Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Mar, 2022

By Hailey Ross and Jason Woleben

U.S. insurers paid out a record amount of death benefits in 2021 as the devastating impact of COVID-19 pushed mortality above the already elevated levels seen in 2020.

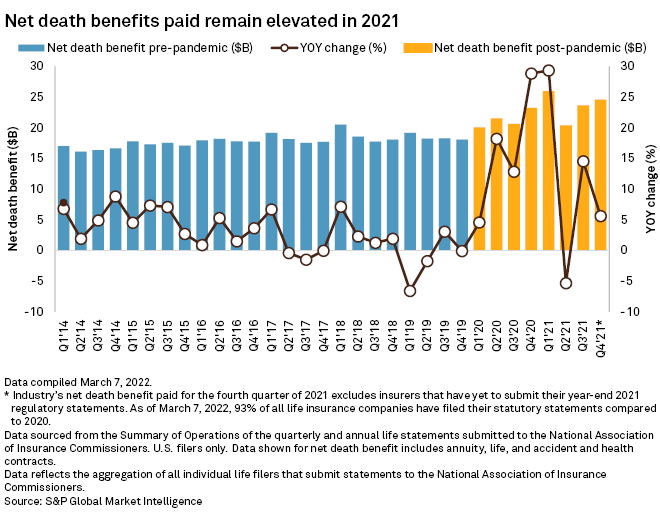

Full-year net death benefits came in at $94.54 billion in 2021, a 10.6% increase from the $85.49 billion paid out in 2020, according to a review of U.S. regulatory data. Net death benefits paid in 2021 were also roughly 28% higher than the $73.74 billion paid in the pre-pandemic year of 2019.

Elevated fourth-quarter mortality

While the Omicron variant, which was dominant during the fourth quarter of 2021, generally caused less severe cases of COVID-19, many U.S. life insurers still reported significantly high mortality levels in the period.

U.S. regulatory data shows net death benefits in the fourth quarter of 2021 were up 5.6% from the year-ago period. That is a striking figure given that the fourth quarter of 2020 saw net death benefits increase 28.8% from the same quarter a year earlier.

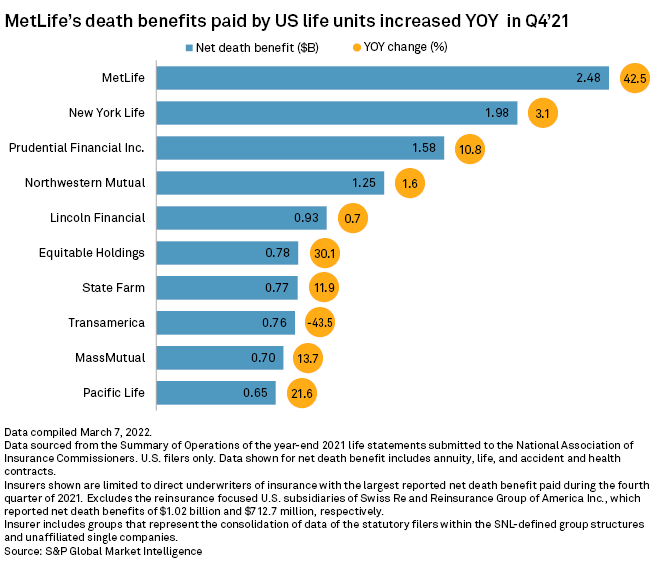

Credit Suisse analyst Andrew Kligerman listed Reinsurance Group of America Inc. and Lincoln National Corp. as having withstood some particularly challenging mortality losses. RGA had COVID-19 claims in its U.S. individual mortality book of $247 million in the fourth quarter of last year, or about $19 million for every 10,000 general population deaths. This figure was at the high end of its expected range of $10 million to $20 million.

Lincoln too saw a spike in claims related to U.S. COVID-19 deaths in the quarter, also experiencing some unfavorable mortality unrelated to COVID-19.

Unum Group similarly posted elevated mortality in its group life business for the fourth quarter of 2021, reporting that its results were "significantly impacted" by COVID-19 claims.

Sun Life Financial Inc. reported "significantly higher-than-expected mortality" related to COVID-19 among the U.S. working age population during the period, while The Hartford Financial Services Group Inc. not only experienced elevated excess mortality but also higher short-term and long-term disability claims.

U.S. COVID mortality hits European reinsurers

A number of European reinsurers also reported substantial impacts stemming from COVID-19 mortality claims in their most recent earnings results.

SCOR SE saw higher life reinsurance claims from COVID-19 related deaths in the fourth quarter of 2021, but its top executive expects a "much milder" COVID-19 experience in the coming periods, particularly the second and third quarter.

Lancashire Holdings Ltd. CEO Alex Maloney meanwhile described peers' decisions to release provisions set aside to pay for COVID-19 claims as potentially "premature."

Swiss Re AGSwiss Re AG reported a little more than $2 billion in COVID-19 claims for full year 2021. Executives said pandemic-related mortality in the U.S. accounts for the bulk of the claims and "remains significant."