S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Apr, 2022

By Asma Rafique and Jason Woleben

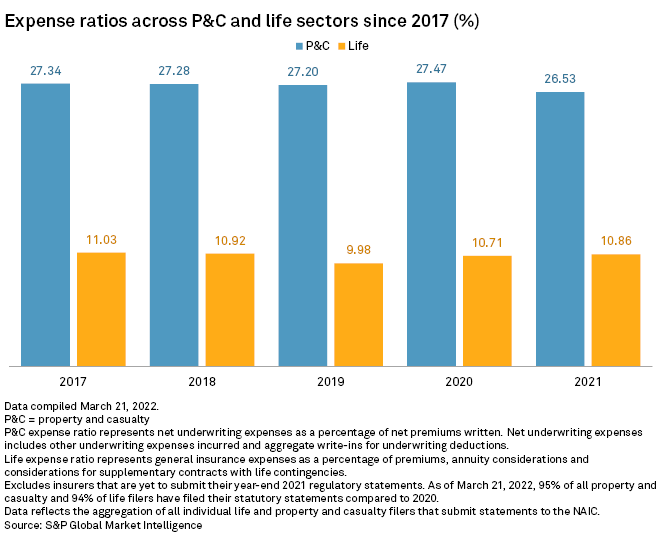

Even with the ongoing inflationary surge, U.S. property and casualty insurers recorded their lowest expense ratio in five years in 2021.

P&C sector expense ratio drops sharply

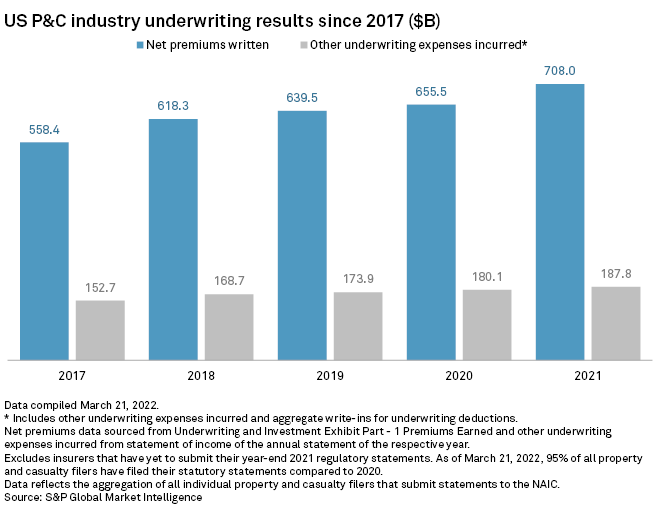

According to an analysis of statutory results obtained by S&P Global Market Intelligence as of March 21, the P&C industry's expense ratio fell by essentially 100 basis points to 26.5% in 2021 from 27.5% at the end of 2020. The decline can be attributed to a large year-over-year increase in net premiums written. The sector's total net premiums written surged 8.0% to $708.0 billion in 2021, while underwriting expenses incurred only climbed 4.3% to $187.8 billion.

The increase in P&C underwriting expenses in 2021 were mainly driven by insurance underwriting salaries and net commission and brokerage. Industry salary expense increased 5.1% year over year to $40.69 billion in 2021, while net commission and brokerage expense rose 6.5% to $78.69 billion from $73.90 billion.

Meanwhile, the sector's expense for obtaining insurance on its operations jumped 18.2% to $444.3 million in 2021 from $376.1 million a year ago. Those figures cover general and underwriting expenses only and do not include loss adjustment or investment expenses.

Life insurers' general expenses increase slightly

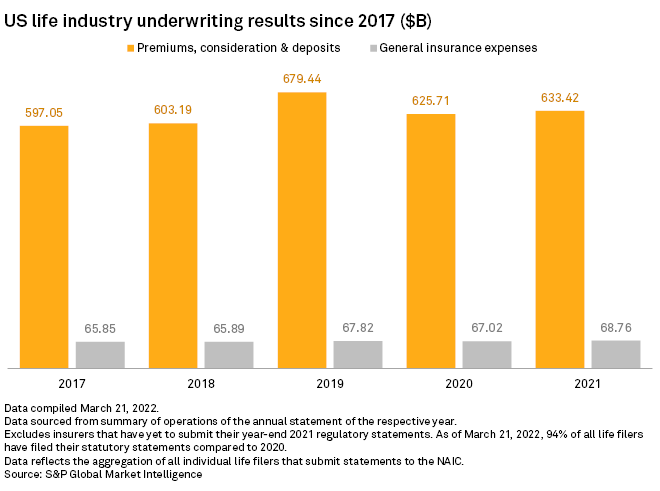

The life insurance industry's expense ratio rose to 10.86% in 2021 from 10.71% in 2020, as general insurance expenses for the year climbed to $68.76 billion from $67.02 billion a year ago. The industry's premiums, considerations and deposits also increased year over year, rising to $633.42 billion from $625.71 billion in 2020.

The increase in life underwriting expenses was primarily due to legal fees and salaries. The sector's legal fees jumped 31.7% year over year to $1.37 billion in 2021, while salary expenses grew 5.5% to $37.12 billion. Travel underwriting expenses, which saw a 64.3% year-over-year decline in 2020, rebounded slightly in 2021, reaching $483.1 million.

The sector's expense for obtaining insurance on its operations, excluding real estate, jumped 63.5% to $433.3 million in 2021 from $265.1 million in 2020. Those numbers cover general and underwriting expenses, but do not include loss adjustment or investment expenses.