Rupawala

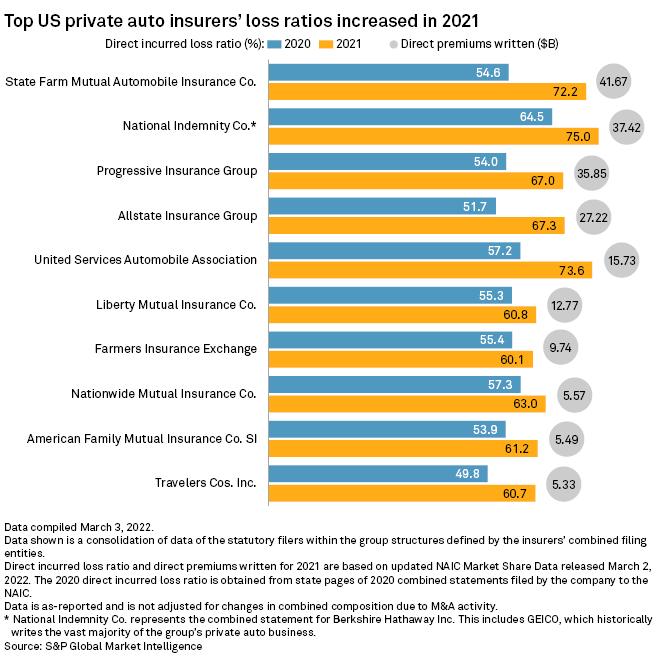

The largest U.S. private auto insurers saw their loss ratios deteriorate in 2021 from the prior year, according to newly released data from the National Association of Insurance Commissioners.

Higher used car prices bite

State Farm Mutual Automobile Insurance Co., the biggest writer of private auto insurance in 2021, with direct premiums written of $41.67 billion, saw its loss ratio worsen to 72.2% from 54.6% in 2020, as inflation and higher severity and frequency pushed up claims cost

The National Indemnity group's direct incurred loss ratio of 75.0% was the highest among the largest private auto insurers in 2021. That figure was up from 64.5% a year earlier. Its direct premiums came in at $37.42 billion. National Indemnity represents the combined statement for Berkshire Hathaway Inc., which includes the GEICO Corp. subsidiaries. Historically, GEICO writes the vast majority of the groups private auto business.

The Allstate Corp. CEO Tom Wilson in a presentation said loss costs "took off" in the second and third quarters of 2021, after the company benefited from reduced accident frequency in 2020 and the first half of 2021 amid a change in driving behavior during the worst of the COVID-19 pandemic. Wilson attributed most of the higher costs to pricier used cars. Higher costs of settling bodily injury claims were also a factor. Allstate, with $27.22 billion of direct premiums written in personal auto, saw its loss ratio rise to 67.3% in 2021 from 51.7% in 2020.

The Progressive Corp., with $35.85 billion of direct premiums written, said in its Form 10-K that it saw a 14% increase in personal auto accident frequency and a 9% increase in personal auto accident severity in 2021 on a year-over-year basis. Both vehicle miles traveled and claims frequency per mile traveled increased relative to 2020.

U.S. inflation experienced its largest annual increase in nearly 40 years and used car values increased materially in 2021, which put pressure on Progressive's average claims cost. In addition to rising frequency and severity, Hurricane Ida, which Progressive said was its costliest storm in terms of loss costs, reduced profitability with nearly $420 million in losses. The auto insurer's loss ratio deteriorated to 67.0% in 2021 from 54.0% in 2020.

Loss ratio improvements halted

Some private auto insurers saw years of loss ratio improvements end in 2021, which Progressive CEO Tricia Griffith described as "a year like no other."

The 67.0% loss ratio Progressive posted was its weakest since at least 2016, while State Farm's loss ratio returned to the 70% range the first time since that same year. United Services Automobile Association was a big beneficiary of reduced driving in 2020 when its loss ratio improved to 57.2%; that reverted back to levels seen in more recent years to 73.6% in 2021. National Indemnity posted its worst loss ratio since 2017.

S&P Global Ratings analysts said personal auto writers, after benefitting from lockdown measures in 2020, saw a significant increase in claims frequency in 2021 as miles driven recovered to near pre-pandemic levels. However, this was compounded by claims severity also jumping owing to supply-driven inflationary pressure on used car prices, replacement parts and labor costs, catching insurers somewhat by surprise.