S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jun, 2022

By Brian Scheid

|

A soft landing from the Fed appears less likely as signs of a recession continue to appear. |

The Federal Reserve is trying to cool the economy without freezing it, a task economists believe is increasingly difficult as the likelihood of another recession grows.

Fed Chairman Jerome Powell is aiming for a "soft landing" where demand is reduced by tightening monetary policy just enough to cause a decline in inflation without sparking an outright recession.

"The Fed is in a major jam," said Oren Klachkin, lead U.S. economist with Oxford Economics. "They don't want to let inflation spiral but they also don't want to kill the expansion. Finding the middle ground between those is hard, and their tools are blunt, so the task before them is monumental."

|

The central bank has begun to hike rates and reduce its record $9 trillion balance sheet, a monetary policy tightening aimed at weakening demand through higher borrowing costs.

Powell has cautioned that the Fed's ability to avert a recession is limited. Monetary policy cannot boost the supply of copper, oil or ships, for example; it can only impact demand for them.

With war raging in Ukraine, incessantly snarled global supply chains, record-high commodity prices, lockdowns in China and persistent risks of additional COVID-19 waves, a recession could be inevitable.

Although the risk of a downturn is high, an outright recession — a material decline in GDP sustained over at least two quarters — is not inevitable, said Ken Matheny, executive director for U.S. economics at S&P Global Market Intelligence.

Instead, the U.S. will likely see a "growth recession" where unemployment rises and real GDP stays positive, though below the economy's theoretical rate of growth, Matheny said.

Down indicators

Other economists see a recession within the next few months as probable, as multiple economic measures have reached troubling points.

"All the indicators are pointing in the same direction, and it's down," said Alfonso Peccatiello, author of The Macro Compass, a financial newsletter, and former head of investments at ING Germany.

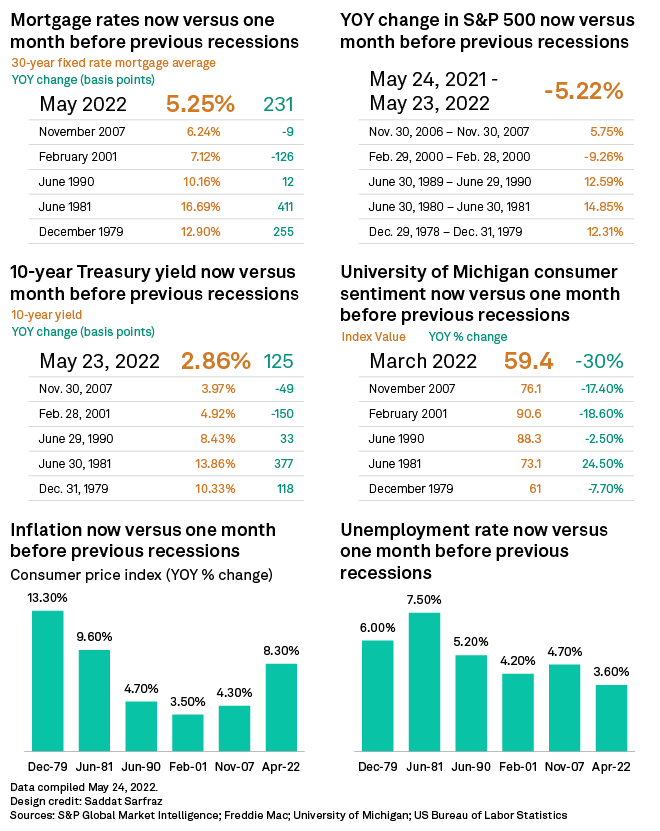

The University of Michigan's consumer sentiment index fell to 59.4 in March, a 30% drop from a year earlier and a steeper decline than the index saw in the months ahead of the five previous U.S. recessions.

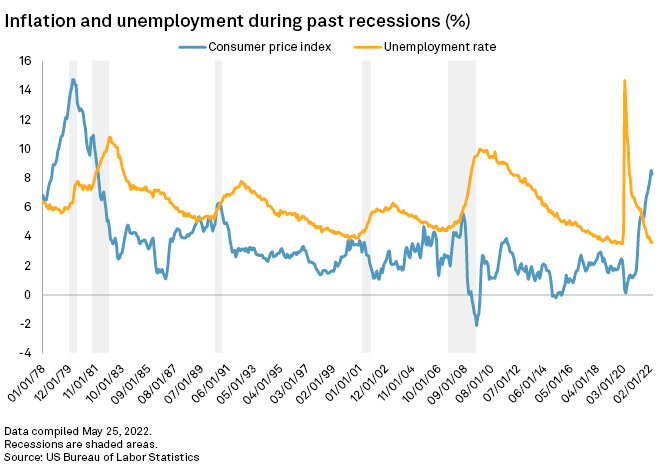

Inflation, which hit 8.3% in April, is now roughly double what it was in the months ahead of the three previous recessions, and the S&P 500 is off to its worst start in decades.

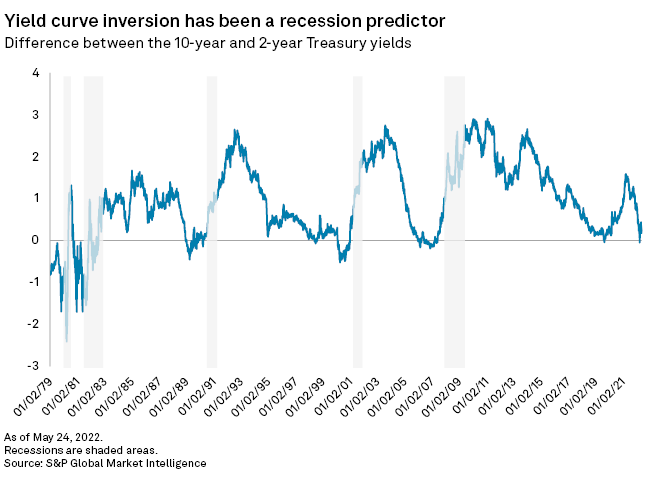

In addition, portions of Treasury yield curve briefly inverted in late March and early April when the 2-year yield exceeded the 10-year yield in anticipation of the Fed's push to increase rate hikes. An inversion of the yield curve, where long-term borrowing costs fall below short-term rates, has preceded every recession over the past 50 years.

Housing signals

No sector may be more indicative of a looming recession than the housing market.

Mortgage rates have surged, with the 30-year fixed-rate mortgage average jumping to 5.25% in May, an increase of 231 basis points in a year. Mortgage applications fell 1.2% for the week ended May 20 and 11% the previous week, according to the Mortgage Bankers Association.

"With housing demand falling as supply rises ... there is the risk that house prices correct lower, and raising interest rates in such an environment is never a good combination for the household sector with sentiment and spending coming under real pressure," said James Knightley, chief international economist at ING.

Sales of new, single-family homes fell 16.6% from March to April, and new home sales were down 26.9% from April 2021, according to the latest government data. That decline in sales is a "clear recession warning," said Robert Dietz, chief economist with the National Association of Home Builders.

The housing market is being battered by soaring inflation. Americans, paying more than ever for food, gasoline and nearly everything else, are much less eager to buy property than they were earlier this year.

"We may be looking at a collapse in demand," said Jeff Weniger, head of equity strategy at WisdomTree Investments.

Even investors once willing to pay in cash for properties, effectively not impacted by rising mortgage rates, have soured on the market as their other investments have dipped.

"If you're losing on stocks, you're losing on bonds and you're even losing on crypto, you're not going to go out and buy that $3 million house in Palo Alto now," Weniger said.

Nonbinary

The Fed raised rates by 50 basis points at its May meeting and is expected to hike by another 50 basis points at its June meeting.

The likelihood of a recession largely depends on whether those rate hikes can tame inflation. There is about an 80% likelihood of a recession by sometime in 2023, largely depending on whether inflation begins to recede this summer, said Michael Crook, chief investment officer at Mill Creek Capital Advisors.

Optimally, the Fed is looking for inflation to cool in the second half of this year, allowing central bankers to avoid further tightening of financial conditions, said Greg Daco, chief economist for EY-Parthenon. But multiple outcomes are possible.

"It's not binary," Daco said. "We have to consider a spectrum of possibilities from a modest cooling of growth to a more severe reduction to stagnation to a modest recession to a severe recession."

Labor woes

Unemployment was at 3.6% in April and May, well below the unemployment levels ahead of previous recessions. As the Fed's policy shift takes effect, unemployment is likely to increase as companies hire less as growth slows.

"The Fed expects and Powell is signaling a willingness to see unemployment go up, and it might have to go up pretty substantially," Matheny said. "We've never had a major rise in unemployment without a recession."

Powell likely sees current unemployment as "unsustainably low" and contributing to inflation with large gains in wages and record high quit rates, said Diane Swonk, chief economist at Grant Thornton.

Ultimately, the fate of the U.S. economy may be out of central bankers' hands.

"The reality of the world we are in ... is that a recession may not be avoidable and the Fed is not the only risk," Swonk said. "Geopolitical risks are intensifying, and developing economies are now being forced to choose between paying for food and energy or servicing their debt. Any one of those things could trigger a more severe blow to demand."