S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Jun, 2021

By Karin Rives

Since the first U.S. green bank was established by Connecticut lawmakers in 2011, another 21 have opened in 16 states and 21 other states are seeking to emanate the success of such programs. But this patchwork of lenders cannot meet the need for clean energy financing today — much less mobilize billions from the private sector to help transition the economy to net-zero emissions, green bank officials say.

The national $100 billion climate finance accelerator program proposed by President Joe Biden is critical for taking the market to scale, green bankers asserted during a June 23 webinar hosted by the Center for Climate and Energy Solutions. The federal funding would be passed on to state and local green banks, which today wrestle with a $21 billion project backlog.

"This is fundamentally a states-based solution that requires national attention," said Jeffrey Schub, executive director of the Coalition for Green Capital. "The number one challenge is, there just isn't enough money."

Green banks have bipartisan support

Since the beginning of the year, no fewer than six bills have been introduced in Congress to establish a national climate bank. In addition, the broad climate bill introduced in the House in March, known as the CLEAN Future Act, would authorize $100 billion in federal support to boost private sector investments in clean energy and other climate solutions.

The House Energy and Commerce Committee on June 29 is holding another hearing on the climate bill, which Republicans have dubbed a job killer. Green banks as institutions, however, have support from both parties. In Alaska, for example, Gov. Mike Dunleavy, a Republican, recently introduced legislation to create a fund to finance clean energy projects in the state. It would be capitalized with $10 million.

Green banks leverage private-sector finance for clean energy projects by offering loan guarantees or by underwriting work that traditional lenders deem to be too small or risky. They can also structure deals and offer technical assistance to drive down capital costs and open up new markets to private investment.

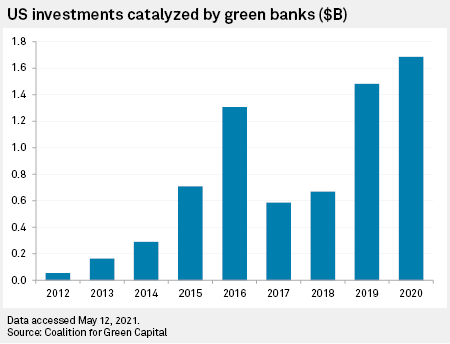

Green banks draw on average $3 in private capital for every $1 they put in to help finance community solar initiatives, energy-efficiency programs, storm resilience upgrades, and a host of other projects in often-underserved markets. They drove nearly $1.7 billion in total investments in 2020, a record.

The NY Green Bank has helped private lenders access the once-nascent community solar market after investing $300 million since 2017, said Kim Erle, a managing director at the bank.

In December 2020, the Greenbacker Capital Management LLC and the New York bank closed on a deal to finance community solar projects across the state. It was the first time a private investor served as a co-lender in a NY Green Bank community solar development.

"So as community solar is increasingly seen as an attractive component in a high-performing energy investment portfolio, we are now raising the bar," Erle said. "We're done with the plain vanilla and moving on to address other financing gaps."

To serve as true catalysts, however, Erle and other leaders of state-run green banks say they need backing from a national program that will leverage their expertise and give public programs muscle. To decarbonize the U.S. energy sector, the nation needs to invest at least $3.3 trillion in wind and solar investments over the next 30 years, Schub said.

Energy transition projects, in turn, will lead to new jobs in diverse American communities, the panel said. The Connecticut Green Bank estimates its programs have created 23,000 jobs in the state over the past decade and nearly $100 million in tax revenue.

"It all comes back to that investment right at the front end," said Bryan Garcia, the bank's president and CEO. "And the more we can do…to encourage those private investments the more we will see those other metrics improve."

The Center for Climate and Energy Solutions released a paper June 23 with policy proposals for the climate finance accelerator that lawmakers are discussing.

Unlike many state banks, the accelerator or national climate bank should have an explicit mandate to reduce greenhouse gas emissions and make communities more resilient to climate change, the paper said. It should also focus on deploying renewable energy technology.

Congress should allocate between $30 billion and $100 billion to establish the bank and set it up as an independent non-profit, the group recommended.