Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2022

By Garrett Hering and Anna Duquiatan

| Plus Power's Kapolei Energy Storage Project in Honolulu County, Hawaii, is on track for completion in May 2023. Source: Plus Power |

After months of pandemic-induced delays, an enormous wave of U.S. energy storage assets is approaching shore.

It includes Plus Power's 185-MW/565-MWh Kapolei Energy Storage Project on the Hawaiian island of Oahu. With its output under contract with a subsidiary of Hawaiian Electric Industries Inc., the project is on track for completion in May 2023. That's almost a year later than originally planned.

"Unfortunately, we had the same issues as the rest of the planet with supply chain," Plus Power CEO Brandon Keefe said in an interview. With all lithium-ion battery systems from Tesla Inc. now sitting on foundations, Kapolei is "the postcard from the future, which is going to enable the island to integrate substantially more renewables," Keefe said.

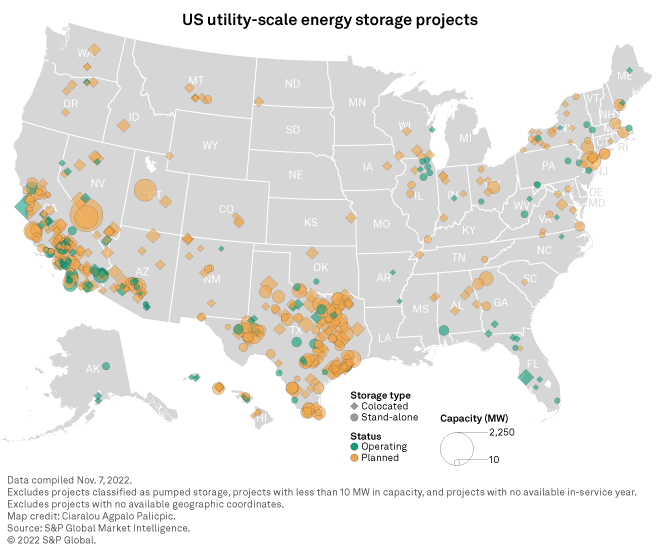

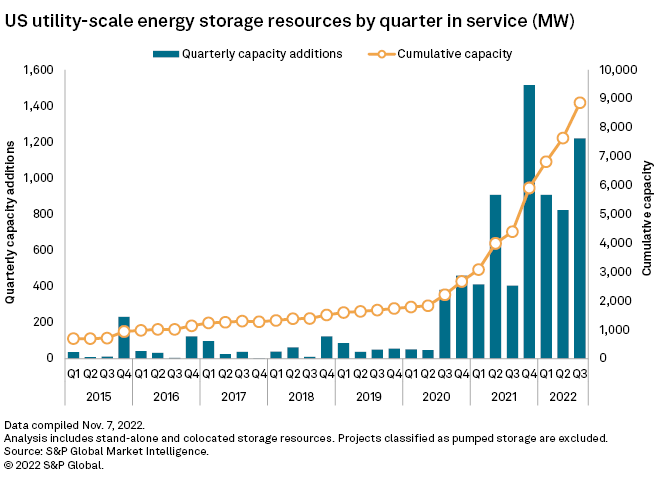

A pack of such postcards arrived in the third quarter of 2022, when developers added more than 1,200 MW of large-scale battery power capacity, tripling from a year ago and pushing total non-hydro storage resources to about 9,200 MW, according to S&P Global Market Intelligence data.

Most battery facilities completed to date are designed to provide between one and four hours of energy storage. Of the 18 projects completed in the third quarter, eight have power capacities of at least 100 MW and 10 are tied to solar farms.

'Musical chairs'

Ensnarled supply chains have forced companies to temper their 2022 ambitions.

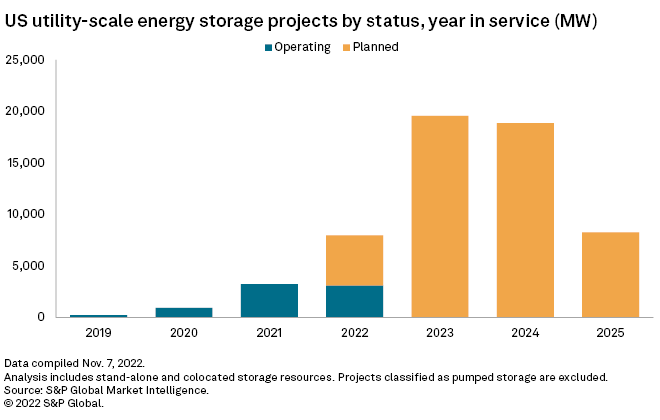

As of Nov. 7, planned additions this year total nearly 8 GW, about 2 GW less than six months earlier, Market Intelligence data shows.

On top of lingering component and labor shortages, the Inflation Reduction Act's improved incentives for energy storage projects, some of which take effect in 2023, could prompt developers to pump the brakes.

But considering 3,300 MW of large-scale storage were completed as of early November, on par with last year's record volume, the industry appears poised for another year of rapid growth.

Overall, the near-term development pipeline keeps surging. Planned additions between 2023 and 2025 have soared to 46 GW, up from 31 GW in June, the data shows.

Among the recently announced facilities are Plus Power's 250-MW Sierra Estrella Energy Storage Project and 90-MW Superstition Energy Storage Project, two four-hour assets in Arizona under contract with Phoenix-area utility Salt River Project.

Keefe does not expect a battery deficit to delay those projects, scheduled to come online by summer 2024. The Houston-headquartered developer currently has excess supply after procuring 6.5 GWh of cells.

"The next year is going to be a game of musical chairs of those who have supply and those who don't," Keefe said. Plus Power is talking with fellow developers in need.

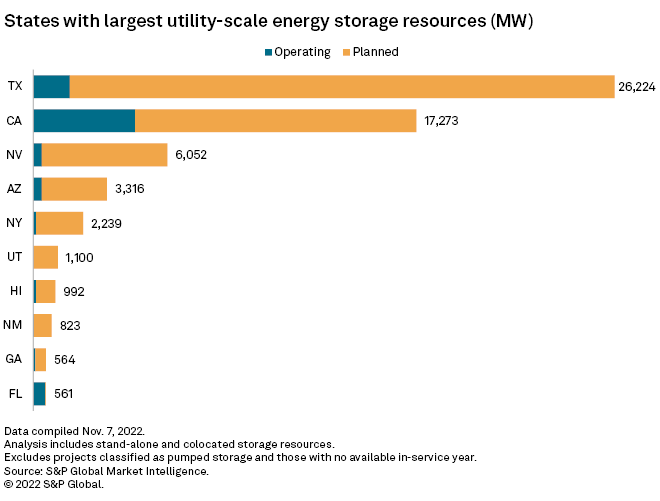

Texas pipeline surges

Most development through 2028 is in Texas, with 23,600 MW planned, up from roughly 15,000 MW six months ago, according to the Market Intelligence data.

Developers have another 12,700 MW planned in California. The state leads the way in terms of operating capacity, with nearly 4,600 MW, compared to 1,646 MW in Texas.

Nevada's pipeline stands at 5,664 MW, with 388 MW in operation, followed by Arizona, with more than 2,900 MW planned and 382 MW operating.