Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jan, 2023

By Susan Dlin

The U.S. added 24.7 GW of new generating capacity to the grid in 2022, an 11.6% decline from the previous year, according to an S&P Global Market Intelligence analysis.

Over the same time period, 16.0 GW of capacity was retired, netting an additional 8.8 GW available to the U.S. power grid, a drop of 54.8% compared to 2021's net additions.

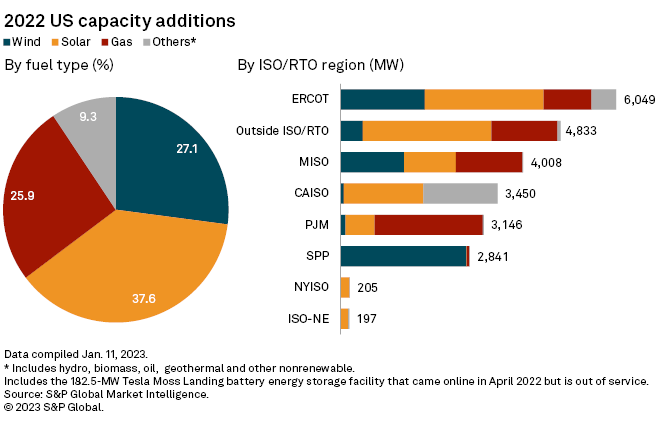

Data collected Jan. 11 show solar, wind and gas capacity dominated new additions, accounting for 37.6%, 27.1% and 25.9% of the total, respectively. Solar surpassed wind as the leader, adding 9.3 GW in 2022. Wind capacity additions declined the most in 2022, down 4.7 GW from the previous year's additions, while natural gas added 1.2 GW more than in 2021.

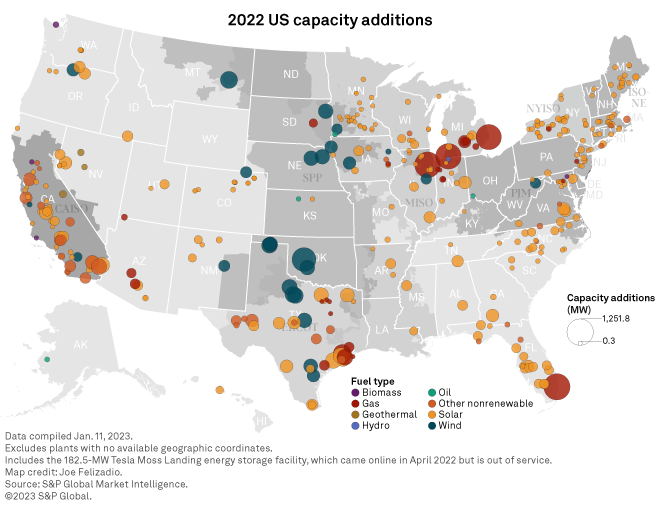

The Electric Reliability Council of Texas Inc. led organized power market regions in new capacity additions, as it did in 2021. Power plant operators energized 6,049 MW of new generating capacity in the region, equivalent to 24.5% of the nation's total. At 2,611 MW, solar led ERCOT's additions accounting for 43.2% of the total, followed by 1,849 MW of wind and just over 1,000 MW of gas.

An extreme winter storm in 2021 caused major power outages and power price spikes in Texas, spurring regulations aiming to prevent future blackouts and increase grid stability. Texas Gov. Greg Abbott, with the backing of the Texas Public Utility Commission, recently announced support for a performance capacity mechanism incentivizing plant operators to provide reliable power and requiring load-serving entities to buy from the highest performers. State lawmakers have not endorsed the performance-based system and continue seeking ways to reform the ERCOT power market.

The largest individual plant added to the ERCOT grid was WattBridge Energy LLC's 8-unit, gas-fired Rabbs Power Station in Fort Bend County, with a total output of 484 MW.

The King Creek wind farm, located in Throckmorton and Haskell counties in Texas, was the second largest plant to come online in ERCOT during the year. The 393-MW wind farm is owned by EDF Renewables Inc., a subsidiary of Electricité de France SA, or EDF. EDF secured multiple power purchase agreements to supply several off-takers. Acrylic manufacturer American Acryl LP signed a power purchase agreement for a portion of the output to power its site in Bayport, Texas, which will help drive decarbonization goals for the company. Molson Coors Beverage Co. said the output from the wind farm will provide clean energy for its first 100% renewable-powered brewery in North America. And Pedernales Electric Cooperative Inc. signed a 15-year agreement for 100 MW of the output.

One large combined-cycle gas plant accounted for over a quarter of the new generating capacity outside of independent system operator and regional transmission organization markets. The 1,252-MW FPL Dania Beach Clean Energy Center, owned by NextEra Energy Inc. subsidiary Florida Power & Light Co., came online in May 2022 and is part of FPL's 10-year site plan.

The Midcontinent ISO region, covering 15 states in the eastern and central U.S., added just over 4,000 MW of capacity. The additions represented about 16.2% of total capacity additions in the U.S., with gas supplying 1,467 MW, or 36.6%, and wind supplying 1,398 MW, or 34.9%, of MISO's total capacity additions. The largest plant to come online in MISO in 2022 was also fueled by gas: DTE Electric Co.'s 1,146-MW combined-cycle Blue Water Energy Center.

MISO's first hybrid solar-plus-storage facility entered service in early 2022. Located in White County, Ark., the Searcy Solar Project, owned by Entergy Arkansas LLC, provides 100 MW of solar capacity combined with 10 MW of energy storage capacity.

The Southwest Power Pool Inc. added 2,841 MW, up from 2,425 MW in 2021. Of Southwest Power Pool's capacity additions, 97.5% were wind, with the largest project supplying nearly 1.0 GW of power. The Traverse Wind Energy Center in Oklahoma, jointly owned by American Electric Power Co. Inc. subsidiaries Southwestern Electric Power Co. and Public Service Co. of Oklahoma, is the largest and last of a group of wind projects called the North Central Energy Facilities.

PJM gas additions

More than three-quarters of the new capacity added in PJM Interconnection LLC, the nation's largest power market serving roughly 65 million people, was gas-fired generation. PJM struggled with grid reliability issues in December 2022 when its customers experienced outages and its generators did not meet their commitments.

Two plants made up the bulk of new gas-fired additions in the region: the 1,200-MW Jackson Generation Energy Center in Illinois and the 1,174-MW Indeck Niles Energy Center in Michigan.

Energy storage continues to climb

Stand-alone battery energy storage systems continued to grow in the California ISO market, with 1,596 MW coming online in 2022. The region remains the leader in stand-alone energy storage additions, with 72.4% located within CAISO compared to all regions, and ERCOT a distant second at 24.3%. CAISO's additions include the reportedly out-of-service 182.5-MW Tesla Moss Landing Battery Energy Storage Project (Elkhorn).

The largest battery energy storage system of the year, the 350-MW Crimson Battery Storage Project in Riverside County, Calif., came online in October 2022. The project's output is fully contracted to Pacific Gas and Electric Co. and Southern California Edison Co.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.