S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Jan, 2023

By Hailey Ross and Jason Woleben

Going into 2023, the U.S. life insurance industry is expected to see continued improvement around mortality earnings and an increased focus on capital levels as rising interest rates boost investment income for the sector.

In an interview, Piper Sandler analyst John Barnidge said that although mortality should continue to improve for life insurers, the COVID-19-related benefits the industry previously saw from a claims utilization perspective should largely go away.

Barnidge added that he would expect fewer companies to be calling out explicit COVID-19 mortality as the impact of the virus continues to wane in what will be the pandemic's fourth year.

Impact of long duration targeted improvement reform

According to Barnidge, it remains to be seen what impact the implementation of the much-awaited long duration targeted improvement, or LDTI, accounting changes will have on the industry. The accounting standard will significantly amend the accounting and disclosure requirements for long-duration insurance contracts. Insurers will be required to review and update the cash flow assumptions used to measure the liability for future policy benefits for traditional and limited-payment contracts at least annually.

A lot of these previously provided estimates were produced using Jan. 1, 2021, rates, Barnidge said. As rates have since changed, it is difficult to see how exactly the implementation of the standard will play out at the start of the new year when SEC filers are mandated to comply.

Top performers

For the first nine months of 2022, U.S. insurers saw

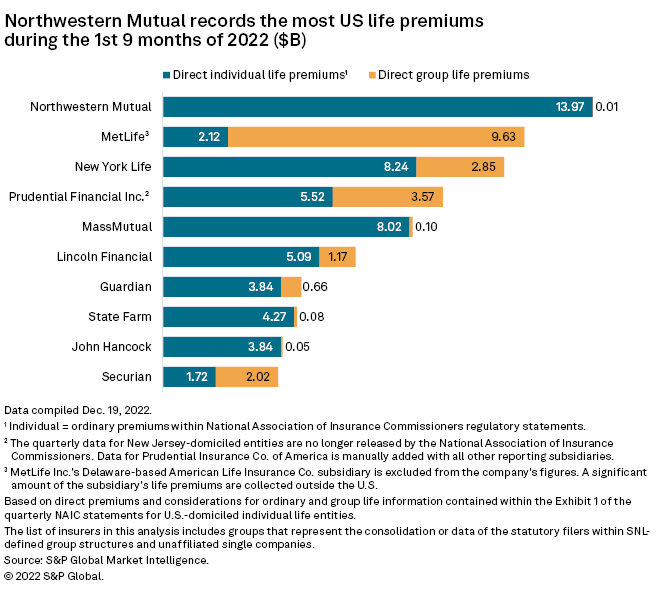

The U.S. life insurance industry experienced a 3.4% increase in combined individual and group life insurance premiums year over year for the period.

Through the first nine months of 2022, The Northwestern Mutual Life Insurance Co.,

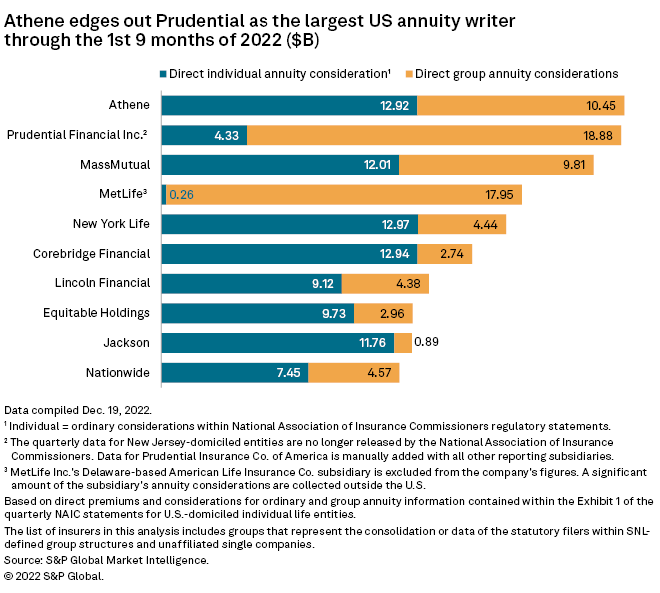

According to S&P Global Market Intelligence, outsized growth in the individual annuity business and ongoing strength in group annuities were notable standouts for the industry over the first nine months of 2022.

In terms of individual companies, Athene Holding Ltd., Prudential Financial Inc. and Massachusetts Mutual Life Insurance Co. were the largest annuity underwriters in the U.S. for 2022 year-to-date. Athene was the top performer of the group with $23.37 billion in considerations for 2022 year-to-date, which reflects an increase of 36.3% from the same period in 2021.

Stable outlook

In a report, Moody's characterized the outlook for the global life insurance sector as being "stable" overall as rising interest rates in most markets have paved the way for higher investment income and improved the profitability of interest-sensitive, guaranteed and spread-based products.

The outlook is also driven by life insurers' "strong capital positions," which should help them manage an operating environment with persistent inflation, tightening monetary policy, geopolitical shifts, market volatility and a rising risk of recession, the report said.

Fitch Ratings has released a neutral sector outlook for North American life insurers for 2023, noting that credit losses "remain benign" for the industry, but that volatility is "substantial" and the sector has moved into "material unrealized loss positions on fixed-income portfolios."

Fitch also added that most of the industry's liabilities are priced on a "nominal basis" and said the impact of high inflation is expected to remain within ratings expectations.

Life insurance sales in 2023 are expected to be "flat to down," according to Elaine Tumicki, corporate vice president and director of insurance product research at LIMRA, a trade association that counts many of the largest life insurers as members.