S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Sep, 2021

By RJ Dumaual and Hassan Javed

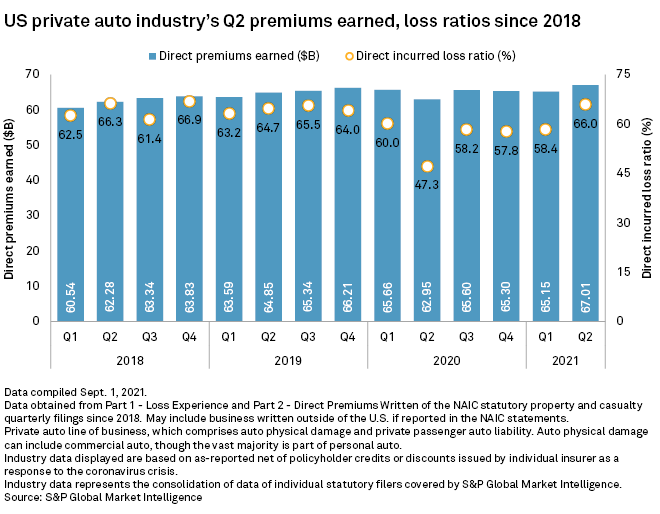

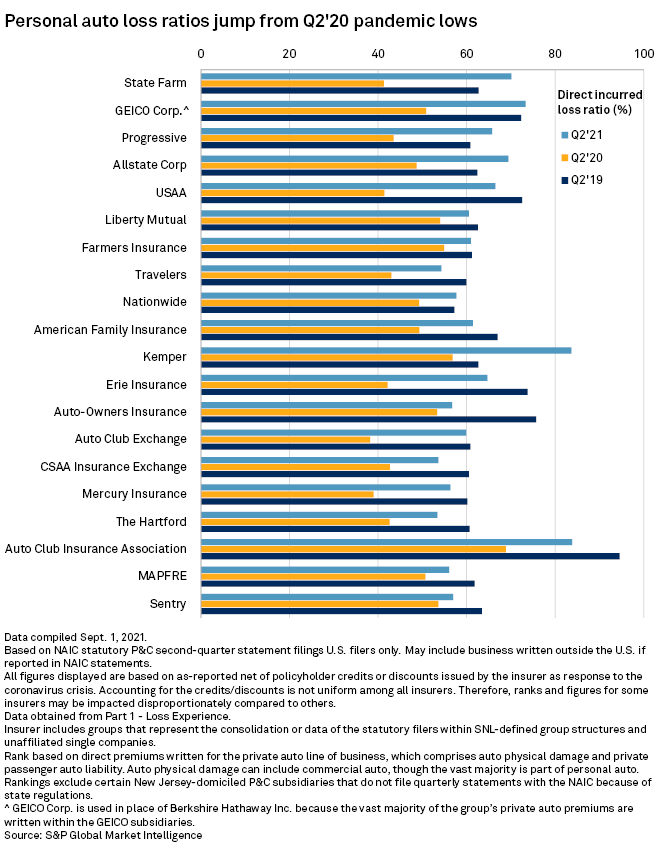

Fourteen of the 20 largest U.S. private auto insurers saw their loss ratios deteriorate by double-digit percentage points year over year in the second quarter, according to an S&P Global Market Intelligence analysis.

Market leader State Farm Mutual Automobile Insurance Co. saw its loss ratio weaken to 70.1% from 41.3% a year ago, the biggest change recorded as more people resumed driving across the country following pandemic-induced lockdowns in 2020. State Farm's direct premiums written shrank 0.7% to $10.38 billion.

The lockdowns caused a surge in profitability for auto insurers, which the American Property Casualty Insurance Association said in 2020 provided more than $14 billion in refunds and credits to policyholders for reduced driving during the pandemic.

The loss ratios of closest competitors GEICO Corp. and The Progressive Corp. jumped to 73.3% and 65.8% from 50.8% and 43.5%, respectively. GEICO logged the second-highest direct premiums written in the latest quarter of $8.94 billion, up 14.5% from the prior-year period. Progressive was a close third after growing its direct premiums written by 6.5% to $8.91 billion.

Wells Fargo analyst Elyse Greenspan in a research note said higher severity trends are hitting the insurance industry, impacting personal auto companies. While frequency has not returned to 2019 levels for most personal auto players, severity is up when compared to two years ago, she said.

Berkshire Hathaway Inc. in a quarterly filing said GEICO's claims frequencies in the first six months of 2021 were higher for all coverages, including property damage at the 11%-to-12% range, bodily injury at the 13%-to-14% range, personal injury in the 16%-to-17% range and collision in the 21%-to-22% range. Average claims severities in the first six months were higher for property damage coverage in the 2%-to-3% range, collision coverage at the 10%-to-11% range and bodily injury coverage in the 10%-to-13% range.

Keefe Bruyette & Woods analyst Meyer Shields believes Progressive's "incrementally cautious" personal auto pricing and marketing stances are appropriate as normalizing driving and rising claim costs pressure its core loss ratio. Shields said the near-term impact should include decelerating growth in policies in force until most competitors similarly recognize and respond to loss ratio pressures.

The analyst also expects Progressive to continue reducing its near-term advertising spend, with bigger decreases likely in states where its proposed rate hikes were denied.

The Allstate Corp. logged a loss ratio of 69.4% in the second quarter, much higher than the 48.7% recorded a year ago, while its direct premiums written climbed 14.5% to $6.50 billion. CFO Mario Rizzo in the company's latest earnings call said auto property damage gross frequency increased 47.3% from the prior-year quarter, but was 21% lower than the same period in 2019.

"Auto severity increases persisted relative to the prior year quarter and pre-pandemic periods across coverages, largely driven by the shift in mix to more severe, higher-speed auto accidents and rising inflationary impacts in both used car values and replacement part costs," Rizzo said, according to a transcript of his remarks.

The CFO said Allstate is looking to implement targeted price increases to "maintain attractive auto insurance returns."

Kemper Corp. logged the second-largest loss ratio deterioration to 83.7% from 56.8% a year ago. CEO Joe Lacher in the company's second-quarter earnings call said the "swift reopening" and "environmental challenges" led to increases in both frequency and severity of claims.

Going forward, Wells Fargo's Greenspan anticipates a "tough environment" over the short-to-medium term for private auto insurers as loss trends are likely to remain elevated. Chip shortages, which are leading to higher used and new car prices, as well as increased labor costs, have impacted severity trends., she said.