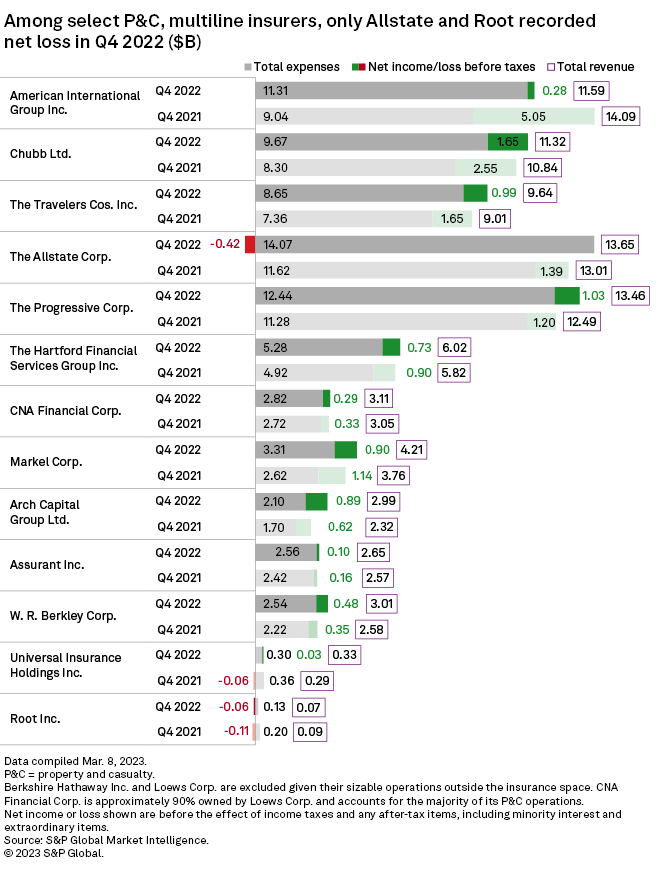

While the final quarter of 2022 was rough for many property and casualty insurers, The Allstate Corp. particularly took it on the chin.

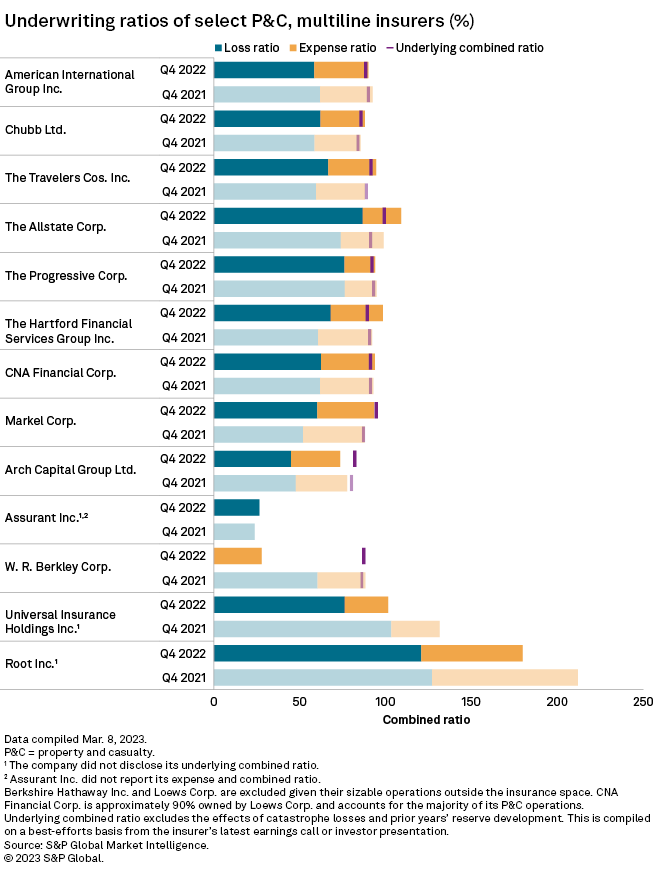

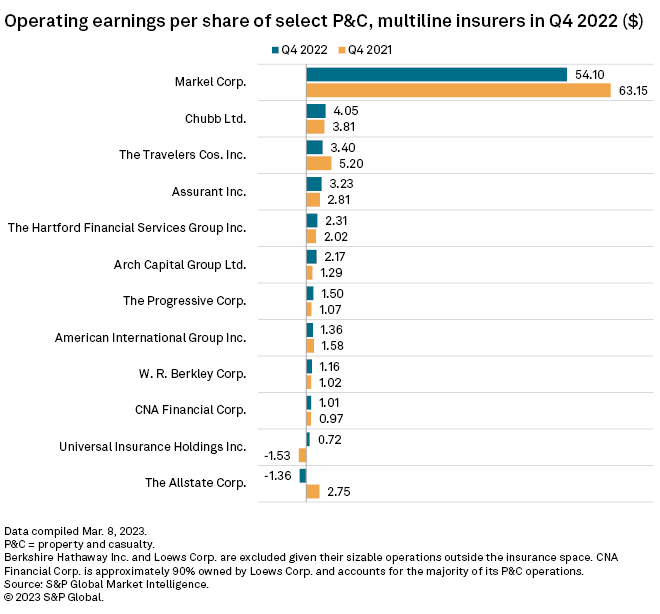

An S&P Global Market Intelligence analysis shows that the insurer reported a loss before taxes of $420 million, a huge reversal from net income before taxes of $1.39 billion the previous year, while operating EPS swung to a loss of $1.36 per share from a positive $2.75 a year ago. Also, the insurer's combined ratio shot up to 109.1% from 98.9% a year earlier.

Allstate was one of three companies to record net losses in an analysis of fourth-quarter 2022 results for select public P&C and multiline insurers trading.

Auto woes drive Allstate losses

Mario Rizzo, president of Allstate's property and liability business, said sharply increasing loss costs in the company's auto lines were a key factor in the insurer's heavy losses.

Speaking on an earnings call, Rizzo said the fourth-quarter 2022 combined ratio of 112.6% for the segment was "substantially worse than our targets," and resulted in an underwriting loss of $974 million for the period. Catastrophe losses of $779 million, primarily from a cross-country winter storm on Dec. 21–26, 2022, was one major factor behind the elevated combined ratio.

Universal Insurance Holdings Inc. and Root Inc. were the only other carriers in the analysis with combined ratios over 100% for the quarter, but both showed improvement year over year. Universal's combined ratio declined to 101.4% from 131.4% a year earlier, while Root's dropped to 179.7% from 211.9%.

The Hartford Financial Services Group Inc. came in just under 100% at 98.3%, an increase from 92.1% a year ago.

The statutory combined ratio for the P&C sector was 103.02% in the fourth quarter of 2022, up from 99.83% a year ago, but down from 106.73% a quarter earlier.

AIG's revenue takes hit, net income plummets

American International Group Inc. logged a 17.8% decline in total revenue to $11.59 billion, from $14.09 billion a year ago. The insurer was one of just two companies in this analysis to see revenues fall on an annual basis.

A decrease in net investment income and realized losses on securities played key roles in AIG experiencing revenue decline among the companies featured in this analysis. AIG's net investment income fell to $3.26 billion from $3.57 billion a year earlier, CFO Sabra Purtill said during an earnings call. Purtill said the decline was due to "lower alternative investment income, principally on private equity investments, and lower bond call and tender premiums and mortgage prepayment fees."

The other company in the analysis that reported a fourth-quarter 2022 decline in revenue was Root, which fell to $71.3 million from $93.2 million a year ago. Root booked a $58.3 million pretax loss in the quarter but managed to cut total expenses to $129.6 million from $203.1 million.

The other company in the analysis that reported a fourth-quarter 2022 decline in revenue was Root, which fell to $71.3 million from $93.2 million a year ago. Root booked a $58.3 million pretax loss in the quarter but managed to cut total expenses to $129.6 million from $203.1 million.

AIG's net income plunged nearly 95%to $279 million from $5.05 billion a year earlier.