S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Oct, 2021

| The complex yet opaque global lithium-ion battery supply chain leaves manufacturers and their customers in automotive, power and tech sectors exposed to significant risks. Source: alengo/E+ via Getty Images |

With lithium-ion battery technology at the center of the electric vehicle revolution, the decarbonization of power grids and the tech boom, a global blitz is underway to secure supplies, from raw materials to finished batteries.

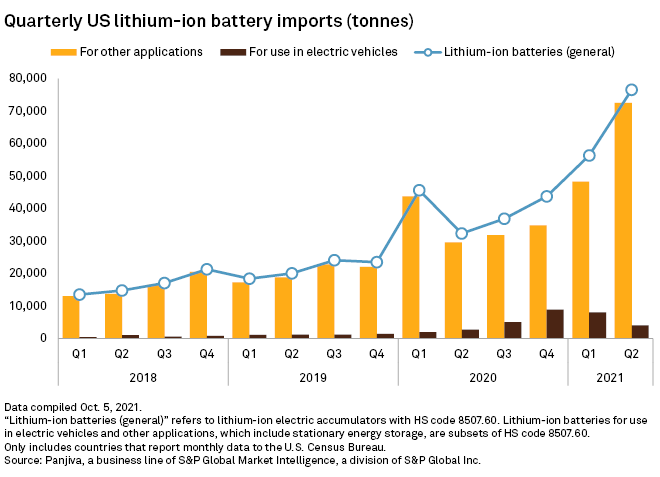

This frenzy is supercharging calls for industries to ensure their products are free of human rights abuses, ecological transgressions and other risks associated with the far-flung, fast-growing supply chain. That is no easy task for companies based in the United States, where imports of lithium-ion cells and packs are skyrocketing.

In the second quarter of 2021, such imports more than doubled from a year earlier to an all-time quarterly high of 76,532 metric tons, according to data from Panjiva. China accounted for 63% of that total, followed by South Korea with 19% and Japan with 5%.

China dominates most links in the supply chain, including more than 60% of global lithium refining, over 70% of cobalt refining and nearly 80% of anode production, according to S&P Global Ratings. Mining for the metals that go into lithium-ion batteries occurs largely outside of China, with the Democratic Republic of Congo as the main source of cobalt and South America home to the abundant "lithium triangle" covering parts of Chile, Bolivia and Argentina.

Few, if any, companies can reliably trace every element that goes into their products or disprove alleged offenses, supply chain experts say.

"On the solar side, we've learned a bunch of really key lessons. And one of those key lessons is if you are innocent, it's almost impossible to prove that you're innocent," Paul Wormser, vice president of technology at Clean Energy Associates LLC, said in an interview.

Message to companies: Be prepared

Clean Energy Associates assists solar companies grappling with U.S. trade sanctions over alleged forced labor involving a major materials supplier in China's autonomous Xinjiang region, helping to trace and document the often opaque supply chains. It advises battery makers and their customers to be prepared as well.

"Storage might get tagged, just as solar has been tagged," Wormser said.

U.S. Customs and Border Protection declined to comment on whether it is exploring human rights violations in the lithium-ion battery supply chain.

Justin Long, CBP headquarters branch chief, said the agency continues to probe "credible allegations" of any forced labor in China and would take action if warranted. The U.S. government has nearly three dozen active orders to detain Chinese merchandise — including silica-based products used in solar panels — over forced labor allegations.

China has vehemently denied the allegations.

"The so-called 'forced labor' in Xinjiang is a complete lie," a spokesperson for the Chinese embassy in Washington, D.C., said in an email. "Using this as an excuse to suppress Chinese products not only violates international trade rules and market economic principles but also disrupts global industrial chains and supply chains. The U.S. side should correct its wrong practices."

Tackling transparency deficit

Supply chain transparency is necessary to conduct thorough analyses of carbon emissions that go into manufacturing, identify root causes of product defects and conduct assessments of risks that have become more obvious during the coronavirus pandemic, Wormser said.

"I just don't believe there's a way of demonstrating ethical performance or greenhouse gas footprint" without a database system to authenticate the claims, said Mathy Stanislaus, policy director for the Global Battery Alliance.

The group is working with EV, battery and material suppliers like Tesla Inc., LG Chem Ltd. and Glencore PLC — as well as investor and government representatives, software specialists and others — on a solution to the transparency deficit.

The Global Battery Alliance's flagship Battery Passport initiative seeks to create a digital record "from the mining to the first sale of a rock, to the smelting operation, to the battery operation," Stanislaus said. T

An initial "minimum viable product" is scheduled for completion by the end of 2022, Stanislaus said. The group's ultimate vision is to facilitate a sustainable battery value chain by 2030, capable of slashing emissions from power and transportation sectors, creating millions of new jobs and supporting a just energy transition.

'We want authenticated data'

The effort to provide more transparency comes as battery, EV, energy storage and consumer electronics giants feel pressure for swift action.

"We see firsthand the people — children, women and men — who work in undignified conditions in artisanal mining where their health, safety and futures are jeopardized," said Winifred Doherty, who represents Our Lady of Charity of the Good Shepherd before the United Nations. "We see how the earth and surrounding land and environment are destroyed through poor mining practices."

The international order of Roman Catholic nuns, commonly known as Sisters of the Good Shepherd, has ministries in Congo and is calling for companies across the lithium-ion battery supply chain to be more transparent and accountable. The New York province of Sisters of the Good Shepherd filed a shareholder proposal in 2021 for Tesla's board of directors to commission an independent assessment of the company's human rights and sourcing practices to "either verify or disclaim if there are short fallings," Doherty said in an email.

Though Tesla shareholders rejected the measure Oct. 7, it performed slightly better than a similar 2020 proposal from the Sisters, garnering 148,684,322 of the 575,808,675 votes, roughly 26%.

|

Congolese cobalt linked to child labor is one of the complex risk |

Tesla and several large tech companies are named in a class-action lawsuit before the U.S. District Court for the District of Columbia. The lawsuit, filed by International Rights Advocates in December 2019, alleges the companies are "knowingly benefiting from and aiding and abetting the cruel and brutal use of young children in [Congo] to mine cobalt."

Tesla did not respond to an email request for comment about the lawsuit or the Sisters' proposal.

"Being named as a defendant in a pending lawsuit does not indicate that Tesla is responsible for any wrongdoing," the company said in an SEC filing on Aug. 26.

Concerns over human rights abuses go well beyond shareholder activism and cobalt, and they will likely persist until companies can prove they are beyond reproach.

"The institutional investors are also turning to battery companies, the EV companies, to say ... 'We want authenticated data to demonstrate compliance,'" said Stanislaus of the Global Battery Alliance.

While domestic manufacturers scramble to address ESG risks associated with imported goods, some are calling for the Biden administration to step in with tax incentives and other support to expand the underdeveloped U.S. lithium-ion battery supply chain.

Tesla's manufacturing complex in Nevada with Japanese electronics giant Panasonic Corp. is one of the largest lithium-ion battery production sites in the world. Tesla also has a pilot battery cell facility and an energy storage system assembly plant in California and intends to manufacture cells in Texas too. General Motors Co., Ford Motor Co. and their partners are pumping billions of dollars into domestic battery and EV manufacturing. Koch Strategic Platforms LLC, the investment arm of industrial giant Koch Industries Inc., recently formed a joint venture with European upstart Freyr Battery to produce cells in the U.S.

Wormser of Clean Energy Associates hopes domestic factories become more vertically integrated. "Instead of bringing raw materials that have been processed in China over to the U.S. ... it would be interesting to see them go from start to finish, from digging rock out of the ground to a finished product that all takes place in the country."

Companies are expressing such ambitions. Tesla's goal is to source as many components as possible on the continents where it produces its EVs, according to Andrew Baglino, senior vice president of powertrain and energy engineering. "And not just at the end assembly level, but as far upstream as possible," Baglino told investment analysts on an Oct. 20 earnings call.

Ford is working with South Korean battery maker SK Innovation Co. Ltd. to invest $11.4 billion to manufacture batteries and EVs at multiple sites in the Southeast, the automaker announced Sept. 27. One manufacturing hub in Stanton, Tenn., dubbed Blue Oval City, is envisioned as a reinvention of how EVs and lithium-ion batteries are made and recycled.

"Our vision is to achieve closed-loop battery manufacturing in the U.S.," Ford spokesperson Martin Günsberg said in an email.

Ford's plan relies partly on Redwood Materials, Inc., a battery recycler and materials supplier co-founded by former Tesla Chief Technology Officer Jeffrey Straubel. Redwood Materials operates a recycling plant in Nevada, where it pulls cobalt, lithium, nickel and other metals from scrap for reuse in new batteries for EVs, energy storage systems and consumer electronics.

"We believe it is important to have a North American supply chain built up for materials going to battery cell production in North America," said Jeremy Bezdek, managing director of Koch Strategic Platforms and a board director at Freyr. "Is the supply chain ready? I would say not yet. But there are significant investment dollars going into North American-based companies that are going to build out that supply chain over the next decade."

Panjiva is a business line within S&P Global Market Intelligence, a division of S&P Global Inc.