Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 May, 2022

By Camille Erickson and Susan Dlin

| President Joe Biden delivers remarks on gas prices from the South Court Auditorium of the White House on March 31, 2022, in Washington, D.C. That same day, Biden also invoked the Defense Production Act to bolster U.S. production of critical minerals needed to make lithium-ion batteries and develop a clean energy grid. Source: Anna Moneymaker/Getty Images News via Getty Images |

Mining companies eager to break ground on critical mineral projects in the U.S. cheered the U.S. House of Representative's endorsement of a $600 million appropriation for the Defense Production Act, saying the funding would go a long way in accelerating the build-out of new mining capacity and technology.

The House included the funding in an aid package for Ukraine on May 10. The money would support President Joe Biden's March 31 order to authorize the use of the Defense Production Act to supercharge domestic manufacturing of several critical minerals considered key to making rechargeable batteries and building a low-carbon energy economy.

The U.S. relies on China, Russia and other foreign actors

"This is yet another signal of bipartisan consensus that the battery supply chain is a national priority," said Todd Malan, chief external affairs officer and head of climate strategy at Talon Metals Corp., the majority owner and operator of the Tamarack nickel-copper-cobalt project in central Minnesota. The project is a joint venture with Rio Tinto Group.

"Basically, [the Biden administration] wants to know what it can do to accelerate the development of more U.S. EV battery supply chain muscle from mine through to processing to recycling," Malan said.

A matter of national security

The Defense Production Act dates back to the 1950s and endows the federal government with sweeping authority to stimulate domestic industries for national defense purposes through fiscal incentives and assistance.

Russia's invasion of Ukraine on Feb. 24 sent nickel and other critical mineral markets spiraling over fears that sanctions or export disruptions could create supply shortages. Russian mining company PJSC MMC Norilsk Nickel is the No. 1 producer of primary nickel, including the type of nickel used in electric vehicle batteries. Recent waves of volatility across commodity markets have exposed the fragility of U.S. energy and defense supply chains, said proponents of the use of the Defense Production Act for critical minerals.

"There are many minerals and metals mined and manufactured in Russia," said Ben Steinberg, executive vice president and co-chair of the critical infrastructure group at Venn Strategies. "Having the Defense Production Act funding in this bipartisan vehicle allows the U.S. and our allies to shore up supply chains and reduce dependence on adversaries."

Tethered to imports

The U.S. remains heavily reliant on other countries, especially China, for clean energy technologies' raw materials, including the lithium and graphite used in EV batteries and the rare earth elements needed for the magnets installed in wind turbines and EV motors. A dearth of mineral processing infrastructure in the U.S. also means critical minerals mined domestically are usually refined outside the U.S. The mining industry welcomed the additional pot of money to support domestic critical mineral projects, calling it a matter of national security.

The Biden administration has made the case that congressional funding for the Defense Production Act is needed to stimulate the production of critical minerals and wean the U.S. off its dependence on China and Russia in the name of national security.

"This supplemental request will use the Defense Production Act to expand domestic production and reserve — and the reserve of critical materials — materials like nickel and lithium that have been disrupted by Putin's war in Ukraine and that are necessary to make everything from defense systems to automobiles," Biden said in April 28 remarks on the funding request to Congress.

Metals producers backed Biden's call.

"This additional funding is further recognition of how important it is to our national security, our competitiveness and our climate ambitions that we build secure, responsible mineral supply chains and do so with real urgency," Conor Bernstein, vice president of communications at the National Mining Association, told S&P Global Commodity Insights in a written statement. "Invoking the Defense Production Act was an important signal to markets that far more investment is needed in the mining sector — in the U.S. mining sector — to responsibly meet the surge in demand."

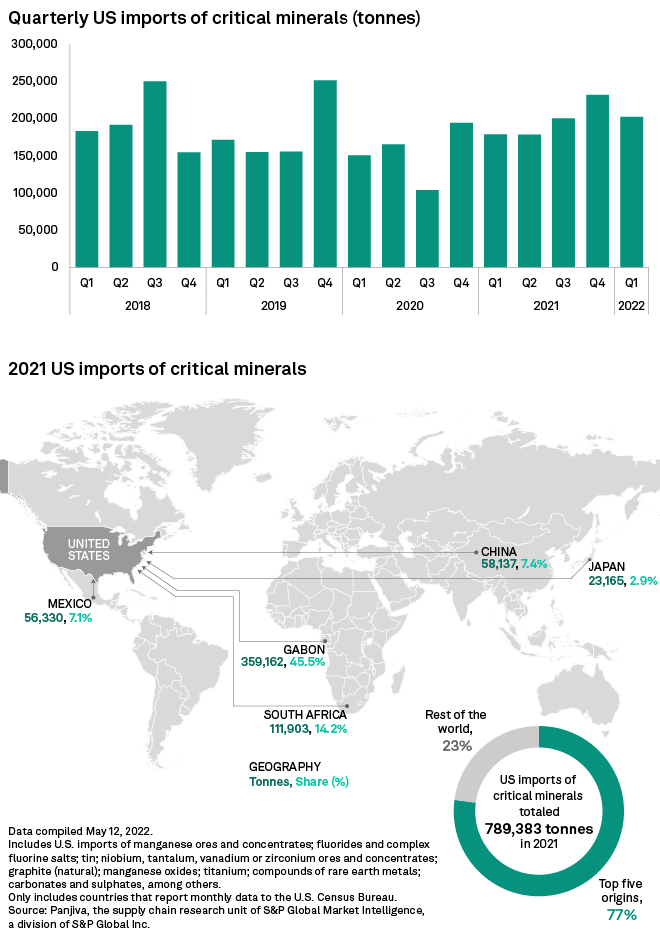

China leads the world in making critical minerals, processing approximately 90% of the world's rare earth elements along with 50% to 70% of global lithium and cobalt, according to the International Energy Agency. The U.S. imported 789,382 tonnes of its critical minerals in 2021, up 28.5% from 2020, according to S&P Global Market Intelligence data.

"I think it can go a long way," Steinberg said of the appropriation for the Defense Production Act in an interview. "It's a limited funding pot right now. Having the government involved as early as possible and engage through the mining process from exploration to scoping of projects and just putting in seed funding is really helpful."

Not a silver bullet

Some environmental groups have opposed the employment of the Defense Production Act to expand mining at home, saying the administration needs to first update mining regulations before giving the industry money to ramp up extraction efforts.

"The government should use its purchasing power to maximize reuse of recycled content and build a circular materials economy," Lauren Pagel, policy director at Earthworks, an environmental nonprofit focused on mining and energy development, said in a March 31 statement. "Expanding mining without addressing the shortcomings of our archaic mining laws would be disastrous."

And although the funding for the Defense Production Act is a positive start, more comprehensive federal action is needed if the U.S. wants to stave off a critical mineral shortfall, including reducing regulatory and permitting hurdles, said Duncan Wood, vice president for strategy and new initiatives at the Wilson Center.

"The funding that has been made available is not likely to change very much on the ground in terms of resolving the critical minerals shortage, but the support by legislators of the administration's appeal for help is significant," Wood told Commodity Insights. "It is the same with the Defense Production Act announcement itself — we are seeing a mobilization of most of the relevant actors in the federal policy community."

The House-endorsed emergency appropriation for Ukraine still needs approval from the Senate before going to Biden's desk. Senate Majority Leader Chuck Schumer, D-N.Y., indicated the Senate would "move swiftly" to pass the emergency funding for Ukraine.

S&P Global Commodity Insights produces content for distribution on S&P Global Capital IQ Pro.