S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Mar, 2021

Online grocery sales in the U.S. will moderate this year after a pandemic-induced surge in 2020, but analysts expect growth to remain higher than pre-COVID-19 levels and benefit retailers pushing forward with investments in e-commerce operations and fulfillment capacity.

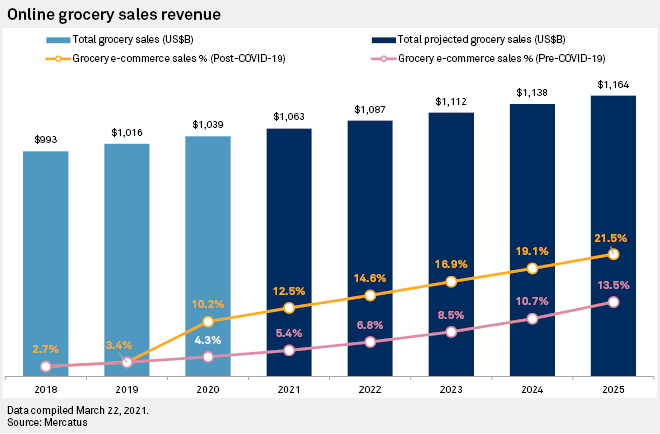

By 2025, online grocery is expected to account for 21.5% of total U.S. grocery sales, or about $250 billion of the $1.16 trillion grocery market, according to Mercatus, an e-commerce grocery platform whose clients include grocers such as Weis Markets and Smart & Final Inc. That is up from a 10.2% share in 2020, which is already much higher than the pre-pandemic 2020 forecast of 4.3%. Prior to the pandemic, Mercatus had expected e-commerce sales would reach 13.5% of total grocery sales by 2025.

Demand for e-commerce grocery platforms spiked in 2020 when states rolled out lockdown measures during the early days of the pandemic and scores of Americans started shopping online for items such as milk, bread and eggs. Going forward, growth is expected to continue at a pace more aligned with pre-pandemic levels, but from a permanently elevated base.

A combination of increased vaccinations and a lifting of state restrictions, allowing stores and restaurants to increase capacity, has led consumers back to the grocery aisles, said Nick Shields, a senior analyst with Third Bridge who covers the retail sector.

"If they [shoppers] have already had one or two shots, they are more comfortable sort of window-shopping inside a Whole Foods for that unique salsa or exotic seasoning or some of the meat behind the case," Shields said.

The slowdown in online grocery sales is already apparent. The U.S. online grocery market posted $8 billion in sales during February, a 14% decline from $9.3 billion in January, according to a survey conducted by consultancy Brick Meets Click and sponsored by Mercatus.

January online grocery sales were higher than usual because consumers used their $600 stimulus checks approved in late December to shop for groceries online, said David Bishop, a partner with Brick Meets Click.

Bishop predicts a 10% decline in the number of U.S. household shopping for groceries online in March, although consumers who recently received $1,400 stimulus checks could provide a boost. "They now have this additional money to help out," he said.

Despite expectations of more modest growth, the pandemic has increased the adoption rate of online grocery, creating long-term demand for retailers that grew their e-commerce grocery businesses by 100% in 2020, said Tory Gundelach, senior vice president of retail insights with Kantar.

Consumers who tried online grocery for the first time will continue that behavior even if they head back to the stores. "People have taken the time to learn how to put in an order, learn how pickup works at Kroger or Target or learn how to use Instacart or Shipt," she said.

|

|

Consumers may use a combination of in-store grocery shopping a couple times per week or month and online grocery shopping for convenience purposes, such as ordering ingredients for an impromptu barbecue or to making cupcakes for a school bake sale the next day, she said. COVID-19 cases are also still rising in several areas of the country, which is expected to continue to drive growth.

Ongoing demand will bode well for grocery retailers including Amazon.com Inc., Walmart Inc. and Target Corp. that are investing in automation, and boosting curbside pickup and other fulfillment options.

It will also benefit retailers that were just starting their online grocery businesses last year, Gundelach said.

"Growth exploded so quickly," she said. "A lot of retailers have said 'this was the capacity we were planning for three years in the future, five years in the future.'"

The companies will now focus on infrastructure to support higher levels of volume more efficiently and profitably, Gundelach said. "I think in the next two years, we just have a lot of catching up to do as an industry," she said.

Many grocers are turning to investments in microfulfillment centers, which are often in the rear of a store or in a stand-alone building where thousands of a company's most popular items are stored.

"There's a significant increase in demand," said Curt Avallone, chief business officer for Takeoff Technologies Inc., a Massachusetts microfulfillment-center company whose customers include Koninklijke Ahold Delhaize NV, Albertsons Cos. Inc. and Australian grocer Woolworths Group Ltd.

He said Takeoff Technologies plans to have 40 centers up and running by this summer, with more in the pipeline.

Avallone expects business to remain steady partly because restaurants, a big competitor to grocers, are not back up to full capacity. "Until the restaurant industry is rebuilt, there are still tailwinds for the overall grocery industry and a lot of that is tied to e-commerce," he said.