S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jan, 2023

By Vanya Damyanova and Gaurang Dholakia

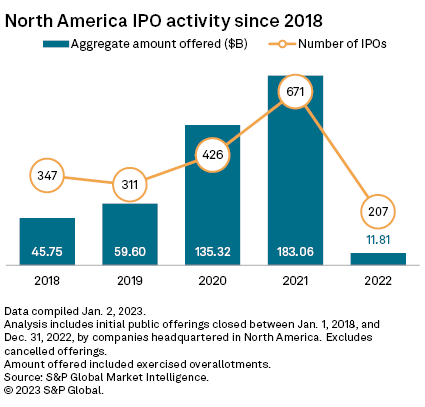

| The volume of IPOs in North America fell more than threefold in 2022. |

The leading U.S. and European investment banks face another challenging year for IPO and equity underwriting revenues as markets in their home regions remain choppy after a dreary 2022.

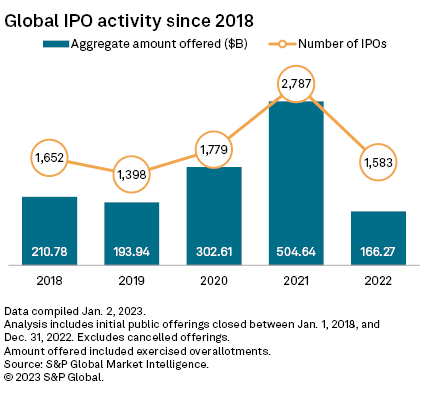

Global IPO activity in 2022 by value was the weakest in five years, mainly due to drops in the Americas and Europe, S&P Global Market Intelligence data shows. Recession fears, uncertainty about the pace of central bank rate hikes and the economic fallout of the war in Ukraine will continue to weigh on activity and banks' ability to earn in 2023, market observers said.

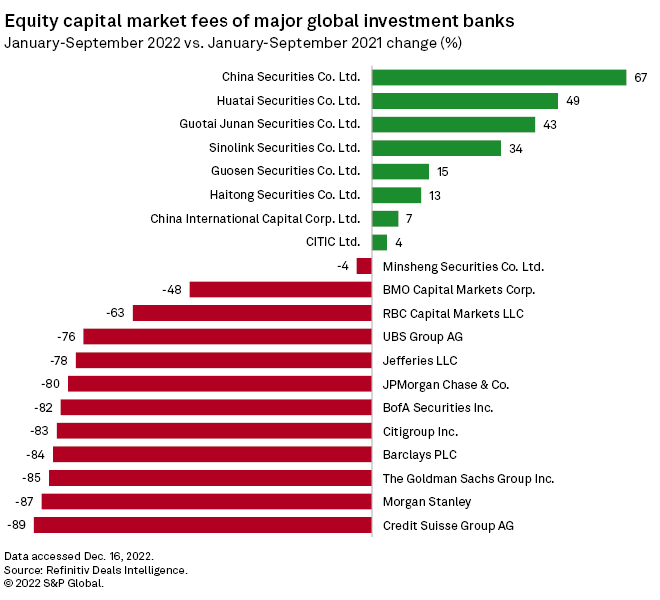

Revenues generated by investment banks from global equity capital markets, or ECM, services fell 67% year over year to some $10.54 billion in the first nine months of 2022, data by London Stock Exchange-owned market intelligence company Refinitiv shows.

The ECM revenue decline was even steeper at Barclays PLC, BofA Securities Inc., Credit Suisse Group AG, Citigroup Inc., The Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley, who all booked revenue drops of 80% or more, while UBS Group AG and Jefferies LLC recorded drops of over 70%.

A year of 2 halves

Banks' revenues from IPO and equity issuance operations may recover somewhat in 2023, though it is unclear whether they will return to pre-pandemic levels, said Eric Li, research director at financial services analytics company Coalition Greenwich. The special purpose acquisition company-driven record highs of 2021 will not be reached in the foreseeable future, Li said.

A return to a "solid" IPO market is unlikely until investors and companies gain confidence that the macroeconomic and geopolitical backdrop will improve over the medium term, said Stuart Newman, head of the global IPO center of PwC U.K. Furthermore, private markets have not caught up to the downward repricing in public markets, which means there is a gap between what buyers ask for and what sellers are willing to offer, Newman noted.

"Industry expectations are that the downturn will continue for at least the first half ... with the second half being the earliest opportunity for some recovery," said Emma Miller, head of investment banking and capital markets at London Stock Exchange.

Given the current pipeline of listings for the next 12 to 24 months, IPO volumes in 2023 are expected to be below 2018/19 levels, Caroline Gauthier, co-head of equities at Edmond de Rothschild, told Market Intelligence.

"With a global recession looming, offerings introduced early in 2023 will likely set the tone for the rest of the year," said Merlin Piscitelli, chief revenue officer of Europe, the Middle East and Africa at deals intelligence provider Datasite.

Investment banks are likely to have more luck with their debt capital markets underwriting and M&A advisory activities in 2023, Barclays CEO C.S. Venkatakrishnan said at a conference in November.

Debt capital markets business will be strong from the first quarter of the year as low valuations boost dealmaking, said Darko Kapor, partner at research company Tricumen.

East-West divide

While IPO activity in North America and Europe plummeted, the declines elsewhere were less pronounced, with stronger performance in China and the Middle East in particular. There is a "sense of an East-West decoupling" in trends given that geopolitical and energy market woes have been more of a Western crisis, Newman said.

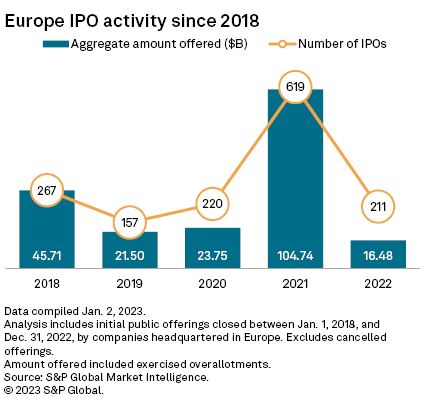

IPO volumes in North America fell more than threefold, and the aggregate amount offered was 6.5% of 2021's total, Market Intelligence data shows. The figures were similar for Europe, though it was home to the year's largest IPO, that of German carmaker Dr. Ing. h.c. F. Porsche AG.

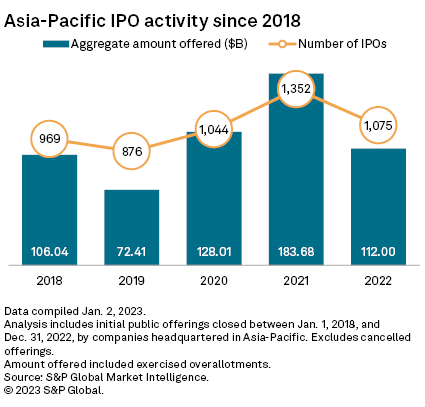

In the Asia-Pacific region, activity was stronger than in both 2018 and 2019 on both a volume and value basis, while in the Middle East, the value of IPOs rose in 2022 to its highest level since 2019. Activity was driven by large listings in the energy sector and privatization initiatives by governments including Saudi Arabia and the United Arab Emirates.

The diverging trends were noticeable in investment bank rankings too. Large Asian players, including Citic Ltd., China Securities Co. Ltd., China International Capital Corp. Ltd., Huatai Securities Co. Ltd., Haitong Securities Co. Ltd. and Guotai Junan Securities Co. Ltd., rose to the top 10 global IPO bookrunner spots in the first nine months of 2022, while major U.S. banks dropped down the list, Refinitiv data shows.

China and the Middle East and Africa region "will be significant in driving an IPO and ECM business recovery in 2023," London Stock Exchange's Miller said.