Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Nov, 2022

|

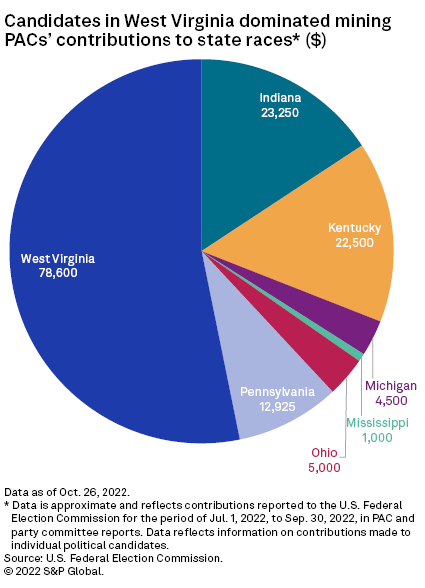

Mining interests led by coal PACs devoted 53% of their third-quarter campaign spending to West Virginia, which made headlines for banning or restricting financial institutions with strict ESG policies. |

Top mining political action committees donated 35% less to individual candidates in the 2022 U.S. midterm elections than they did in the 2018 midterms, even as national campaign spending on the election skyrocketed.

Select major mining PACs spent approximately $413,000 on donations to individual candidates between July 1 and Sept. 30, according to PAC and party committee reports from the U.S. Federal Election Commission, with coal interests outspending their diversified mining peers. Mining PACs have spent nearly $965,000 on campaigns for the entirety of the 2022 election cycle as of Oct. 31, according to nonprofit campaign finance tracker OpenSecrets.

Campaigns overall are expected to spend $9.3 billion in 2022, up from $7.1 billion in 2018, OpenSecrets reported, suggesting that while candidates and their other financial backers see this election as a high-stakes affair, miners are content to work with whichever party takes control of Congress.

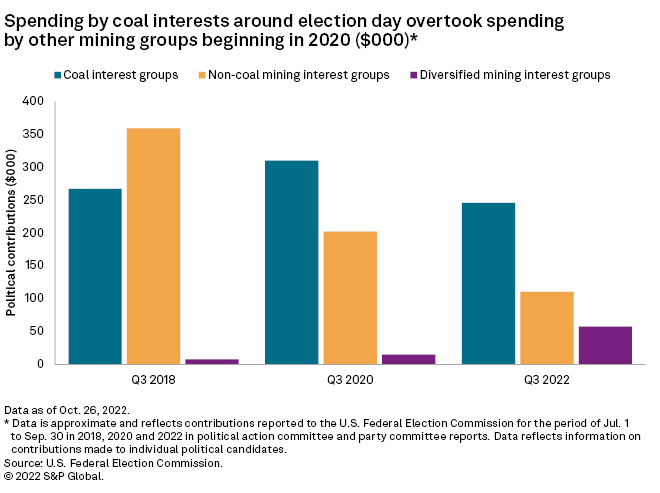

Third-quarter donations by the mining industry were down 21.5% compared to the same period in 2020, according to an analysis of campaign finance data by S&P Global Commodity Insights. Special interest groups typically spend less money for midterm elections than they do in presidential election years.

In 2022, mining interests have split their donations almost evenly between federal and state-level races.

"As a U.S.-based metals and mining company, we support policies that will encourage minerals independence, responsible resource development, and allow our industry to continue investing in the rural and remote parts of our country where mining takes place," said Mitchell Krebs, president and CEO of Coeur Mining Inc., a precious metals producer whose PAC gave $19,500 to campaigns in the third quarter.

Most of these contributions went to candidates representing states with major mining interests, such as Nevada, where Coeur has several projects. "We look forward to continuing our efforts with the new Congress to advance the policies that support a reliable, domestic metals and minerals mining industry," Krebs said.

|

Those priorities have become increasingly bipartisan in recent years as Democrats passed major spending bills that promote domestic mining, and the party made a doomed attempt at changes to federal permitting law that could find new life in a split Congress.

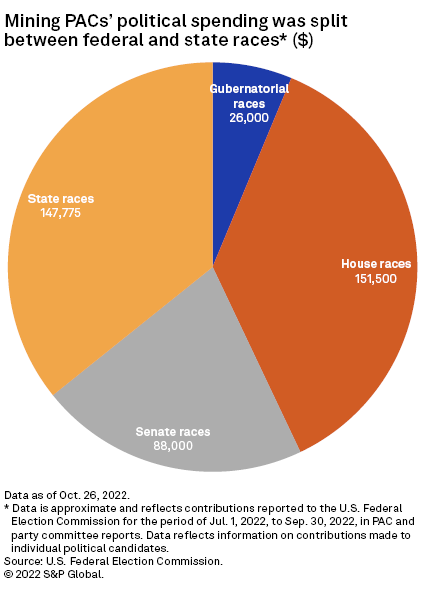

A narrow majority of total spending by mining interests in the third quarter, approximately 58%, went to candidates campaigning for federal offices, while the rest went to state-level races, including candidates for governorships and state legislatures.

Coal plays kingmaker

Of mining company campaign donations, 59.4% came from coal interests and 13.9% came from diversified miners with some coal operations. That 73.3% total proportion marks an increase from 61.7% in 2020 and 43.2% in 2018.

PACs representing coal interests spent approximately $246,000 in the third quarter, more than double the $110,000 in contributions from mining groups without ties to coal, according to campaign spending data.

As coal has increased its share of donations, coal prices have rallied and U.S. coal producers expect to report higher earnings in the wake of Russia's invasion of Ukraine. Even before the war, U.S. exports of coal increased 23% between 2020 and 2021, reaching 77.3 million tonnes after previously declining from a 2018 high of 105 million tonnes.

Non-coal-producing companies appear to be keeping their powder dry. Even developers with controversial U.S. projects — such as Antofagasta PLC subsidiary Twin Metals Minnesota LLC, which owns Maturi, and Northern Dynasty Minerals Ltd., the owner of the Pebble copper-gold project in Alaska — had no contributions reported in the FEC database.

Spending goes local

Local legislatures have become an increasingly important battleground for mining issues. Of the major contributions to individuals analyzed, nearly $148,000, or 35.8%, went to nongubernatorial state elections.

Mining companies may use their influence in state legislatures to fight back against federal environmental, social and governance considerations, such as the climate disclosures proposed by the SEC, that are putting pressure on the mining industry. Mining interests, led by coal PACs, devoted 53.2% of their campaign spending to West Virginia, where the Republican-led state made headlines for banning or restricting financial institutions with strict ESG policies.

"The SEC's ESG rule is a priority," Mike Cope, president of the Ohio Coal Association, said in an interview, suggesting industry backlash to ESG rules could take shape in states and potentially progress to the Supreme Court.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.