Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Sep, 2021

|

|

The bulk of lithium extraction, processing and refinement still occur outside the U.S. During the second quarter, Argentina supplied the majority of processed lithium materials to the country. Lithium processing operations in Susques, Argentina, are pictured above. |

U.S. lithium imports picked up pace in the second quarter as the economy recovered from the first waves of the COVID-19 pandemic, and companies revived industrial activity.

The country's reliance on lithium imports exposes the relatively undeveloped U.S. production and manufacturing base for the metal, despite U.S. President Joe Biden's efforts to promote domestic production. U.S. electric vehicle and electronics manufacturers instead import finished batteries, while much of the country's lithium imports go toward industrial uses, according to an analysis by S&P Global Market Intelligence.

U.S. lithium import volumes are low compared to the global lithium trade, analysts said, as the U.S. instead imports finishedbatteries manufactured abroad. Second-quarter imports of lithium-ion batteries for electric vehicles boomed, jumping 47.8% year over year, according to Panjiva data. Lithium-ion batteries imported for other applications surged 145.0%.

Broken supply chains

The Biden administration called on the U.S. to strengthen domestic critical mineral supply chains aimed at bringing raw material, battery and EV production closer to home or sourcing these products from nations considered allies to the U.S.

Permitting hurdles and insufficient processing infrastructure have hindered the country's development, and the U.S. has a long way to go if it wants to be a major player in lithium markets, said Ian Lange, an economist at the Colorado School of Mines and a former economic advisor during the Trump administration.

"If we want to have more secure supply chains, that means thinking about having more, or most, of the supply chain in the U.S. and allied countries," Lange said.

The U.S. lags at all stages of the supply chain, including lithium-ion cell production, with 12 "battery megafactories" in operation, according to Benchmark Mineral Intelligence. Tesla operates a battery plant in Sparks, Nev., and a pilot plant in Fremont, Calif. Battery makers LG Energy Solution Ltd., SK Innovation Co. Ltd. and Envision AESC own battery plants in the country too.

By comparison, China hosts 156 battery megafactories.

Imports rising amid industrial bounceback

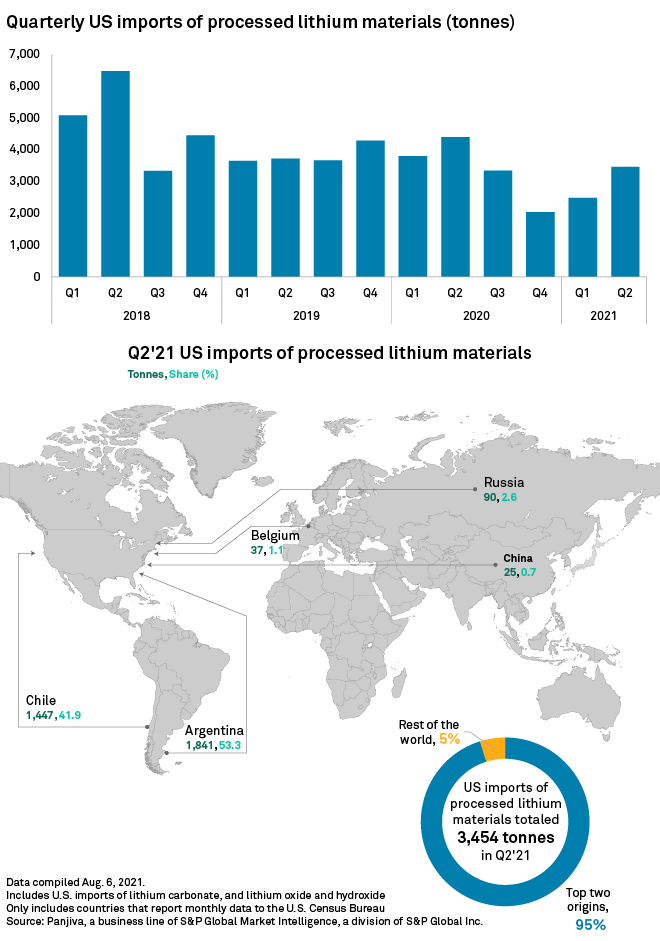

Imports of processed lithium — including lithium carbonate and lithium hydroxide — rose during the June quarter from last quarter, though they slipped 21.3% from the year-ago period to 3,454 tonnes, according to data sourced from Panjiva.

>Companies extract lithium ores or brine concentrates and process the ore into lithium compounds. The processed metal is then refined into lithium chemicals. Refined lithium includes products such as lithium metal and lithium chloride, while processed lithium includes lithium carbonate and lithium hydroxide.

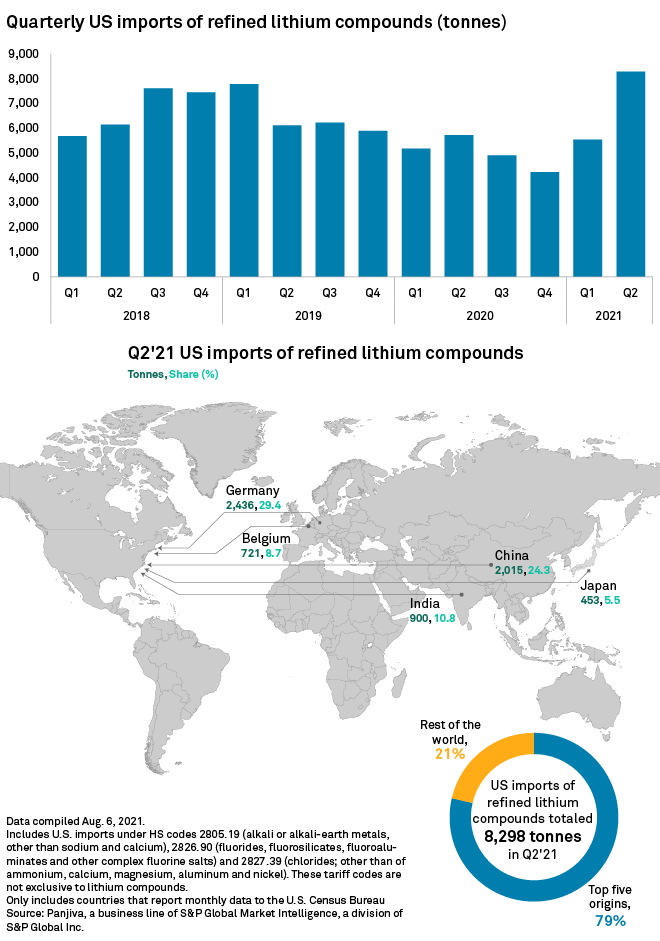

About 95.2% of processed lithium materials arriving in the U.S. during the second quarter came from Argentina and Chile. Meanwhile, the majority, 29.4%, of refined lithium was routed from Germany and 24.3% from China.

Second-quarter imports of refined lithium — including lithium metal and lithium chloride — rose 49.7% year over year to 8,298 tonnes, increasing 26.8% in the first half of the year as industrial activity rebounded.

"The recovery in traditional industries — refractories, steel mills, manufacturing — in Europe and the U.S. has really been exceptional," Benchmark Mineral Intelligence lithium analyst George Miller said in an interview.

The majority of the lithium the U.S. imports goes toward industrial uses, such as glass or grease, Miller said. Lithium imports rose amid an economic recovery as the pandemic eased.

However, that may start to change.

"We expect the North American use of lithium to move more toward battery consumption, and this is when these import statistics may become more representative of EV market growth," Miller said.

Some of the lithium imports during the June quarter likely went to the country's leading EV manufacturer, Tesla Inc., and Japanese battery maker Panasonic Corp. too.

In a certain way, we know [the imports] could also be attributed to Tesla's increase in production," Miller said. "Tesla and Panasonic have been doing incredibly well in the U.S. as of late, and their vehicle sales have really been skyrocketing."

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.