S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jan, 2021

A muted fourth quarter, with just two corporate defaults among constituents of the S&P/LSTA Leveraged Loan Index, brought to a close an otherwise breakneck year for debt restructurings in 2020.

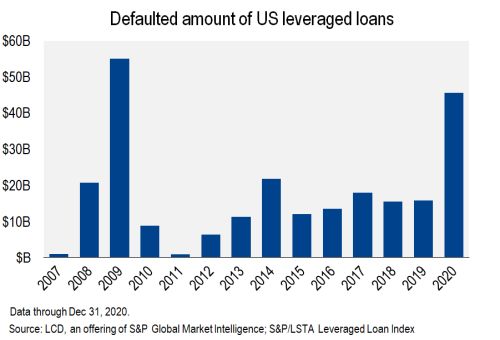

Defaulted loan volume, at $45.66 billion for the full year, nearly tripled 2019's total, though it fell $9.52 billion short of the 2009 record as the credit markets — buoyed by liquidity from central banks — staved off the more painful default wave that many had feared.

|

The two issuer defaults in the fourth quarter, totaling $2.66 billion, followed 11 defaults totaling $10.63 billion in the third quarter and a record 27 defaults in the second quarter, totaling $23.09 billion.

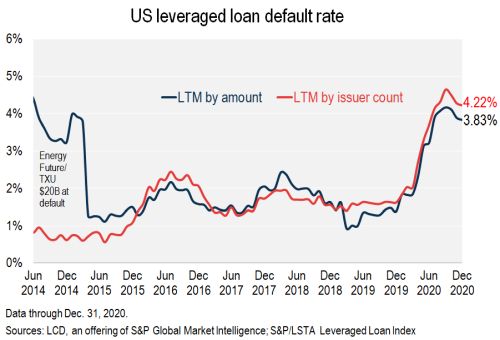

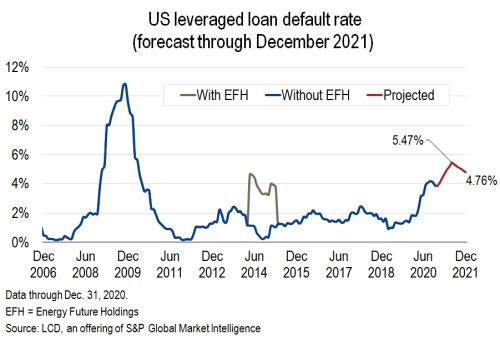

The slower pace into year-end lowered the U.S. leveraged loan default rate to 4.22% by number of issuers, from a 10-year high of 4.64% at the end of the third quarter. But it remains significantly higher than the 1.62% rate where it finished 2019.

By amount, the default rate, at 3.83%, is almost a full percentage point above its 2.88% historical average.

|

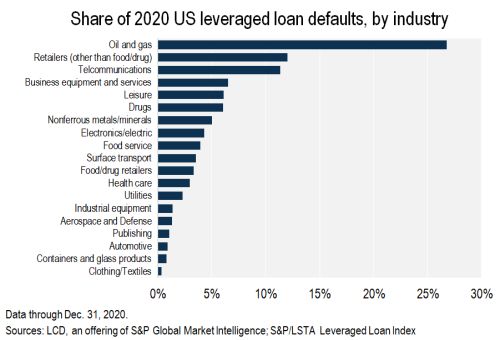

Oil & Gas maintained its dominance throughout the year, accounting for 27% of all loan defaults at the end of the fourth quarter, versus 20% at the half-year mark and 38% at the end of the first quarter. Retail had the second-highest share, at 12%.

|

In 2020, the opportunity set for loan debt priced in distressed was short-lived, as the deluge of Fed liquidity and raging credit funding markets allowed companies to tap liquidity, extend maturities, and seek breathing room on loan terms in record numbers. That said, regarding future default activity, capital structures going into 2021 are significantly worse than they were a year ago.

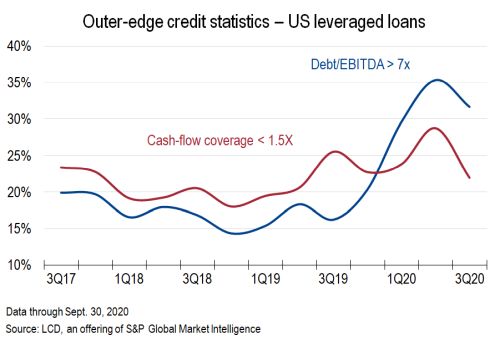

On the back of the damage caused by global lockdowns and monthslong closures of nonessential businesses, public companies within the S&P/LSTA Leveraged Loan Index, on average, reported a staggering 23% year-over-year decline in EBITDA in the second quarter, followed by a shallower, but sill negative, 1% year-over-year decline in the third quarter. By this time, an eye-watering 32% of public filers in the index carried leverage of greater than 7x, double the proportion a year earlier, and up from 14% at the cycle low for leverage in the fourth quarter of 2018.

|

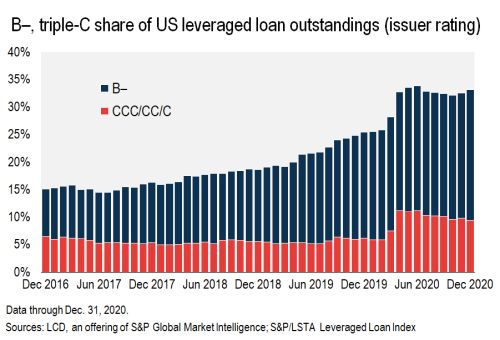

Meanwhile, the COVID-era downgrade cycle further weakened the ratings quality mix of the leveraged loan market, with the share of index loans rated B- or lower (excluding defaulted credits) at the corporate level representing an eye-watering 33% of the market in December, versus just 12% five years prior. CCC or lower loans make up 9.3% of the index, versus just 3.6% in December 2015.

|

On March 23, 2020, 57% of the $1.2 trillion leveraged loan market was priced below the 80 price threshold of distress. By contrast, at the end of 2020 only 2.2% of performing loans were in the distressed price category.

|

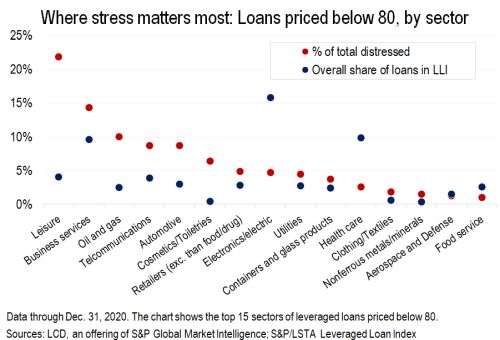

A look at the sectors containing loans priced under 80 at Dec. 31, 2020 could provide a hint as to which sectors could be ripe for defaults and bankruptcies in 2021. Leading the data is Leisure, whose loans make up 4% of the outstanding loan market. Some 12% of loans in that sector are priced under 80, which for the loan index as a whole, equates to 22% of all distressed index loans stemming from the Leisure industry.

Business Equipment and Services, on the other hand, has a sector-level distress ratio of 3%, but with a near-10% market share, loans from this sector make up 14% of all distressed loans in the index.

|

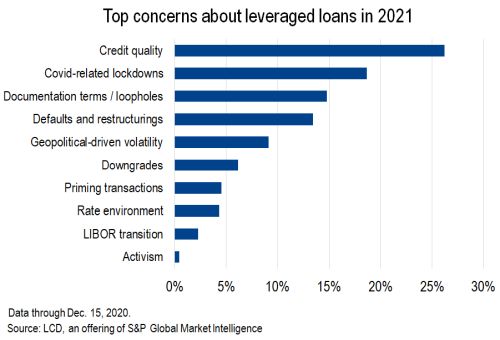

In a read of market expectations for the year ahead, in light of the rebound from levels of distress in the market and the spate of defaults already flushed out of the pipeline, a market survey polled by LCD in December shows credit quality — over default activity — was cited as the main concern for leveraged loans in 2021, accounting for 26% of the responses. COVID-19-related lockdowns came in second place at 19%, with documentation terms/loopholes placing third at 15%.

|

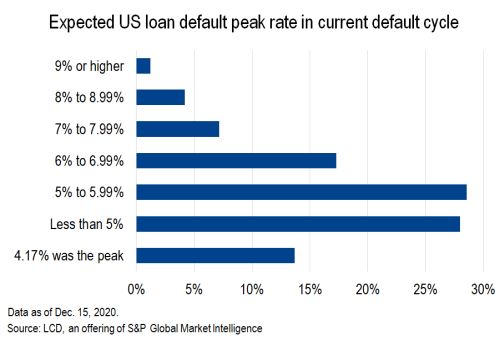

Regarding where survey respondents expect loan defaults will rise to in the next 12 months, only 29% say the peak will be at 6% or above. This marks a significant improvement from the throes of the market crash in March when Street expectations generally called for peak default rate of 7%-8%.

|

Ultimately, market participants, on average, see the default rate of leveraged loans ending 2021 at 4.76%.

|

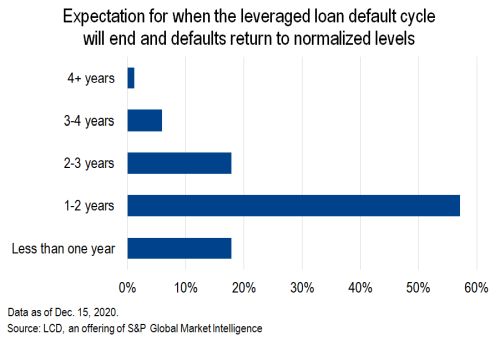

Against the backdrop of easing EBITDA declines in the third quarter of 2020 and the Federal Reserve's efforts to shore up liquidity — which helped normalize funding markets, stem downgrade activity and curtail overall distress levels — a majority (57%) of respondents expect the cycle of above-average default rates to end in one to two years.

|