Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jan, 2022

By RJ Dumaual and Husain Rupawala

U.S.-based insurance and insurtech companies raised about $35.0 billion from capital markets in the second half of 2021, according to an analysis by S&P Global Market Intelligence, down from $58.17 billion in the first half of 2021, but slightly up from $34.31 billion in the prior-year period.

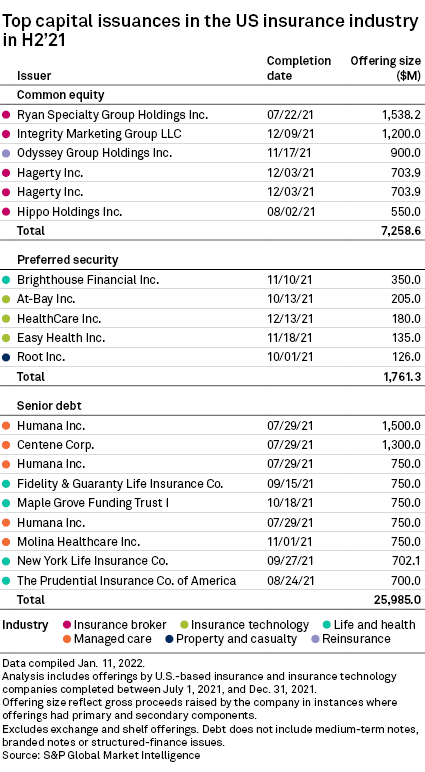

A big chunk of the proceeds came from senior debt offerings, which accounted for $25.99 billion of the total. Preferred equity raises totaled $1.76 billion, while common equity offerings generated about $7.26 billion.

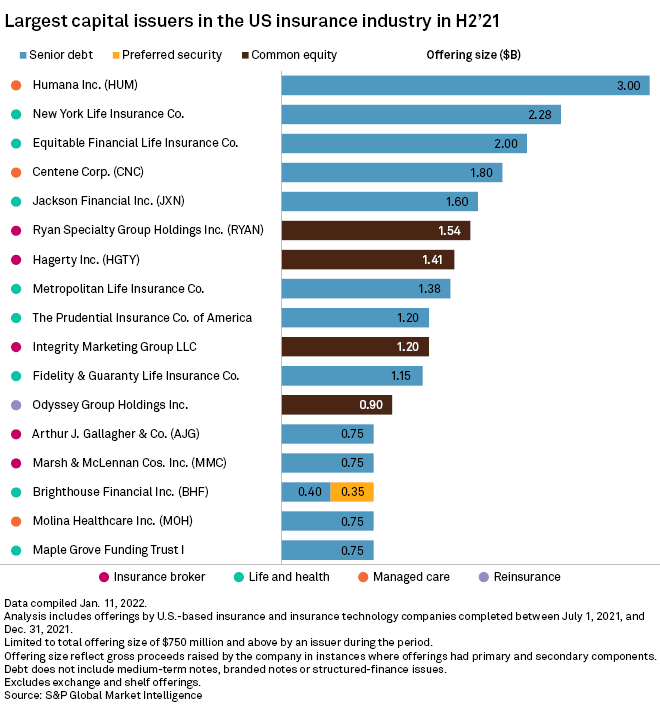

Health insurers were again some of the biggest issuers of senior debt. Humana Inc.'s debt issuances for the back half of 2021 totaled $3.0 billion, while Centene raised about $1.80 billion.

Life insurers were also active, with New York Life Insurance Co., Equitable Financial Life Insurance Co. and Jackson Financial Inc. raising $2.28 billion, $2.0 billion and $1.60 billion, respectively, from senior debt.

Ryan Specialty Group Holdings Inc. was the top common equity issuer in the period, following its July 2021 IPO. The stock has jumped from its initial price of $23.50, closing at $37.46 on Jan. 12. The broker was recently maintained at "overweight" by Barclays, which also raised its target price to $44 per share from $43 per share.

CEO Patrick Ryan in a December 2021 conference pointed to a number of tailwinds for the company, including the recent retail broker consolidation that has led to larger clients.

He expects the tailwinds to remain strong, but will vary. Ryan said the company's organic growth trajectory "has to drop back," and competition is expected to pick up as "people correct their balance sheets."

Brighthouse Financial Inc. was the biggest issuer of preferred securities in the second half of the year, following a $350.0 million offering in November 2021.