S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Dec, 2022

By Garrett Hering and Molly Christian

The U.S. Commerce Department issued a preliminary decision Dec 2. affirming that certain crystalline solar cell and panel imports from four Southeast Asian countries are circumventing decade-old tariffs on China by relying on components from that country.

The preliminary decision came after a monthslong investigation into allegations by California-based module manufacturer Auxin Solar Inc. Auxin alleged that Chinese solar photovoltaic, or PV, producers are assembling cells and modules in Cambodia, Malaysia, Thailand and Vietnam with parts and components made in China to avoid antidumping and countervailing duties imposed in 2012 by the Obama administration.

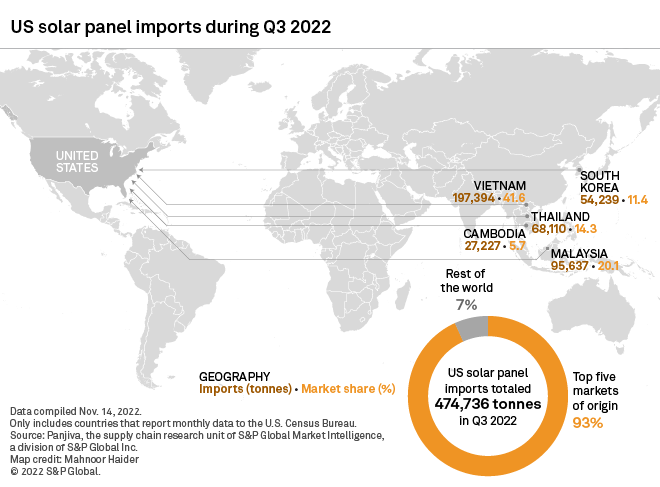

Those four countries accounted for roughly 82% of PV panels imported into the U.S. in the third quarter, according to research firm Panjiva. The Commerce Department decision highlights the U.S. solar industry's ongoing broad exposure to trade risks as it seeks to expand domestic alternatives with the help of valuable manufacturing incentives passed in the Inflation Reduction Act.

After a "detailed factual investigation" of eight companies, the Commerce Department determined that half were circumventing duties, a senior Biden administration official associated with the department said during a call with reporters.

Subsidiaries of BYD Co. Ltd., Canadian Solar Inc., Trina Solar Co. Ltd. and LONGi Green Energy Technology Co. Ltd. were found to be circumventing tariffs. Affiliates of Hanwha Solutions Corp., Jinko Solar Co. Ltd. and Boway Group, as well as New East Solar (Cambodia) Co. Ltd., were preliminarily found not to be sidestepping tariffs.

The Commerce Department named another 22 "non-cooperative" companies that failed to respond to information requests and are preliminarily determined to be circumventing duties. The agency's findings led it to determine that circumvention may be occurring on a "countrywide" basis.

If the preliminary findings are confirmed, company-specific tariffs would be applied in June 2024 after the expiration of a two-year tariff waiver that President Joe Biden granted in June. Suppliers can also enter a certification process to show they are not circumventing tariffs, and thus avoid the tariffs.

Imports of solar cells and modules to the U.S. that violate antidumping laws face tariffs that the U.S. government collects in the form of cash deposits. Those deposits are determined by company-specific percentage rates on the value of imported goods.

"Currently, over 90% of the [Chinese] cell and module companies with their own [antidumping and countervailing duty] rates have total rates below 35%," the Commerce official said, adding that products from companies controlled by the Chinese Communist Party could face rates higher than 200%.

Trina Solar, for instance, is subject to a 254% import tariff, the official added.

Over the next few months, the department will be sending teams to the four Southeast Asian countries to audit the information from the eight companies Commerce investigated. It will also take comments and hold a hearing on the preliminary determination before making a final determination May 1, 2023, the Commerce official said. "This is a quasi-judicial process, and the findings could change from the preliminary to the final [order]," the official said.

Renewable energy groups blast decision

Noting that solar importers will have 18 months to find new suppliers "who are willing and able to show that they're complying with American trade laws," the official said the agency's action would not impede U.S. climate targets.

But renewable energy groups blasted the decision, saying it would deal a blow to the Biden administration's efforts to decarbonize the U.S. power sector.

"This decision will strand billions of dollars' worth of American clean energy investments and result in the significant loss of good-paying, American, clean energy jobs," said Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association. "While President Biden was wise to provide a two-year window before the tariff implementation, that window is quickly closing, and two years is simply not enough time to establish manufacturing supply chains that will meet U.S. solar demand."

Commerce's finding will impose "massive new red tape with certification requirements that could further chill the industry and thwart the administration's clean energy objectives," said Gregory Wetstone, president and CEO of the American Council on Renewable Energy. "This is a major step backward at a time when there is finally hope the U.S. can get on the path toward a climate solution."

"After years of supply chain challenges and trade disruptions, I remain concerned that the Commerce Department chose a path that could jeopardize the solar industry's ability to hire more workers and construct the clean energy projects needed to meet our country's climate goals," added George Hershman, CEO of utility-scale solar installer SOLV Energy LLC.

But representatives of domestic manufacturers applauded Commerce's move.

"This is an important win for the rule of law, American manufacturers, and the tens of thousands of workers that they employ," said Michael Stumo, CEO of the Coalition for a Prosperous America. Stumo also called on Biden to rescind his June order temporarily freezing antidumping duties on certain solar imports.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.