Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 May, 2022

By Asma Rafique and Husain Rupawala

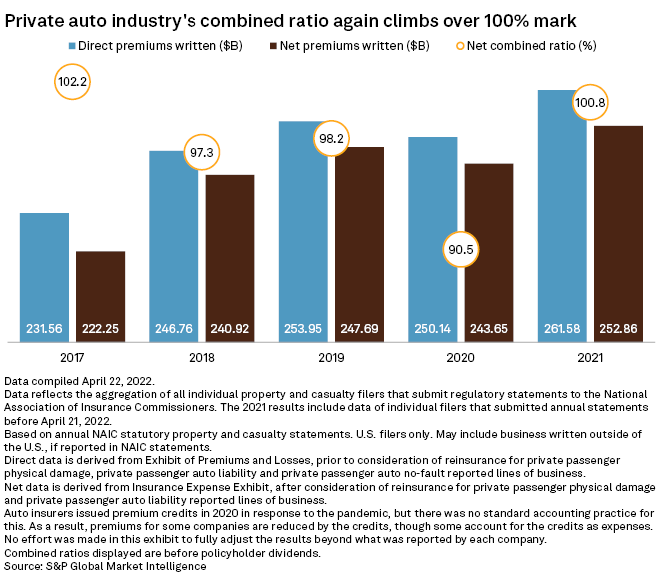

Claim cost inflation and increased driving activity took their toll as the U.S. private auto insurance industry's combined ratio climbed above the 100% benchmark for the first time since 2017.

The combined ratio for industry, when excluding policyholder dividends, worsened to 100.8% in 2021 from 98.2% in 2019, the last full year before the COVID-19 pandemic, according to an S&P Global Market Intelligence analysis of annual statutory statements. The 90.5% combined ratio in 2020 was heavily influenced by the pandemic, which caused stay-at-home orders to be issued across the country and led to a pronounced decline in driving activity.

Industrywide, private auto insurers' direct premiums written rose 4.6% year over year to $261.58 billion in 2021 from $250.14 billion in 2020. Net premiums written across the industry increased 3.8% year over year to $252.86 billion from $243.65 billion in 2020.

The industry's loss ratio deteriorated to 67.6% from 55.9% a year ago. Prior the pandemic, the private auto industry's combined ratio was 64.6% in 2019.

Kemper's combined ratio soars

At the company level, nine of the top 20 insurers posted combined ratios above 100% in 2021. Kemper Corp. had the highest combined ratio among the insurers included in this analysis at 117.6%, followed by State Farm Mutual Automobile Insurance Co. at 107.5%. The Hanover Insurance Group Inc. had the lowest combined ratio at 92.0%.

Marketshare rankings mostly unchanged

There was little change in the marketshare rankings among the 20 largest private auto insurers in 2021. Most companies recorded higher direct premiums written year over year. State Farm retained its top spot, reporting direct premiums written of $41.67 billion for the year

Berkshire Hathaway Inc.'s GEICO Corp. and The Progressive Corp. retained their respective Nos. 2 and 3 spots with premiums written of $37.42 billion and $35.85 billion, respectively.

Auto Club Insurance Association and Mapfre SA had the steepest declines in annualized two-year direct premiums written among the top 20 private auto insurers at 7.7% and 7.3%, respectively. Two-year annualized direct premiums written fell by 5.6% for Nationwide Mutual Insurance Co., 4.1% for The Hartford Financial Services Group Inc. and 3.2% for Mercury Insurance Co.

Progressive's two-year annualized direct premiums written climbed 7.5% to $35.85 billion in 2021. State Farm and GEICO both saw growth as well, as direct premiums written rose by 0.5% and 3.3%, respectively, in that period.