Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jan, 2024

US life insurers are expected to see a benefit to investment income amid high interest rates in 2024, but investors will likely still be watching for potential issues related to their commercial real estate portfolios.

The 10-year Treasury yield, which serves as a benchmark for insurers' new money yields, has been growing over the past couple of years. As of Dec. 29, 2023, the 10-year Treasury yield sat at 3.88%, an increase from 1.63% at the start of 2022.

In an interview, CreditSights analyst Josh Esterov pointed out that new money rates are "well ahead" of insurers' portfolio book yields despite the potential for the Federal Reserve to start cutting rates this year.

"That's going to be a medium- to long-term kind of tailwind for the industry," Esterov said.

More 2024 trends

Life insurers' commercial real estate portfolios have been a hot topic, particularly as the market for office space saw challenges in 2023. Concerns over exposure persist even though company executives have used earnings calls to try and assure investors that any potential problems in commercial real estate are manageable.

Enhanced scrutiny of growing private-equity investment into the insurance space may also be on the docket in 2024. In the Financial Stability Oversight Council's 2023 annual report, the council noted the increasing influence of new entrants in the life insurance space including private equity and alternative asset managers.

"The Council recommends that [the Federal Insurance Office], along with the National Association of Insurance Commissioners (NAIC), work with member agencies to evaluate the potential impact of these trends on systemic risk and associated financial stability considerations," the report said.

In 2024, the life insurance industry will also have to contend with developments around a fiduciary rule proposed by the US labor Department. The rule would update the definition of an investment advice fiduciary under the Employee Retirement Income Security Act and would also lower what it calls investment "junk fees" that consumers pay when purchasing retirement products.

During a mid-December 2023 hearing, insurance industry trade groups voiced strong opposition to the rule, arguing that regulations already in place are adequate, among other things. At least one insurance commissioner has also expressed displeasure with the proposed rule.

The 60-day comment period for the proposed rule was scheduled to close Jan. 2.

Top players

Heading into 2024, Metlife was the largest life insurance company based out of the US and the seventh largest globally in 2023. The company also landed a spot as the second-worst performing US life insurance stock in 2023 with its shares dropping around 7.5% for the year.

Meanwhile, The Northwestern Mutual Life Insurance Co., MetLife Inc. and New York Life were the largest US life insurers in terms of premiums, according to data compiled by S&P Global Market Intelligence.

Through the first nine months of 2023, the vast majority of Northwestern Mutual's $13.30 billion direct premiums came from individual life business. Metlife saw $11.45 billion in total direct premiums during the same time period, with $9.55 billion coming from group life business. New York Life followed closely behind with $11.13 billion in total direct life premiums.

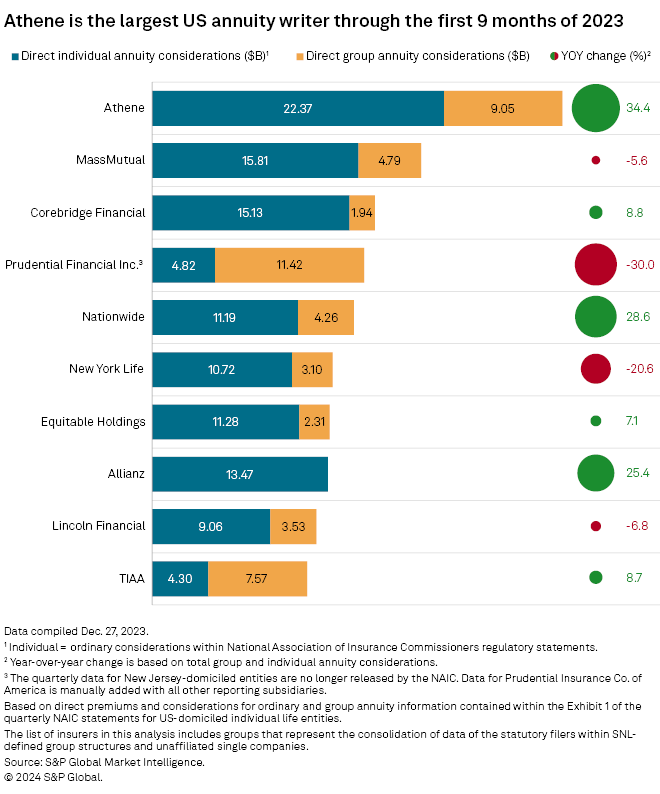

Meanwhile, Athene Holding Ltd. was the top US annuity writer with a total of $31.42 billion in combined direct individual and group annuity considerations reported in the first nine months of 2023. Athene also saw the largest year-over-year change with 34.4% growth in the same time period.

Massachusetts Mutual Life Insurance Co. and Corebridge Financial Inc. had the second- and third-highest amount of combined direct individual and group annuity considerations, reporting $20.6 billion and $17.07 billion in total considerations, respectively.

In a note, Moody's Investor Services classified the US life sector as being "stable" for this year noting that the higher interest rates "support portfolio yields" as well as a "robust sales pipeline" for certain products such as fixed-rate deferred annuities.

"The influx of private capital in the sector will raise asset risk, and insurers will face credit deterioration over the next several years in their sizable commercial real estate portfolio," Moody's said.