S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 May, 2022

By Yizhu Wang

| Shoppers wait to enter a Gucci store in New York. Gucci is among the latest additions to a list of companies to offer a cryptocurrency payment option. Credit: John Lamparski/Getty Images News via Getty Images |

Starbucks Corp. is doing it. So is Home Depot Inc. The latest to join the list is Kering SA's luxury brand, Gucci.

|

A growing number of companies in the U.S. are offering some form of cryptocurrency payment option due to rising consumer demand. The growth in stablecoins, a form of cryptocurrency pegged to the U.S. dollar or other reserve assets, is set to further boost this trend.

Companies' interest in accepting cryptocurrencies in transactions is prompting an evolution of the payments ecosystem.

"You're now for the first time really starting to see some consumer applications that make it possible for you to literally use your crypto to buy stuff like coffee," said Brian Brooks, CEO of digital currency technology company Bitfury Group Ltd. and a former U.S. acting comptroller of the currency. "The consumer interface is spanking new but they are now out there."

Card giants Visa Inc. and Mastercard Inc. and payment processors such as Worldpay, a subsidiary of Fidelity National Information Services Inc., support direct settlements in a fintech-issued stablecoin, and a group of banks is experimenting with blockchain payment networks.

Still, progress will be limited until there is regulatory clarity.

"If there's a very clear, user-friendly regulatory framework created around this ecosystem — and I think that's very possible over the next year or two — you'll see the mainstream commercialization of this follow up very rapidly," said Randal Quarles, chairman of investment firm Cynosure Group. Quarles was vice chair for supervision at the Federal Reserve from 2017 through 2021.

Consumer interest paves the way

Cryptocurrencies as a payments option is in its infancy.

BitPay Inc., one of the first payment gateway companies to enable consumers to spend cryptocurrencies at merchants, has processed over $5 billion in transactions since inception in 2011, a spokesperson said. The spokesperson did not provide further details. A payment gateway helps merchants to accept electronic payments for goods and services.

In comparison, the U.S. Automated Clearing House system — an electronic funds transfer system for conventional payments — processed $72.6 trillion in 2021.

Many consumers still view cryptocurrencies as an investment asset, but exposure to the asset class is growing. About 23% of U.S. consumers — nearly 59.6 million people — owned at least one cryptocurrency in 2021, according to a survey by PYMNTS and BitPay. Nearly one-third of them have used a digital currency to make a payment, the survey said.

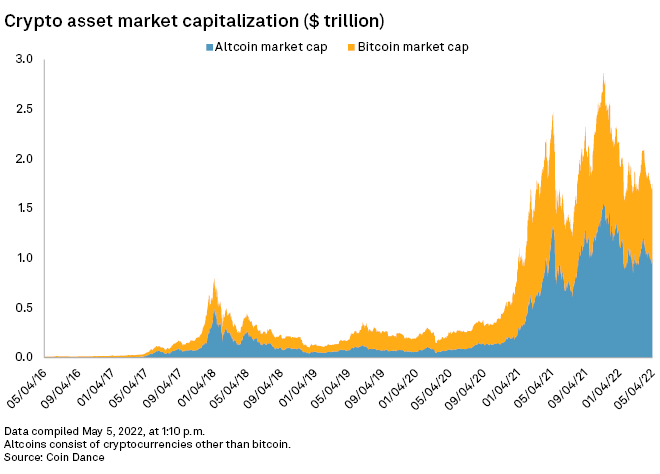

The total market capitalization of crypto assets was estimated at $1.748 trillion as of May 4.

"Over the past 18 to 24 months, we have seen more inbound interest from our client base to accept crypto as a form of payment," said Nabil Manji, head of crypto and emerging business at Worldpay, a payment processor that handles the logistics of managing card transactions.

Merchants who have ventured into the virtual currency universe accept payments in a host of currencies, including bitcoin, dogecoin, shiba inu and stablecoins.

Transaction costs, currency volatility and the cost of converting into fiat currency are some of the factors that merchants need to consider as they integrate cryptocurrency into their payment systems.

Current payment applications enable cryptocurrency acceptance at checkout and do not require changes to the merchant's core infrastructure. "Many center around an indirect acceptance of cryptocurrency, where merchants partner with a supplier and the supplier allows consumers to pay with the crypto of their choice," said Joshua Pynn, strategic insights consultant at payments advisory firm CMSPI.

This approach uses the services of a specialized payment gateway, a company that buys and sells digital currency against fiat currency in the open market and settles payments for merchants in fiat currency. This also helps merchants to avoid dealing directly with cryptocurrencies, which can have legal and fiscal implications for their businesses.

Entertainment giant AMC Entertainment Holdings Inc. is one of several companies to adopt this method. It uses BitPay to facilitate cryptocurrency payments when customers buy movie tickets. "As soon as we receive that crypto payment, we credit the merchant's ledger and settle in fiat or U.S. dollars the next business day," said BitPay CMO Bill Zielke. "As a result, they are not exposed to price volatility."

AMC did not respond to queries from S&P Global Market Intelligence.

Stablecoin is the next frontier

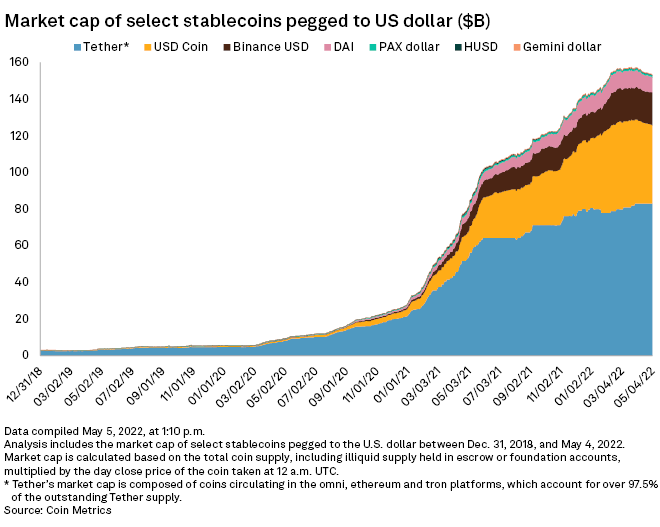

Bank-sponsored stablecoins are another avenue to develop cryptocurrencies as a mode of payment. "The innovation that is actually catalyzing the use of crypto in commerce is the use of stablecoins," said Vikas Shah, managing director at Rosenblatt Securities.

Stablecoins have the potential to be widely used by households and businesses as a means of payment, a November 2021 white paper said.

The asset class has a market capitalization of nearly $160 billion, according to Coin Metrics. Yet most stablecoins are issued by nonbank entities, so there are widespread concerns over redemptions and a run on the currency in times of stress.

A recent initiative by a group of banks to mint their own stablecoin has attracted analyst attention, as it is seen as a test case for broader industry acceptance and usage.

The consortium — which includes Amerant Bancorp Inc., ConnectOne Bancorp Inc., FB Financial Corp., National Bank Holdings Corp., Primis Bank, New York Community Bancorp Inc., Synovus Financial Corp., Webster Financial Corp. and Atlantic Union Bankshares Corp. — created the USDF token in January. The token operates on blockchain — the technology that underpins cryptocurrencies — by fintech startup Figure Technologies Inc.

The group is working with the Federal Deposit Insurance Corporation to review its operating agreement. It expects to receive feedback by the end of the second quarter, either with questions, requests for modifications or an outright greenlight, said Figure CEO Mike Cagney.

Once the regulatory stance is clarified, the consortium plans to work with merchant acquirers to encourage the adoption of USDF as a payment method, Cagney said. Merchant acquirers offer goods and services providers with payment facilities.

The bank consortium did not respond to queries from Market Intelligence.

Challengers or partners?

Digital currencies and blockchain have also attracted the attention of payment network and technology companies in recent years.

Visa in March 2021 developed technology to settle transactions in USD coin, a stablecoin issued by fintech firm Circle Internet Financial Ltd., while Mastercard in October acquired CipherTrace Inc., a cryptocurrency intelligence company. Visa and Mastercard have introduced cryptocurrency advisory services among a host of other initiatives in the past six months.

"They're definitely working hard to make sure that cryptocurrency doesn't pose an existential threat to their business, which, long term, it conceivably could," said Jordan McKee, principal research analyst of 451 Research at Market Intelligence. Visa and Mastercard have the advantage of being trusted technology partners for financial institutions, McKee said. "I see them trying to play a role in being enablement partners for banks to participate in crypto."

Visa and Mastercard did not respond to queries from Market Intelligence.

While blockchain has the potential to evolve and become the dominant payments technology over time, legacy structures can last longer than most people expect them to, said Bitfury's Brooks.

The technology needs further development to iron out some key issues. One challenge is that every bank uses its own version of blockchain, and payments can flow only between its own customers, said Quontic Bank CEO Steve Schnall. "That has limited utility because most customers need to be able to transact with the outside world, not just with same-bank customers."

Regulatory clarity needed

Still, cryptocurrencies have made enough technological progress and seen meaningful commercial adoption in the U.S. for regulators to take them seriously, experts said.

"I don't see regulators outright saying they are opposed to the use of this technology, or that they are opposed to figuring out how it can be productively leveraged to maintain the U.S. competitive position in the world," said Bao Nguyen, partner at Skadden, Arps, Slate, Meagher & Flom LLP. Nguyen was also former principal deputy chief counsel at the OCC.

Guidance to the public has come mostly from officials' speeches, white papers and updates of certain rules. These are insufficient and create risks for businesses to lose investments or violate compliance requirements, Nguyen said.

Cryptocurrency companies are regulated by various federal entities, such as the Commodity Futures Trading Commission, the SEC, the U.S. Department of Treasury and state regulators. Some companies obtain licenses for money transmission and lending. Companies have urged a consolidation of federal supervision.

In March, President Biden signed an executive order to bolster the development of digital assets in a responsible way, including exploring a central bank digital currency and regulated stablecoin arrangements.

"Cryptocurrency has the potential to be another payments option and increase competition, but the role it will play depends on how it evolves," said Leon Buck, vice president at the National Retail Federation, a trade association representing merchants. "It shouldn't be allowed to become just another mechanism for the credit industry to collect another fee."

451 Research is part of S&P Global Market Intelligence.