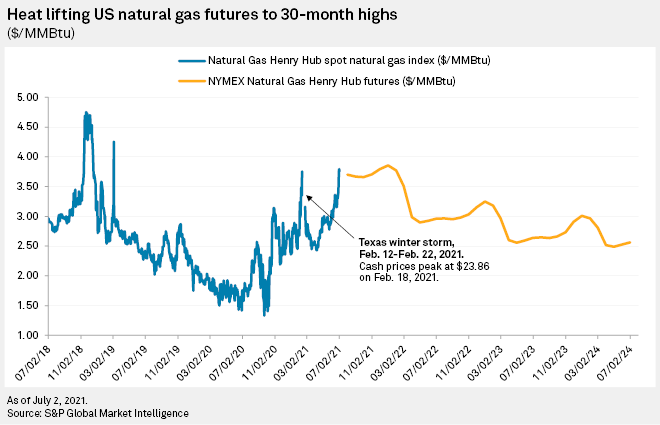

A June rally saw natural gas futures prices hit their highest point in two and a half years, but whether prices will continue to rise in July depends a lot on the usual suspect — warm weather — and how much gas keeps its grip on power generation.

The prompt month NYMEX contract for August delivery settled at $3.608/MMBtu on July 6, just above the July contract's final settlement of $3.593/MMBtu before rolling off the board June 28, according to S&P Global Market Intelligence data.

"The summer rally was initially spurred by a heat wave that lifted temperatures into the mid-90s in many locations, stoking gas-fired cooling demand," S&P Global Platts reported July 5. Platts said traders in the market also reported that a short squeeze spurred more buying by traders to cover bets that prices would fall.

Looking to the first full month of summer, the Natural Weather Service issued a revised July forecast showing a 60% to 70% chance of warmer-than-normal temperatures across the northern half of the country.

But how much gas will keep of its market share as a power generation fuel is open to debate, according to gas analysts at energy investment bank Tudor Pickering Holt & Co.

"We continue to keep tabs on power generation as a key variable to balance the U.S. gas market, with July data thus far suggesting the rise in price as having caught up with the commodity for power generation," Tudor Pickering Holt said July 6. Amid the hot weather, rising spot prices and a climbing forward curve did not keep power generators from employing more natural gas, but gas use in the electricity sector has been trending downward so far in July, the analysts said.

"We'll continue to keep tabs on gas' share of the stack in the coming weeks, with recent power generation data loosening balances vs. our prior modeling, though the recent three month forecast for above average temperatures in the Lower 48 suggests the call on gas for power gen may remain tight," Tudor Pickering Holt analysts wrote.

Higher-than-normal demand is forecast for natural gas over the next two weeks, according to S&P Global Platts Analytics' daily update for July 6.

LNG exports are applying additional upward pressure on U.S. gas prices as domestic exporters look to meet global demand. "Higher natural gas prices are in response to low natural gas inventories around the world," Tortoise Capital Advisors LLC Managing Director Rob Thummel said. "The global economic recovery coupled with elevated summer temperatures have limited the ability to increase natural gas inventories to traditional levels. Natural gas futures prices remain elevated in anticipation of winter demand that could further deplete already depleted inventories."

Pure-play natural gas stocks, including EQT Corp. and other Appalachian drillers, did not share in the strength in gas prices July 6, with most down by a few percent at the market close. Still, a basket of equally weighted shares of pure-play shale gas drillers has gained 64% in value year-to-date, according to S&P Global Market Intelligence data, as commodity gas prices recover from near record lows in 2020.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.