Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2022

By Jason Woleben and Hailey Ross

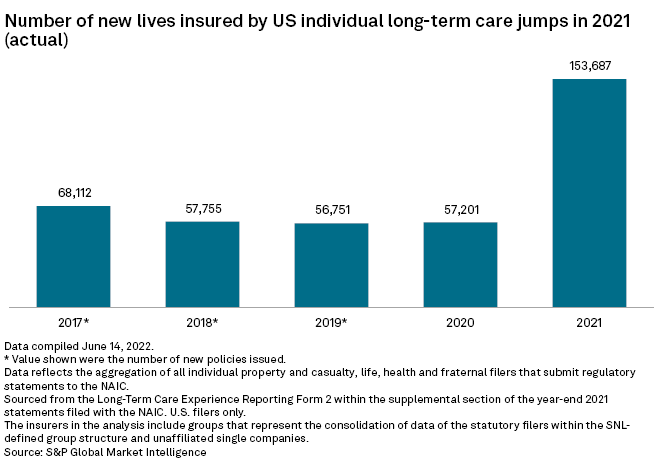

The number of new individual long-term care customers nearly tripled in 2021.

The spike was likely a one-time bump related to the creation of a public option in the state of Washington, which caused many residents to seek private coverage instead of participating in the government-mandated program, according to Jesse Slome, executive director of the American Association of Long-Term Care Insurance.

One-time bump

In aggregate, U.S. underwriters added 153,687 new lives to their books in 2021, compared to roughly 57,200 during the previous year, according to a review of annual regulatory statements.

|

* Download a spreadsheet with details of the annual long-term care reporting form 2 supplement. * Read an article about the 2021 operating performance within the long-term care business line. |

Although many residents in Washington were motivated to apply for private long-term care policies, implementation in the state's public long-term care fund was delayed and is not expected to impact workers' payrolls until at least 2023, with benefits becoming available in 2026. Slome in an interview said there is "no question" that many people in Washington applied for policies. The ultimate fate of the program, however, could be up in the air as state lawmakers could always shut it down. Whether customers would retain their policies is also uncertain.

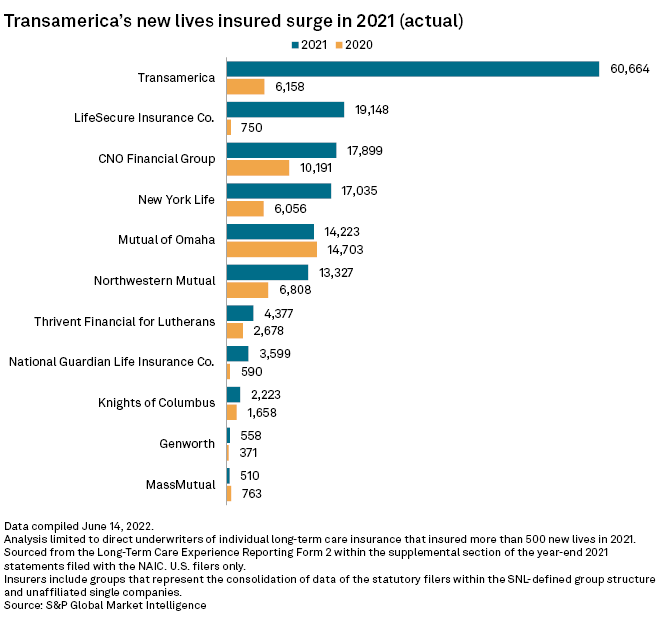

Transamerica's new customer surge

Aegon NV's Transamerica affiliates issued new individual long-term care, or LTC, policies covering 60,664 lives in 2021, about 55,000 more customers compared to 2020. About 93% of the insurer's new 2021 customers were residents of Washington. Transamerica stopped issuing new individual LTC policies during the year.

LifeSecure Insurance Co. also saw a large year-over-year increase in the number of new customers. The Michigan-based insurer's new customers grew to 19,148 in 2021 from only 750 in 2020. Of its new customers in 2021, roughly 18,300 reside in the state.

Of the 11 U.S. writers of individual LTC with at least 500 new lives issued in 2021, only the affiliates of Mutual of Omaha Insurance Co. and Massachusetts Mutual Life Insurance Co. reported year-over-year decreases.

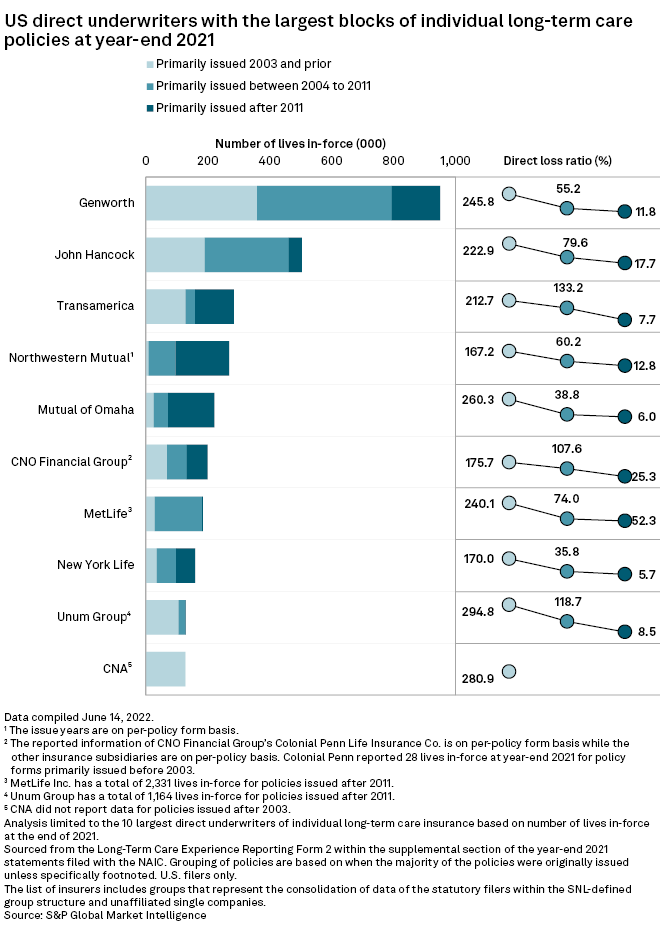

High loss ratios on old blocks

A majority of the largest direct underwriters of individual LTC policies reported direct incurred loss ratios in excess of 200% on their oldest blocks of business.

Unum Group, for instance, reported a direct loss ratio of 294.8% on individual LTC policies issued prior to 2003. The insurer had almost 106,000 lives in force within its oldest block of policies at the end of 2021, accounting for roughly 81% of its total policies. The Tennessee-based insurer had about 22,600 lives in force for policies issued between 2004 and 2011. Unum reported a direct loss ratio of 118.7%, on those policies, which equates to $52.8 million in incurred claims on $44.6 million in earned premiums.

Genworth Financial Inc. reported almost 950,500 covered lives with its individual LTC book at year-end 2021, accounting for about 22% of the total U.S. individual LTC market. Its largest block of in-force lives comprises policies issued between 2004 and 2011, which totaled $1.19 billion in earned premiums and $656.6 million of reported incurred claims.