S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Nov, 2022

U.S. and European investment banks are planning to shed jobs and cut bonuses in their advisory and underwriting teams amid slumping revenues since the start of 2022.

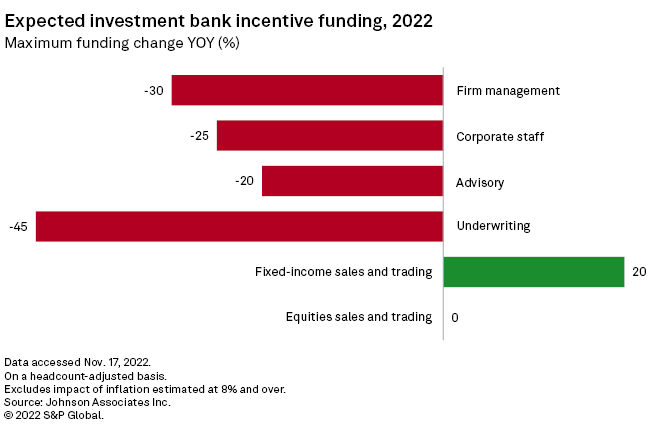

Advisory and underwriting bankers' pay at the largest U.S. groups is expected to shrink 20% to 45% this year, with layoffs across American and European institutions to follow in 2023, recruitment specialists and sector observers said.

Banks went on a hiring spree in 2021 as M&A and initial public offering revenues in particular hit record highs, driven by soaring business volumes. The boom was cut short in early 2022 with the onset of the war in Ukraine and central bank rate hikes across major Western economies.

The global investment banking revenue wallet has shrunk over the first nine months of this year, with the third quarter being the weakest for the top U.S. and European institutions so far.

The average third-quarter revenue drop booked at the 12 leading global investment banks — Bank of America Corp., Citigroup Inc., The Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley, Barclays PLC, BNP Paribas SA, Credit Suisse Group AG, Deutsche Bank AG, HSBC Holdings PLC, Société Générale SA and UBS Group AG — was almost 49% year over year, S&P Global Market Intelligence estimates show.

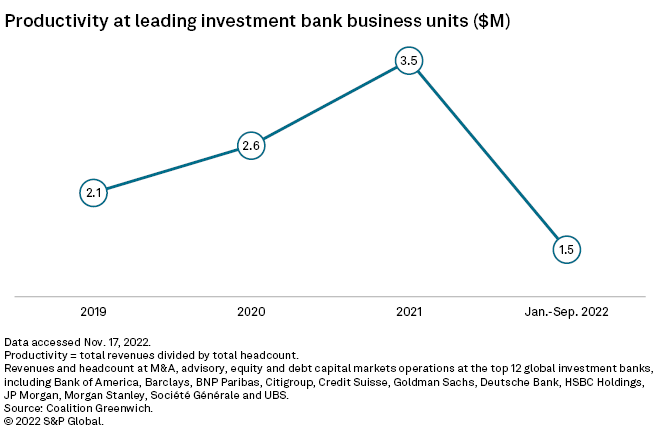

To compensate for the loss of revenue and return to pre-pandemic productivity levels, those 12 banks would need to cut their advisory and underwriting headcount by about 20% in 2023, said Michael Turner, head of CIB analytics at research firm Coalition Greenwich.

Productivity, measured as total investment banking revenue per employee, peaked at $3.5 million in 2021, compared to pre-pandemic average levels of around $2 million, Turner said. This dropped to $1.5 million in the first nine months of 2022, he said. Even though advisory and underwriting revenues are expected to recover in 2023 to about 10% above full-year 2022 levels, investment banks would still have to cut jobs.

Some of the largest banks, including Citigroup, Barclays, Goldman Sachs and Morgan Stanley, have already started cutting investment banking jobs, according to a Nov. 8 Bloomberg News report. Credit Suisse plans to lay off about 900 client-facing staff in its investment bank amid a wider group overhaul, Financial News reported the same day.

Record lows

The first nine months of 2022 was the slowest period for global equity capital markets activity since 2003 and marked the largest year-over-year percentage decline in M&A activity since 2009, according to data provider Refinitiv.

Investment bank revenues in the first nine months plummeted as a result, dropping to their lowest level since 2019, the data shows. Third-quarter figures were particularly weak, recording the lowest quarterly level since the last three months of 2016, Refinitiv said.

Speaking during third-quarter earnings calls, senior bankers did not hold out hope for an immediate improvement. Deutsche Bank CFO James von Molte suggested a weak fourth quarter ahead, while UBS CEO Ralph Hamers predicted a slow start to 2023. "I would be surprised [if] the first quarter is good there," Hamers said Oct. 25.

European banks lead Q3 losers list

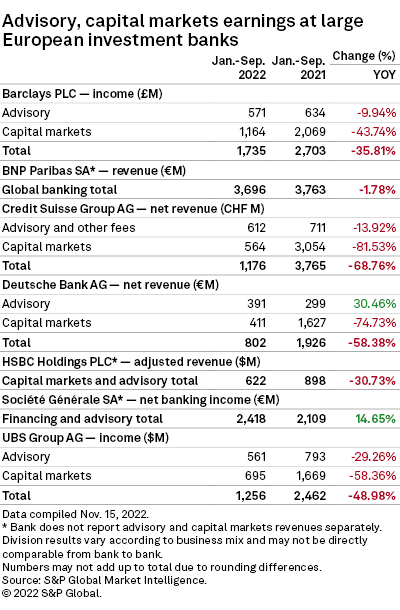

All but one of the investment banks sampled reported third-quarter drops in advisory and underwriting revenues compared to a year ago, Market Intelligence analysis shows.

Deutsche Bank booked the steepest revenue drop for the period, falling more than 85% year over year. Credit Suisse recording the second-largest decline, at 74%.

Business mix, rather than franchise weakness, was the reason for the loss of market share Deutsche Bank suffered in advisory and underwriting amid the "extremely weak" business environment this year, CFO von Moltke told a conference Nov. 9.

Credit Suisse's drop was driven by "substantially lower activity" in equity capital leverage finance and CHF120 million of mark-to-market losses in leverage finance, CFO Dixit Joshi said Oct. 27. The group, which has been plagued by financial losses and compliance failures over the past three years, continues to lose ground to its global peers.

French banks BNP Paribas and Société Générale were the best performers in the third quarter and the first nine months of the year overall, with Société Générale being the only one to book revenue growth for both periods. Key drivers were the robust asset financing and natural resources financing and advisory business, where Société Générale saw strong demand for environmental, social and governance transition solutions, CFO Claire Dumas said on an earnings call Nov. 4.

Coalition Greenwich is a research company owned by CRISIL, which is part of S&P Global Inc.