Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Apr, 2021

As a number of pharmaceutical companies rushed to create COVID-19 vaccines in 2020, U.S. insurers added to their equity investments in those companies.

Johnson & Johnson is the latest drugmaker to receive an emergency use authorization for a COVID-19 vaccine in the U.S., as the Food and Drug Administration signed off on its shot in February. The FDA had already greenlighted vaccines made by Moderna Inc. and Pfizer Inc. in December 2020. AstraZeneca PLC's shot has received approval for emergency use in the U.K., European Union and India.

According to an analysis of 2020 year-end statutory statements, more U.S. insurers increased their positions in COVID-19 vaccine makers than reduced them. This analysis excludes insurers in which all insurance subsidiaries have yet to file their year-end 2020 regulatory statements.

In aggregate, 284 insurers changed their stakes in Johnson & Johnson, with 154 companies adding shares versus 130 insurers that cut their position in the company. A total of 80 insurers saw no change in their positions in Johnson & Johnson. United Services Automobile Association added almost 118,000 shares of Johnson & Johnson, the largest increase by any U.S. insurer.

Affiliates of State Farm Mutual Automobile Insurance Co. added to their industry-leading positions in both Pfizer and Johnson & Johnson, buying roughly 60,400 shares in the former and 24,600 shares of the latter in 2020. State Farm's position in Johnson & Johnson was valued at $4.27 billion as of Dec. 31, 2020, while its holdings in Pfizer were worth $1.57 billion.

U.S. affiliates of Chubb Ltd. substantially boosted the company's position in Pfizer. The insurer ended 2020 owning a little more than 2 million shares of Pfizer, having added 1.8 million shares over the course of the year. The insurer also purchased an additional 315,870 shares of AstraZeneca in 2020.

As of the end of 2020, only 18 insurance companies owned stock in Moderna, which had not produced an authorized vaccine prior to making its COVID-19 shot. Among U.S. insurers, The Progressive Corp. was the most acquisitive of Moderna's stock, purchasing 35,050 shares during the year.

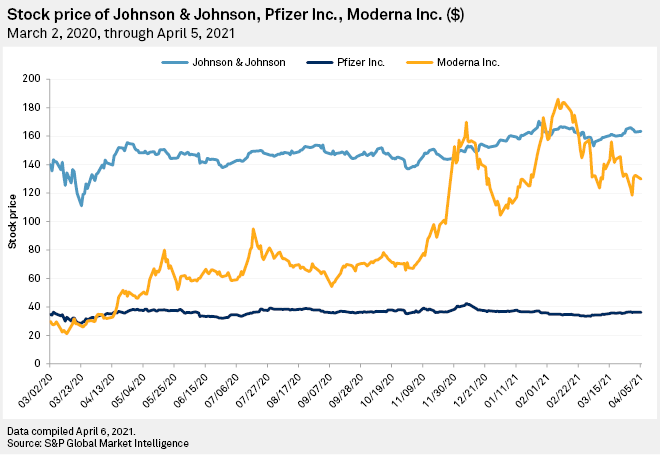

Of the three U.S.-based drugmakers that have produced authorized COVID-19 vaccines, Moderna has seen its share price increase the most since the start of the pandemic. The stock stood at nearly $130 per share as of the April 5 close, up from around $30 in early March 2020.