S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Mar, 2021

By Garrett Hering and J. Holzman

| China's |

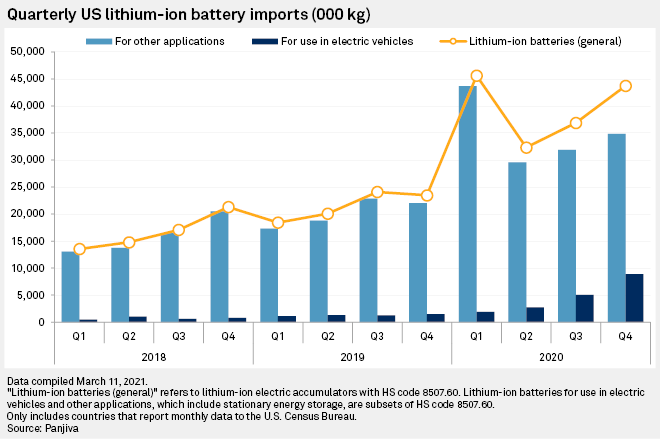

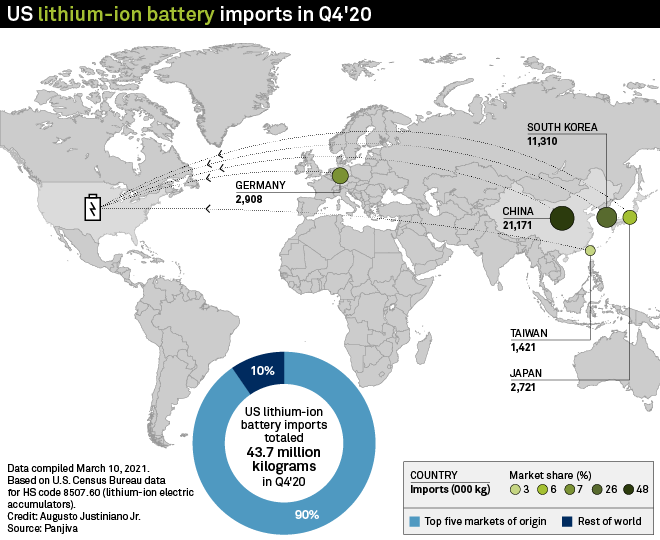

U.S. imports of lithium-ion batteries from Asia, especially China, are surging in synch with America's rising appetite for electric vehicles, consumer electronics and battery peaker plants.

Imports of lithium-ion batteries jumped 86% in the last three months of 2020 to 43.7 million kilograms, growing eight times faster than a year before, according to data from Panjiva. China shipped a 48% share of the imported lithium-ion cells and packs in the fourth quarter of 2020, followed by South Korea with 26%. Germany accounted for another 7% and Japan supplied 6%.

For the full year, lithium-ion battery imports rose 84% to 158.5 million kg, up from 29% growth in 2019, Panjiva data shows.

The acceleration of imports comes as the U.S. federal government reviews the risks of the country's rising reliance on foreign sources of critical battery metals and system components and seeks to stimulate domestic manufacturing, as President Joe Biden ordered in February.

"The Biden administration will need to support the full [battery] supply chain," said Chris Rogers, supply chain analyst at Panjiva.

The U.S. has had some success establishing a foothold in lithium-ion battery production. Electric carmaker and energy storage system supplier Tesla Inc. partnered with Japanese electronics giant Panasonic Corp. on a large-scale lithium-ion battery manufacturing plant in Nevada, and Tesla plans to ramp up another site in Fremont, Calif.

Other projects are moving more slowly. Two major South Korean battery suppliers, LG Chem Ltd. and SK Innovation Co. Ltd., are in a protracted legal battle over intellectual property that threatens a planned lithium-ion battery factory in Georgia.

Meanwhile, China is going all-in on lithium-ion battery production, with more than 50 such lithium-ion "megafactories" now in operation and at least 50 more planned, according to Benchmark Minerals Intelligence.

Raw materials gap

But setting up factories to build batteries for carbon-free transportation and power may be easier than establishing a supply chain to operate American facilities.

"The biggest challenge for the Biden administration isn't getting production of batteries into the U.S. — Tesla and LG are already doing that — but rather accessing the raw materials," Rogers said.

|

|

Panjiva is tracking emerging challenges with U.S. imports of critical battery materials. Shipments of lithium have declined 35.4% in the past 12 months.

Federal policymakers are aware of the supply-side challenges as well as opportunities such as substantial untapped lithium reserves in North America.

"America is in a race against economic competitors like China to own the EV market — and the supply chains for critical materials like lithium and cobalt will determine whether we win or lose," U.S. Energy Secretary Jennifer Granholm said March 18 in announcing $30 million for critical minerals research. "If we want to achieve a 100% carbon-free economy by 2050, we have to create our own supply of these materials, including alternatives here at home in America."

While the U.S. mining industry is eager to work with the Biden team and has even adopted the president's "Build Back Better" rhetoric around green energy stimulus, stakeholders agree that more than research money will be required for the U.S. to become a major player in global battery supply chains. However, it is unclear whether a polarized Congress with slim margins of Democratic control in both chambers will be able to enact a massive energy bill, even if such a measure included opportunities for miners in Republican-controlled jurisdictions.

'A better model, better standards'

To be sure, there is interest harnessing America's battery metal resources. For instance, state officials in California have formed the Lithium Valley Commission, including public- and private-sector officials, to explore lithium extraction in the Salton Sea area of Southern California. Additional significant lithium reserves are in Arkansas, Nevada, North Carolina and Utah.

For now, most of the world's largest lithium extraction projects are in Australia, Chile and China. But U.S. companies have another way to procure lithium and other battery metals: investing in other countries' production. One option could be Canada, one of America's largest trading partners. U.S. Commerce Department officials recently met with Tesla and other battery-makers to discuss creating a North American battery supply chain to source critical minerals from Canada, Reuters reported March 18.

Through so-called impact investment, akin to environmental, social and governance investing, U.S. companies could put money into battery metal production in nations outside of China and enforce higher environmental and human rights standards at the same time, Janvier Désiré Nkurunziza, chief of the commodities research and analysis section of the U.N. Conference on Trade and Development, told lawmakers at a March 16 hearing in the U.S. Senate Energy and Natural Resources Committee.

"That's what most countries are doing now because not every country will have all the resources," Nkurunziza said. "The U.S. can be a champion actually of all these problems. They can go in with a better model, better standards."

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.