S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Jul, 2022

By EMMA CONCEPCION BERGADO

Welcome to The Daily Intel, a roundup of exclusive news and analysis from S&P Global Market Intelligence, curated by our journalists.

Editor's Pick

Upcoming midterm elections pose new challenge to Biden climate agenda

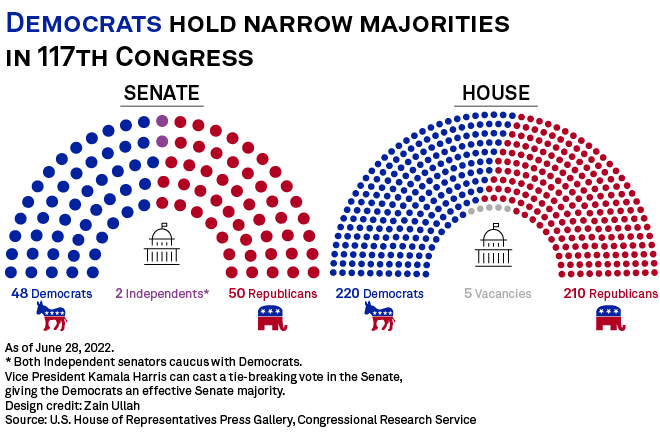

A potential Republican takeover in Congress after the November midterm elections could further complicate U.S. President Joe Biden's ambitions to decarbonize the power sector and broader economy.

Although the elections are months away, recent polling has favored Republicans to retake majorities in the U.S. House of Representatives and possibly the Senate. GOP lawmakers have backed oil and natural gas industry calls for easier access to federal areas for production to curb soaring energy prices and replace lost supply from Russia after its invasion of Ukraine. They have also opposed Biden's efforts to enact tougher emissions rules for the power sector and establish a national clean energy standard.

Financials

The slowdown in U.S. bank M&A activity is likely to drag on for at least the rest of the year as a number of factors plague banks' deal appetite.

Extended closing times plague large bank deals

Some pending deals have surpassed median deal close time of 141 days by a considerable margin.

Hungarian banks to suffer major profit blow from new windfall tax

A new windfall tax in Hungary will strike a significant blow to banks' earnings over the next two years, as the government says key institutions have been making "extra profits."

Dutch bank ING could exceed revenue target amid rising rates

ING Groep NV could beat its medium-term net interest income target amid a tightening of monetary policy.

Insurance

US insurance companies with highest price-to-estimated 2022 EPS ratios in Q2

U.S. publicly traded property and casualty insurers had a median price-to-estimated 2022 earnings multiple of 13x as of June 30, down from 13.5x a quarter earlier.

Private Equity

Private equity, venture capital deal value worldwide plunges in June, Q2

Private equity and venture capital deal value worldwide sank 56.1% in June to $62.63 billion from $142.73 billion in the same month a year ago, according to S&P Global Market Intelligence data.

Energy and Utilities

Renewable energy supplied over a quarter of US power in April

U.S. power generation from utility-scale renewables reached 85.3 million MWh in April, down from 87.1 million MWh in March, supplying 28.0% of U.S. power needs for the month.

Technology, Media and Telecommunications

Zendesk to be acquired for $9.9B in wave of private equity software deals

Private equity firms are increasingly targeting software-as-a-service companies, with five $1 billion-plus deals in the sector already announced in North America in 2022, according to S&P Global Market Intelligence data.

Metals and Mining

1st meeting of White House mining law reform group provides hope for industry

Permitting rules and a drive to increase U.S. metals production anchored discussions at the first meeting of President Joe Biden's Working Group on Mining Regulations, Laws, and Permitting in May, participants told S&P Global Commodity Insights.

Want more sector-focused news?

Read our in-depth coverage of Financials, Real Estate, Energy & Utilities, Materials, Healthcare and TMT on the S&P Capital IQ Pro platform.