Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 May, 2022

By Camille Erickson and Anna Duquiatan

| In the first quarter of 2022, 98.8% of processed lithium imported into the U.S. came from Chile and Argentina. A worker at a lithium processing plant in Susques, Argentina, is pictured above. Source: Ricardo Ceppi/Getty Images News via Getty News |

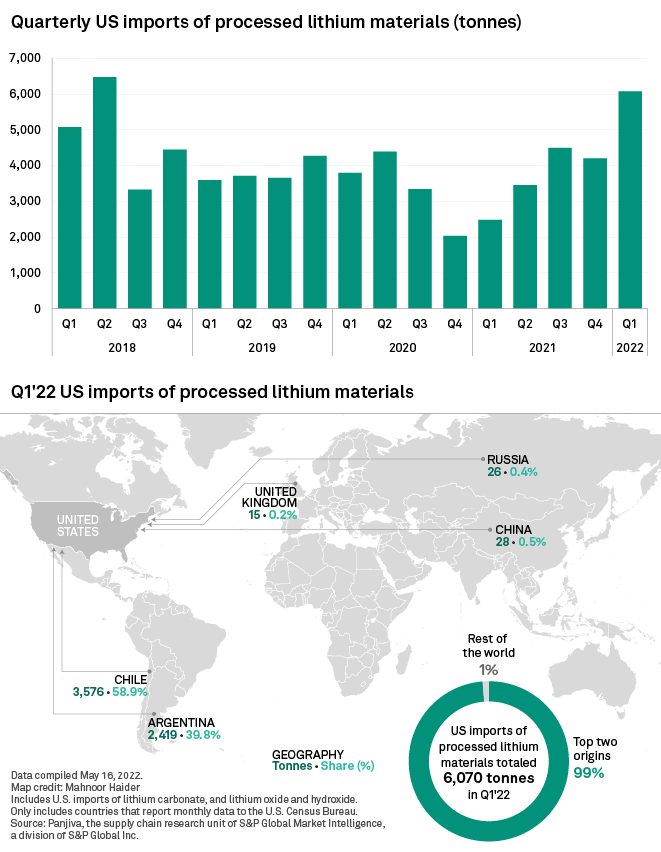

The U.S. imported 13,560 tonnes of processed and refined lithium materials in the first quarter, 69% more than in the same quarter in 2021 and 21.9% more than in the previous quarter, according to S&P Global Market Intelligence data.

Much of the lithium imported into the U.S. goes toward making industrial products, such as glass or lubricants, but an increasing proportion is being used to build the rechargeable batteries installed in electric vehicles. U.S. battery manufacturing capacity is expected to increase 10-fold between 2021 and 2025 as the country becomes a top EV market, according to Market Intelligence analysis. By 2030, U.S. battery capacity is forecast to hit 620 GWh, up from just 38 GWh of capacity in 2021.

Several companies plan to expand battery capacity this decade in the U.S. and increase domestic battery production for EV product lines, including automakers General Motors Co., Ford Motor Co., Tesla Inc. and Toyota Motor North America Inc., as well as battery manufacturers SK Innovation Co. Ltd. and LG Energy Solutions.

A long supply chain

Lithium is processed along a lengthy global supply chain before it can become a battery. Companies first extract lithium ores or brine concentrates and process them into lithium compounds. This processed material is then converted into lithium chemicals. Refined lithium includes products such as lithium metal and lithium chloride. Processed lithium includes the lithium carbonate and lithium hydroxide used in EV batteries.

Global lithium demand is forecast to reach 620,000 tonnes lithium carbonate equivalent in 2022, 21.3% more than 2021 demand, according to Market Intelligence data forecasts. A 2,000-tonne LCE deficit is expected to emerge in 2024 and balloon to an estimated 50,000 tonnes by 2026. The U.S. produces little of its own lithium, though some projects are in development.

Domestic lithium mining projects have been slow to come online due largely to permitting hurdles. Canadian developer Lithium Americas Corp. plans to produce 60,000 tonnes of battery-grade lithium carbonate at its Lithium Nevada lithium project once commissioned. The company has obtained its state environmental permits for the project and is awaiting a ruling on a federal permit, as of May 5. Australian company ioneer Ltd. also has its sights on Nevada, where it is planning its Rhyolite Ridge lithium-boron project. The company expects the project to come online in 2024, though it too is pending full regulatory approval.

The limited lithium mining and processing capacity in the U.S. forces companies to import raw materials. In the first quarter of 2022, 98.8% of processed lithium imported into the country came from Chile and Argentina, while the majority, 30.7%, of refined lithium came from China. Germany and Japan were the next largest suppliers of refined lithium to the U.S.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.