Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Sep, 2022

By Karin Rives

At the U.S. Securities and Exchange Commission's headquarters in Washington, D.C., agency staff are finalizing a rule that will require publicly traded companies to disclose greenhouse gas emissions and other climate risks in their financial filings.

|

The proposed rule is one of several Biden administration initiatives likely to be challenged by Congress should Republicans gain full control of both the House and Senate in November. Some lawmakers are already strategizing to hinder the SEC's initiative through the budget process.

With a GOP House majority, lawmakers would "very likely" pass a government funding bill with a so-called rider, defunding the SEC climate risk disclosure program, predicted U.S. Rep. Chris Stewart, a Republican from Utah and member of the House Appropriations Committee.

"The question then becomes: Is the president or our Democratic leaders willing to endure, or have the country endure, a potential government shutdown over this language?" Stewart said in an interview. "I can't imagine that they would."

Stewart said he and his Republican colleagues would not hesitate to use the threat of a federal government shutdown to stop what he called an overreach of SEC authority and effort to circumvent the will of Congress.

Observers said Republicans could also attack the SEC rule by changing securities laws to let Congress override any regulation. Doing so would require 60 votes to avoid a potential filibuster, however.

Another option for Republicans is to use the Congressional Review Act. Under its provisions, an incoming Congress with a simple majority vote may overturn a major regulation passed within 60 days of the conclusion of the previous Congress. But Biden would have to sign such a resolution, something highly unlikely.

Others predict the SEC climate risk disclosure rule will be finalized and implemented as planned.

"I don't think, even if Republicans were to gain control of both houses, that it would necessarily impact the SEC's rule because this is a regulatory agency and appointments have been made," Danielle Fugere, president and chief counsel of shareholder advocacy group As You Sow, said in an interview. "I think the SEC will continue moving forward and, obviously, regulatory agencies are under the direction of the White House."

In conversations with Republican lawmakers, SEC Chairman Gary Gensler has pointed to the huge volume of comments submitted on the rule — at least 14,645, according to a July tally published in the National Law Review — and to the broad support it has received from institutional investors.

"This rule is rooted in decades of law and it's about a conversation that's already going on between public companies and their investors," Gensler told a Sept. 15 hearing by the Senate Committee on Banking, Housing and Urban Affairs. "Investors, I think, would benefit from the fragmented disclosures that are happening now."

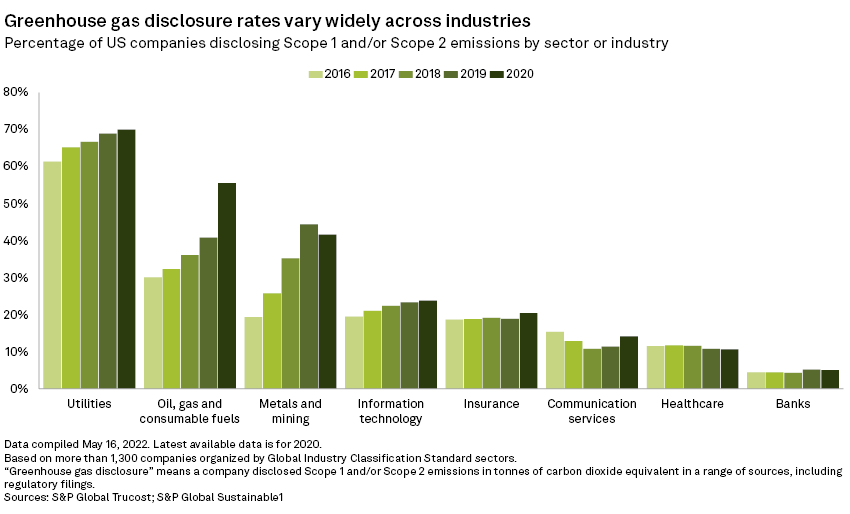

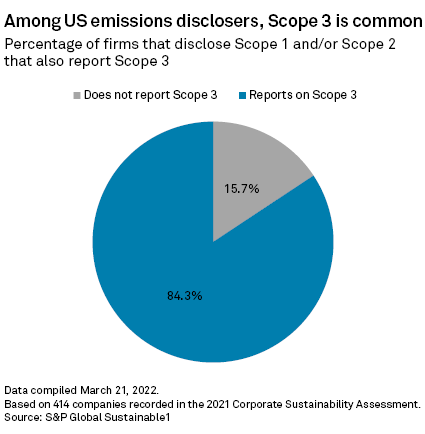

Many companies already disclose their carbon footprints, including indirect Scope 3 emissions, and disclosures vary by industry. Under the proposed rule, publicly traded companies that already report or have committed publicly to reducing Scope 3 emissions associated with their end users or supply chains would be required to estimate the annual volume of such releases "or just discuss how they're managing that," Gensler told the Senate hearing.

SEC 'on notice'

Opponents of the SEC rule have also been emboldened by a recent U.S. Supreme Court ruling that limited the U.S. Environmental Protection Agency's authority to regulate power plant carbon emissions.

The opinion in West Virginia v. EPA for the first time cited the "major questions doctrine," which the court's majority said comes into play when an agency pursues a novel rule that could affect the nation's economy. The June court ruling may also have opened the door for legal challenges to rulemakings across the federal government, the court's three liberal justices suggested in their dissent.

The court "ruled that the executive branch cannot use novel interpretations of existing law and pretend they have a legal authority to support sweeping policy changes, including on climate change, that Congress never intended," Sen. Pat Toomey of Pennsylvania, the top Republican on the Senate banking committee, said to Gensler during the Sept. 15 oversight hearing.

"Well, that's precisely what the SEC appears to be trying to do with its climate disclosure rule," Toomey continued. "The SEC should consider itself to be on notice by the court that the separation of powers that still exists will be upheld."

Many organizations contacted for this story, including the SEC, were hesitant to comment on a politically charged issue.

"We'd be speculating, so will decline comment," an Institutional Shareholder Services spokesperson told S&P Global Commodity Insights in an email. The company provides environmental, social and corporate governance data along with research and ratings to some of the world’s largest financial institutions.

States gearing up for litigation

If Republicans in Congress still find their options limited, they can expect help from red states that signaled they will sue the SEC once the rule becomes final later this year or in early 2023. Lobby group American Legislative Exchange Council has prepared model legislation for Republican-led states willing to challenge a "forced imposition" of the SEC's environmental, social and governance policies.

Led by West Virginia Attorney General Patrick Morrisey, who brought the case against the EPA in West Virginia v. EPA, 16 Republican attorneys general warned the SEC in a joint comment on the planned rule in June that it is "hard to see how it can legally, constitutionally and reasonably assume a leading role when it comes to climate change."

Such state intervention, including decisions by Texas and West Virginia to ban banks that seek to reduce fossil fuel holdings, concerns As You Sow's Fugere more than a possible Republican majority in Congress come 2023.

"I think that it can have a chilling impact and that we should all be taking it seriously," Fugere said. "But I see little likelihood that this Republican onslaught will change the nature of the way companies are doing business with respect to climate change. This is about politics."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.