Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2021

By Peter Brennan and Brian Scheid

|

The rate of inflation in the U.S. has likely peaked as consumers switch from buying goods to services, but economists doubt the annualized increase in prices will fall back to the Federal Reserve's target rate of 2% before 2022.

Inflation is running hot as a variety of factors — pent-up demand and supply shortages, among others — have pressured prices for many goods, including used cars and trucks, apparel and electronics products. But some of those pressures are starting to wane as economic reopening is allowing consumers to spend more on services such as airfares, restaurants and cinemas, sectors of the economy that suffered during COVID-19 lockdowns.

"We are seeing an inflection point. In general, we'll see inflation moderate going forward," Gregory Daco, chief U.S. economist at Oxford Economics, said in an interview.

The headline consumer price index rose 5.4% in June, or 4.5% excluding volatile food and energy prices. The latter figure is the highest jump since 1991 as people rushed to buy the consumer goods such as cars denied to them during the pandemic.

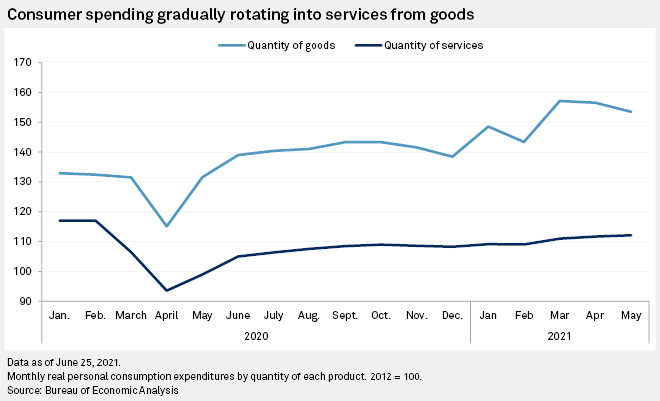

Real personal consumption expenditures — the total amount spent by consumers on goods and services — in May were 1.9% higher than in February 2020, before the pandemic ravaged the U.S. economy. But so far the recovery has been two-paced with the sale of goods surging, while service sectors such as airfares are taking longer to recover as COVID-19 measures are gradually removed.

Outlays on goods were 15.9% higher in May than the pre-pandemic level

The rotation into services means inflation will likely drop somewhat in the months to come, economists say. But the same pressures driving prices up will not disappear entirely, such that price rises through 2021 are likely to stay above the Fed's 2% target level, a key metric for determining when the central bank will wrap up its pandemic-era economic support.

"We're approaching peak inflation, yes, but the bigger question is not whether core [CPI] inflation will stay at 4.5% but whether it will drop back to 2% or below," Paul Ashworth, chief North America economist at Capital Economics, said in an email. "With wage growth accelerating, cyclically-sensitive price inflation on the rise — housing and food away from home — and inflation expectations rising, I don't believe this is largely transitory."

Switch to services

The persistent increase in the rate of inflation has piled pressure onto Fed policymakers who insist the effects are transitory — borne of disruptions to the global supply chains, and a sudden release of pent-up consumer demand as vaccination programs allow economies to unlock. The central bank has so far held off accelerating plans to tighten its ultra-loose monetary policy, which would see the Fed roll back $120 billion in monthly securities purchases.

"It should pass," Fed Chairman Jerome Powell told a House committee on July 14. "We should look at this as temporary."

Spikes in the sales prices of cars and the cost of commodities such as lumber and metals reflected the inability of the economy's supply to keep up with pent-up demand for goods.

A global shortage in semiconductors has held back new vehicle production, boosting demand for used cars and trucks in the U.S. Used vehicle prices grew by 45% between June 2020 and June 2021, the largest increase on record, according to the U.S. Bureau of Labor Statistics' latest data.

Cars contributed over 2 percentage points to the annual core inflation in June, according to economists at Dutch bank ABN Amro, meaning that without pressures from the car market, core inflation would have been a more tranquil 2.4%.

But prices of cars are now reversing.

Spending on autos plunged 8.5% in May, according to Oxford Economics. This reduced spending is apparent in the Manheim Used Vehicle Value Index, which measures used vehicles sale prices. The index showed that wholesale used vehicle prices fell 1.3% from May 2021 to June 2021.

As the economy continues to reopen, allowing consumers to spend their money on services, there will be less upward pressure on the price of goods, easing the inflationary bubbles that have appeared.

"June is likely to represent the peak in both monthly and annual inflation," said ABN Amro's senior economist, Bill Diviney.

Inflation likely to stick around

While some big pressure points will ease, inflation will not drop back toward the Fed's target level any time soon. The central bank's preferred core personal consumer expenditure metric was 3.4% in May, well above the bank's 2% target.

In a poll of 606 U.S. businesses across industries conducted by 451 Research, 33% said they are raising prices against just 4% who said they are falling, with retail — 44% — and manufacturing — 41% — leading the way with price rises.

Bottlenecks in global supply chains remain a concern. New outbreaks of COVID-19 in Taiwan are potentially another stumbling block as the global industrial base clamors for semiconductors, a key input in cars, computers and other electronic goods.

"We continue to expect the chip bottleneck to ease gradually in the second half of 2021, particularly for car companies, yet semiconductor supply will likely remain tight," Carol Liao, China economist at PIMCO, said in an email.

Meanwhile, hospitality prices, pushed low by a lack of demand during the pandemic, are expected to rise as consumer confidence rebuilds.

"We think there will be some stickiness [to inflation]. Core PCE will likely hover around 3%, a little bit lower than currently, in the back half of this year and then moderate in early 2022," Oxford Economics' Daco said.

James Knightley, chief international economist at ING, said inflation was likely to remain "well above" the Fed's 2% target for years.

"Yes there are several components that have contributed heavily, such as airfare and car prices, but given the strength in demand, I am worried that there is broader scarring in the economy, and this may limit the economy’s ability to fulfill that demand," Knightley said in an interview.

451 Research is part of S&P Global Market Intelligence.