Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Apr, 2022

|

In 2011, American Electric Power Co.'s 2,900-MW John E. Amos coal-fired power plant finished a major pollution control project started in 2004. Existing coal plants without the same emissions controls may be forced to install them or retire earlier than planned. |

With the U.S. Environmental Protection Agency's climate authority over the nation's power sector in legal limbo, the Biden administration unveiled a plan in March for addressing interstate smog pollution that is projected to drive 18 GW in incremental coal-fired power plant retirements by 2030.

That would rival the nearly 20 GW of coal-fired plants that were retired between January 2015 and April 2016 to comply with the Obama-era Mercury and Air Toxics Standards rule, a contested Clean Air Act regulation finalized in 2012 that was narrowly upheld by the U.S. Supreme Court.

As the conservative-dominated high court considers the scope of the EPA's greenhouse gas authority under a rarely invoked section of the Clean Air Act, the EPA's latest cross-state air pollution plan, issued under a more commonly used section of the act, could present a straightforward opportunity to hasten the nation's shift away from coal-fired electricity.

Power companies are already downplaying the proposal's impact, citing plans to retire most of their potentially affected coal-fired units by the time the plan's pollution control requirements would kick in.

But an analysis of S&P Global Market Intelligence data shows that the EPA's proposal, if finalized as written, could prompt some of the nation's top owners of coal-fired capacity to accelerate their current retirement plans. Comments on the plan are due June 6.

The EPA's cross-state air pollution plan comes as the agency seeks to tackle pollution from existing fossil fuel-fired power plants through an array of air and water regulations, including a separate Clean Water Act rule targeting coal ash pollution.

"I do think there's a sizable portion of the coal fleet that's sitting in a pretty precarious position," Dallas Burtraw, a senior fellow at the independent research organization Resources for the Future, said in a recent interview.

EPA proposal targets nitrogen oxide emissions

The EPA's plan, to be issued under the Clean Air Act's "good neighbor" provision, aims to cut power sector nitrogen oxide, or NOx, emissions in 26 states to 29% below current levels by 2026. The provision was designed to address harmful NOx emissions that drift across state lines and interfere with downwind states' ability to comply with the EPA's National Ambient Air Quality Standards, or NAAQS, for ground-level ozone.

NOx pollution is produced by automobiles, power plants and other industrial facilities. Ground-level ozone, commonly known as smog, is typically worst during the summer months when NOx emissions react with volatile organic compounds in the presence of sunlight. In 2015, the EPA tightened the NAAQS for ozone to 70 parts per billion from a previous threshold of 75 parts per billion set in 2008.

By requiring states to do more to comply with the 2015 standard, the EPA estimated its latest plan would prevent approximately 2,000 hospital and emergency room visits and 1,000 premature deaths annually starting in the 2026 compliance year.

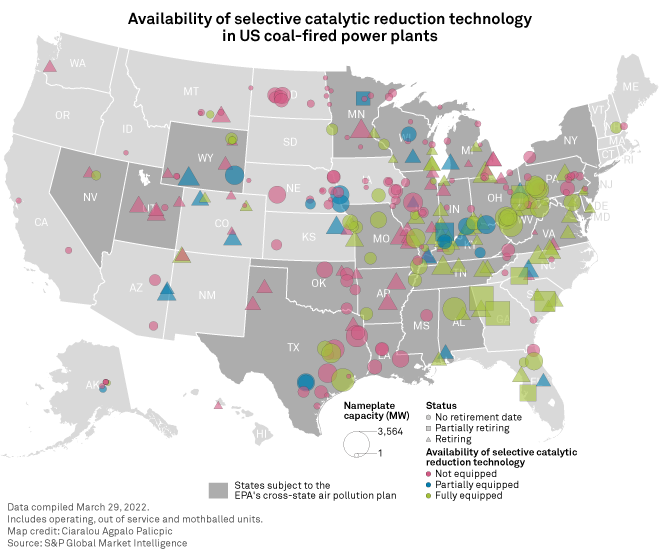

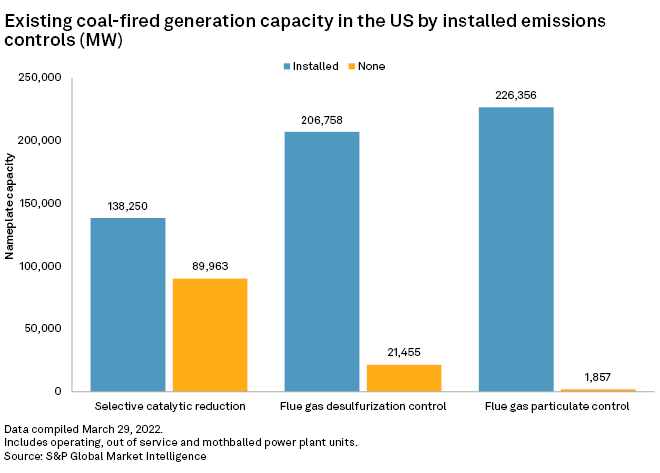

At the heart of the EPA's March proposal are statewide NOx emissions budgets that would build on an existing cap-and-trade framework. The new budgets would effectively require coal-fired units with a nameplate capacity of 100 MW or greater that lack selective catalytic reduction, or SCR, to install that technology by 2027, find other means of compliance, or retire, according to the EPA.

SCR technology, which has been installed on nearly every pulverized coal unit 100 MW or larger built over the past 30 years, can achieve NOx removal efficiencies of up to 90% when operated at full capacity. The technology uses a chemical reaction to break down the NOx naturally present in flue gas streams when coal is combusted for electricity generation.

The EPA's proposal would also set a daily backstop NOx emission rate of 0.14 lb/MMBtu for coal-fired facilities during the summer ozone season, thus preventing plant owners from purchasing emission allowances instead of installing SCR controls or operating existing SCR equipment at full bore.

Using its integrated planning model, a tool designed to model the impact of various environmental policies, the EPA projected that its SCR and backstop emissions rate requirements would result in an incremental 18 GW of coal retirements by 2030 as affected units come into full compliance.

Utilities cite existing retirement plans

The proposal's potential impact on individual companies is unclear. When asked for comment, the nation's top owners of coal-fired capacity without SCR technology pointed to coal exit plans that coincide with major investments in clean energy.

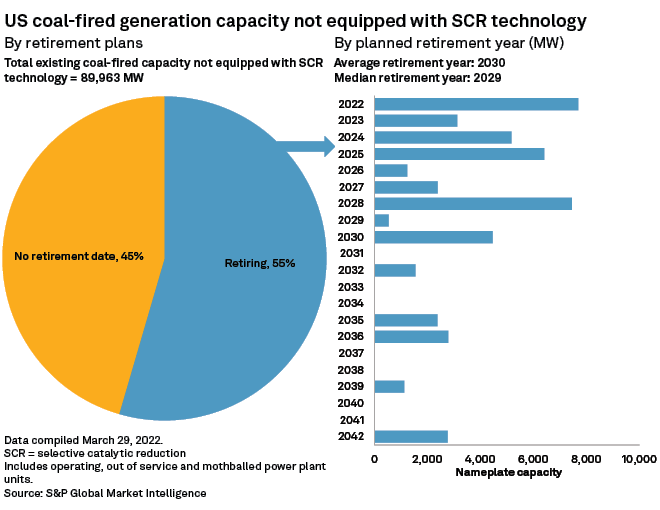

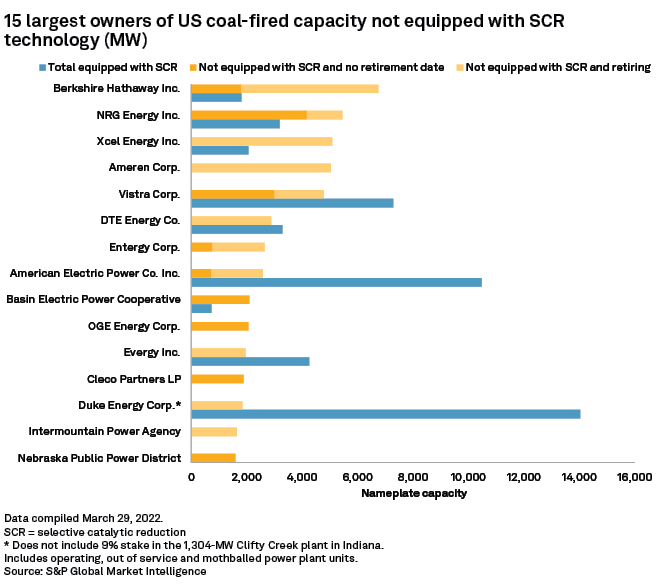

However, owners have announced plans to retire just 55% of the approximately 40% of U.S. coal-fired capacity that lacks SCR controls, with an average retirement year of 2030, according to S&P Global Market Intelligence data.

Berkshire Hathaway Energy, the top owner of coal-fired capacity without SCR controls, said it plans to retire 16 of its coal-fired facilities by 2030. The Berkshire Hathaway Inc. subsidiary said it expects to retire its remaining 14 coal plants sometime before 2050.

"The current proposal focuses on a select portion of our overall service territory," Berkshire Hathaway Energy spokesperson T.J. Page said in an email. Page said the company will consider the need for additional emission controls on an individual basis.

NRG Energy Inc., which ranked second in coal-fired capacity lacking SCR controls, said the company announced the retirement of three potentially affected coal plants well before the EPA unveiled its proposal. "NRG is and will continue to operate in compliance with all permit requirements for our plants," NRG spokesperson Patricia Hammond said in an email.

Xcel Energy Inc. owns the third-largest share of coal-fired capacity without SCR controls. The company is aiming to slash carbon emissions by 80% by 2030 relative to 2005 levels.

"At the present time, there are no changes to our current retirement plans for our facilities and those potentially impacted by the proposed rule," Xcel Energy spokesperson Lacey Nygard said in an email. "Under approved plans, we will retire five coal units between now and 2027 and have proposed plans to fully exit from coal by 2034."

All of Ameren Corp.'s roughly 5,000 MW in coal-fired capacity lacks SCR controls. The company outlined a net-zero-by-2050 plan in February that still anticipates operating two units at its 2,464-MW Labadie plant until 2042.

"Under our current generation plan, by the time EPA's plan would potentially take effect in 2027, Ameren would have retired more than one-third of its current coal-fired capacity," Ajay Arora, the company's chief renewable development officer, said in a statement.

Vistra Corp., fifth on the list of capacity lacking SCR controls, said it announced that it is planning to retire most of its coal fleet by the end of 2027 with three plants set to retire this year. One of the company's two remaining coal plants without retirement dates uses SCR technology.

"We are studying compliance options for the other plant," Vistra spokesperson Meranda Cohn said in an email.

'This isn't the first shoe'

The retirement picture could be muddied even further by a final coal ash rule that requires coal plants to have flue gas pollution controls installed by the end of 2025 or, alternatively, commit to retiring by the end of 2028.

"There are multiple shoes that are going to drop, and this isn't the first shoe," Burtraw of Resources for the Future said of the EPA's cross-state air pollution plan.

As the EPA's interstate smog rulemaking proceeds, environmental groups will be focused on addressing public health concerns and potential loopholes for upwind states, said Hayden Hashimoto, a lawyer for the Clean Air Task Force.

Hashimoto said the environmental community was especially pleased with the EPA's proposal to set backstop emissions rates for coal-fired units during the summer ozone season, citing environmental justice concerns for fence line communities.

"The backstop is important to us in the sense that it would get these units to keep their controls running but also in the sense that environmental groups are generally concerned about trading programs," Hashimoto said. "From an environmental justice focus, I think we would really prefer to have that at least restricted to some degree."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.