Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Oct, 2022

By Brian Scheid

U.S. job growth slowed in September to its lowest level in nearly 18 months. That will not be enough for the Federal Reserve to pump the brakes on its aggressive pace of rate hikes.

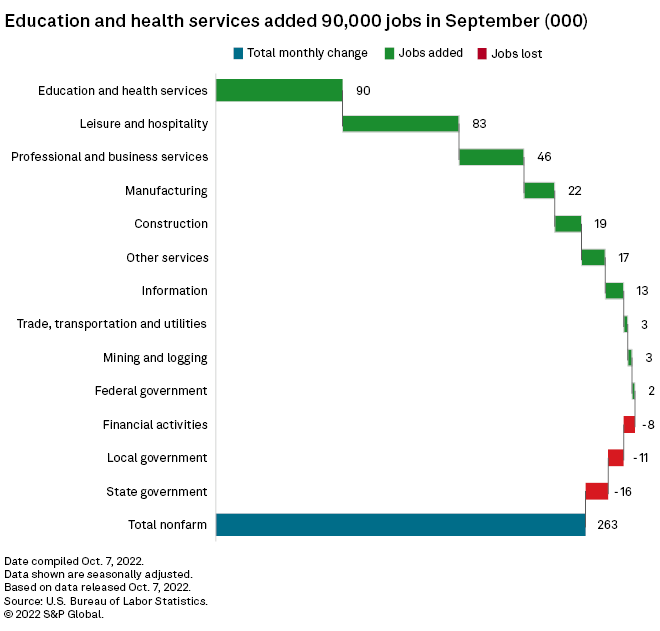

The U.S. added 263,000 jobs in September, the U.S. Bureau of Labor Statistics reported Oct. 7, above economists' expectations of 250,000 jobs for the month, according to Econoday estimates. That is slower than the addition of 315,000 in August and the smallest gain since April 2021. On average, the U.S. has added 439,000 jobs in each of the first eight months of 2022.

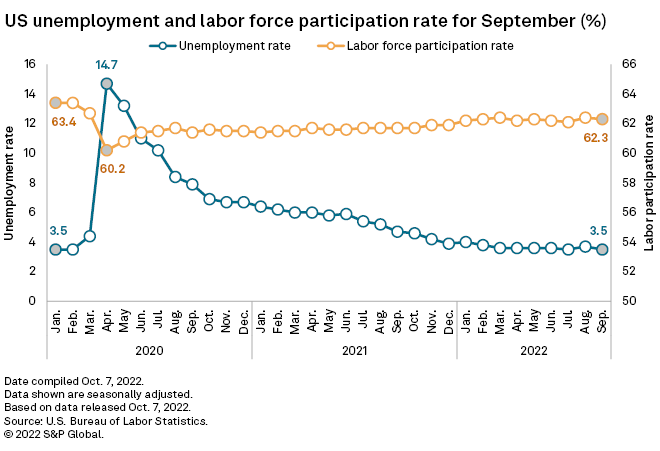

The unemployment rate fell to 3.5% in September from 3.7% in August.

The healthcare, leisure and hospitality industries accounted for more than half of the job gains for the month. While the slower growth indicates that a hot labor market is starting to cool, the latest data shows that the Fed's efforts to tackle soaring inflation through 300 basis points of interest rate increases since March have yet to take root firmly.

"This just reinforces to the Fed that they have to stay the course," said Tom Essaye, a trader and publisher of The Sevens Report. "There's nothing in this report that will make the Fed think: 'Oh gee, we need to alter our plan.'"

The Fed, which has boosted rates by 75 bps at each of its last three meetings, is widely expected to raise another 75 bps at its meeting in early November. Shortly after the jobs data was released, the odds of a 75 bps increase at the next meeting were above 80%, up from less than 2% one month earlier, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market.

Stocks slid Friday afternoon after the jobs report was released. The S&P 500 shed nearly 3% from a day earlier, while the tech-heavy Nasdaq's losses approached 4%.

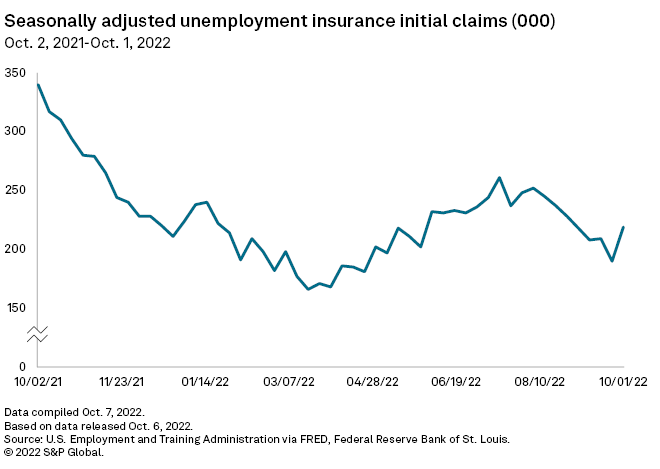

Jobless claims for the week ending Oct. 1 rose to 219,000, up 29,000 from the previous week.

Participation stalls

The labor force participation rate — the number of potential workers in the overall population who are in the job market — fell again to 62.3%, down from 62.4% in August and 63.4% in February 2020, before the pandemic began.

"It's kind of stalled," said Ben Herzon, a senior economist with S&P Global Market Intelligence. "The question is, is this the full recovery in the participation rate or is there more to come?"

While the overall labor force participation rate remains below pre-pandemic levels, the "prime age" rate for Americans between the ages of 25 and 54 was at 82.7%, roughly where it was in 2020. The participation rate for older Americans, those 55 and older, was at 38.8% in September, down from 40.3% in February 2020, largely due to early retirements during the pandemic.

As markets continue to strain under the Fed's hawkish policy shift, older Americans may begin to come back to the workforce due to losses in their home values and investment portfolios, said Shannon Seery, an economist with Wells Fargo. This could relieve some tightness in the labor market as the supply of workers increases, Seery said.

Much of the slack in the participation rate is also due to younger working Americans, aged 20 to 24, who have exited the workforce. In September, the participation rate for the age group was 70.7%, down from 73.2% in February 2020.

"It is going to be increasingly difficult for the participation rate to advance higher from here," wrote Thomas Simons, an economist with Jefferies, in an October 7 note.

Wage growth slows

Average hourly earnings in September climbed to $32.46, up just 0.3% from August and up 5% from September 2021. That month-over-month growth was slightly above the wage growth seen from July to August, but the year-over-year growth was the lowest since December. Annual wage growth has averaged about 5.3% since the start of 2022.

While wage growth is clearly slowing, a sign the Fed's efforts are chilling the labor market, concerns are mounting that wages are falling significantly behind the rapid pace of inflation, Seery said.

The peak in wage growth may be near, Herzon with Market Intelligence said. For now, a near-record level of job openings continues to push wages up, further threatening to keep inflation elevated. There were 10.05 million total job openings at the end of August, down from 11.17 million in July, according to the latest government data.