S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Dec, 2024

By Tom Jacobs and Malik Ozair Zafar

|

An aerial view of homes in Swannanoa, North Carolina, damaged by floods caused by Hurricane Helene on Oct. 4. |

Premiums and loss ratios improved year over year in the third quarter for most of the larger US homeowners insurers despite the impact of Hurricane Helene.

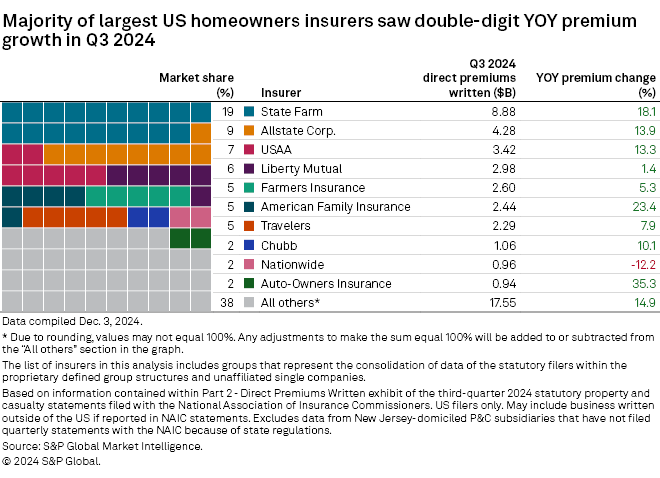

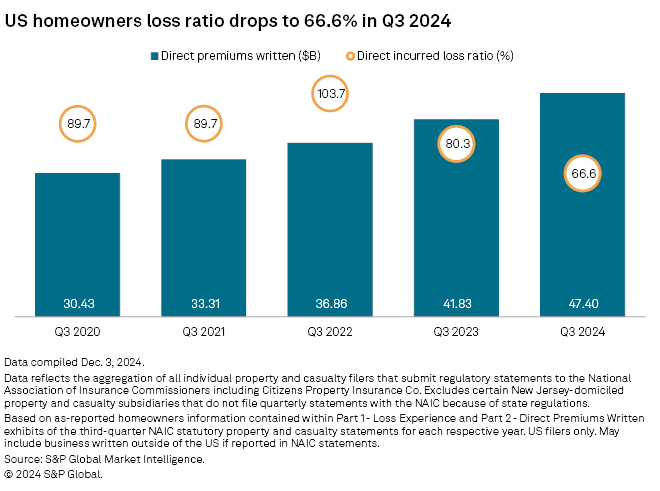

Direct premiums written (DPW) in the sector rose 13.3% to $47.40 billion from $41.83 billion a year ago, according to an S&P Global Market Intelligence analysis. Third-quarter DPW for homeowners insurers increased 55.8% from $30.43 billion in the second quarter of 2020.

State Farm Mutual Automobile Insurance Co. reported an 18.1% year-over-year increase in DPW to $8.88 billion, giving the insurer a 19% market share.

The Allstate Corp.'s total DPW of $4.28 billion gave it a 9% market share, while United Services Automobile Association (USAA) had $3.42 billion in premiums for a 7% market share. Liberty Mutual Group Inc. booked $2.98 billion in DPW, giving it a 6% share.

Farmers Insurance Group of Cos., with $2.6 billion in premiums, and American Family Insurance Co., with $2.44 billion in premiums, both had a 5% share.

Premiums soar

Six companies in the top 10 saw their DPW increase by at least 10%, led by Auto-Owners Insurance Group's 35.3% improvement. American Family, up 23.4%, was ahead of State Farm, up 18.1%, and Allstate, up 13.9%.

USAA and Chubb Ltd. had increases of 13.3% and 10.1%, respectively, followed by The Travelers Cos. Inc., up 7.9%, and Farmers, up 5.3%. Liberty Mutual saw its DPW rise by 1.4%.

Nationwide Mutual Insurance Co. was the lone company in the top 10 reporting a drop in DPW. The company booked $960 million in DPW, a 12.2% decline from the third quarter of 2023.

The rise in premiums has been aided by insurers' aggressive pursuit of homeowners rate increases. The national average rise in owner-occupied homeowner rates for the first nine months of 2024 was 9.7%, according to S&P Global Market Intelligence's RateWatch application.

Ratios recede despite storms

Insurers' direct incurred loss ratios fell 13.7 percentage points to 66.6% in the quarter, a marked improvement from 80.3% a year ago.

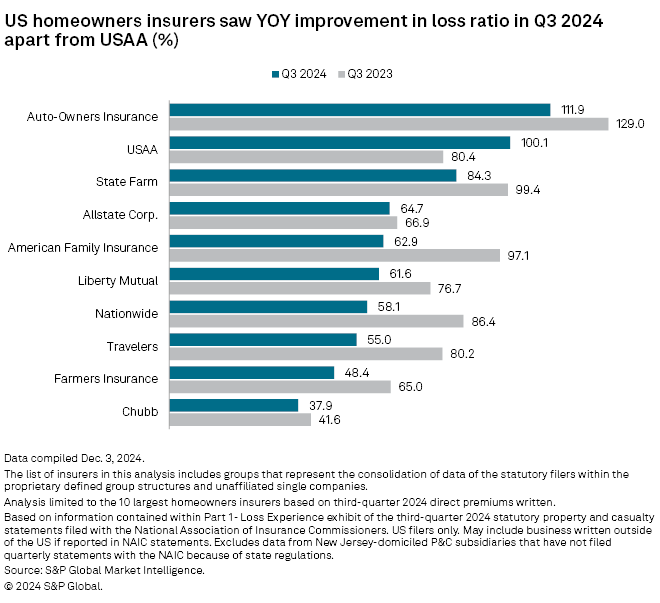

Nine of the top 10 insurers in the analysis recorded a year-over-year improvement in their loss ratios, with seven of them falling by 10 or more percentage points. The decreases came despite the impact of catastrophe losses from Hurricane Helene, one of three tropical cyclones to make landfall in the quarter.

Liberty Mutual's loss ratio improved 15.1 percentage points to 61.6% from 76.7% a year ago, despite incurring insured losses of $1.09 billion in the quarter. Travelers, which has been reducing its homeowners exposure in high-risk areas, reported $939 million in catastrophe losses but saw its loss ratio plunge 25.2 points to 55% from 80.2%.

American Family had the steepest decrease among the top 10, down 34.2 points to 62.9% from 97.1%. Nationwide, down 28.3 points, had the second-best improvement, followed by Travelers with a fall of 25.2 points. Auto-Owners was down 17.1 points and Farmers was down 16.6 points, while Liberty Mutual and State Farm both declined by 15.1 points.

Chubb had the lowest loss ratio in the top 10 with 37.9%, while Auto-Owners had the highest with 111.9. USAA was the lone company in the top 10 that reported an increase in its loss ratio, rising to 100.1% from 80.4%.