Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Oct, 2021

|

Through pilot projects, U.S. gas utilities are positioning themselves to transport and store hydrogen, a strategy that could prolong the useful life of their assets. |

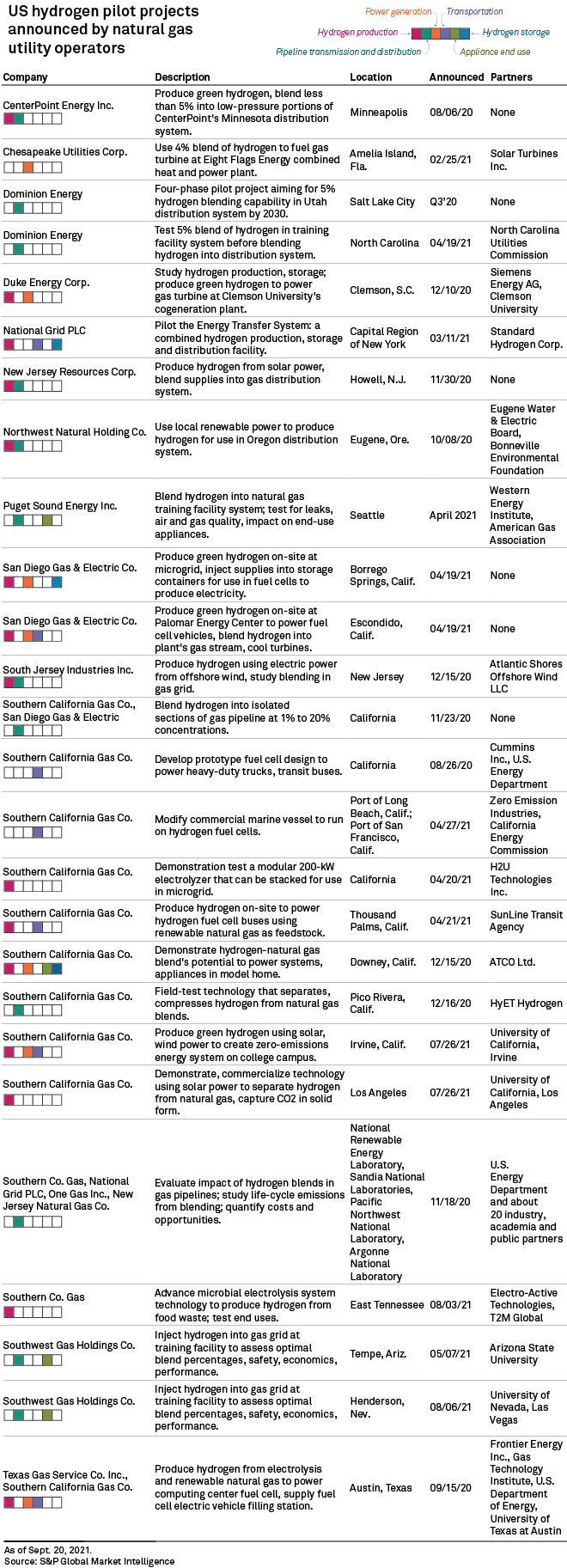

U.S. natural gas utilities have announced at least 26 hydrogen pilot projects in the past year as the industry works out how to make and transport the gas, as well as help customers migrate to the low-carbon fuel.

Subsidiaries of utility holding company Sempra lead the way with 12 projects, ahead of a number of other major utilities with one or two projects each, according to a review by S&P Global Market Intelligence. Most of the projects are in West and East Coast states with ambitious climate targets and more than half involve hydrogen production, particularly green hydrogen. Several projects also seek to understand hydrogen's impact on end-use appliances or explore using the fuel for power generation.

Pilot projects ensure that "when we go to our regulators or other stakeholders to make a very large investment, we've got them familiar with this technology and the application of it," said Kim Heiting, senior vice president of operations and chief marketing officer at Oregon utility operator Northwest Natural Holding Co.

The pilots will help utilities overcome challenges posed by the shift to hydrogen before they commit to hugely expensive full-scale rollouts. Congress and the Biden administration are also teeing up billions of dollars in support for hydrogen commercialization and production tax credits in infrastructure and budget reconciliation bills as part of wider efforts to pare pollution.

The projects under development at Sempra subsidiaries San Diego Gas & Electric Co. and Southern California Gas Co. illustrate the diversity of pilots and demonstrations across the industry. SoCalGas is participating in a multi-stakeholder demonstration in Texas and in developing the nation's first green hydrogen hub in Los Angeles. According to Sempra, the development of smaller projects across the value chain can arm the company with knowledge on where to invest on behalf of customers.

Utilities largely focused on green hydrogen

Green hydrogen production typically involves separating water into hydrogen and oxygen through electrolysis using renewable electric power. The technology is well-established, but there are a range of operational issues for gas distributors and their regulators to explore through pilot projects, according to Heiting.

Northwest Natural has teamed up with Eugene Water & Electric Board for a green hydrogen pilot using a 5-MW electrolyzer, which is relatively large compared to most units already in operation, even if it's dwarfed by planned developments of roughly 100-GW-scale or more.

The pilot will let the partners assess capital and operating expenses and gain experience working with engineering, procurement and construction partners, Heiting said. Northwest also aims to explore efficiencies and electric grid benefits associated with hydrogen production.

One Gas Inc. COO Curtis Dinan also stressed the need for utilities to develop knowledge as state regulators and legislators consider integrating hydrogen into gas distribution systems. Gas distributors need to understand where hydrogen is most viable on their systems and how to deliver it to customers in a manner that prolongs the useful life of assets, Dinan said.

Along with SoCalGas, One Gas subsidiary Texas Gas Service Co. Inc. is participating in a U.S. Energy Department-backed project geared toward demonstrating hydrogen production, transportation, storage and use for vehicle fueling and powering a data center in Texas.

Hydrogen blending in pipelines is major goal

The ultimate goal for many utilities is to blend hydrogen into natural gas distribution systems in order to reduce their customers' carbon emissions. When burned, hydrogen does not release carbon, though combustion does release other pollutants like nitrogen oxides. Pipeline and infrastructure operators must also take care to prevent leakage, since hydrogen is an indirect greenhouse gas with global warming potential.

Chesapeake Utilities Corp. is first piloting hydrogen blending in a combined heat and power plant and is looking ahead to injecting hydrogen into its distribution systems in its Florida and Mid-Atlantic territories. According to Chesapeake Utilities President and CEO Jeff Householder, the industry needs to address operational impacts on distribution systems, such as what hydrogen does to pipe and equipment as well as how to operate the system.

A DOE-backed project called HyBlend is marshaling the resources of four national labs to identify technical barriers to injecting hydrogen into gas infrastructure and life-cycle emissions linked to hydrogen-natural gas blends.

One of the project's aims is to determine the blend at which customers do not notice a difference in flame quality and heat content value in end-use appliances, according to Bryan Batson, chief external and public affairs officer at Southern Co. Gas, the lead industry partner for HyBlend. Researchers will then need to determine how that blend reacts with equipment and materials through distribution systems, down to the individual components in regulators that control gas pressure and the vinyl present in some meters, Batson said.

"We're looking for the sweet spot in the blend, and making sure that our systems can safely, reliably handle that blend in delivery, and make sure we don't need to change anything," Batson said.

Hydrogen has skeptics and believers

Among many climate activists and environmental justice groups, there is growing consensus that hydrogen should only be produced from zero-carbon renewable electric power and consumed in hard-to-electrify sectors. These groups typically favor building electrification, or the phaseout of natural gas use in buildings.

"Hydrogen has great opportunities to decarbonize those really challenging sectors, but it is largely inefficient in others," Natural Resources Defense Council analyst Rachel Fakhry said at a recent DOE hydrogen summit. Building heating has become the "poster child" for where hydrogen does not make sense, Fakhry added.

UGI Corp. President and CEO Roger Perreault is not convinced that producing hydrogen expressly for residential and commercial building use makes sense in the near term. The adoption of hydrogen for these applications could take a while as it is not the ideal molecule for applications such as heating and cooking, Perreault said in an interview.

Since hydrogen is difficult to store and costly to liquefy, it makes more sense to inject surplus supplies into the gas grid, Perreault noted. That would complement and decarbonize the fuel mix, he said.

Others, such as Southwest Gas Holdings Inc. President and CEO John Hester, say that the industry can leap technical hurdles and begin deploying hydrogen relatively quickly. Hester said the conversation around hydrogen today reminds him of the push to integrate solar photovoltaic technology into electric utility systems in Arizona about 25 years ago.

"It was the most expensive source of electricity at the time. Now it's the cheapest," Hester said in an interview. "A lot can happen over a relatively short period of time."