S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Feb, 2022

By Regina Liezl Gambe

Sector Spotlight: Global Financials is a weekly summary of exclusive banking, financial services and insurance industry news and analysis from S&P Global Market Intelligence.

US and Canada

* Biden's pick signals a changing climate for Fed bank regulation

U.S. President Joe Biden's nominee to oversee bank regulation at the Federal Reserve, Sarah Bloom Raskin, is expected to emphasize climate change as a risk to the industry.

* Credit unions grow branch count while banks slash locations

Credit unions added branches in 2021, a year that represented a record high for branch closures in the banking industry.

* Some community banks looking at MOEs to drive future sale value

Community banks are growing increasingly interested in mergers of equals for a number of reasons, such as to rapidly gain scale, offset current industry headwinds or create value for a potential sale in the future, deal advisers said.

Europe, Middle East and Africa

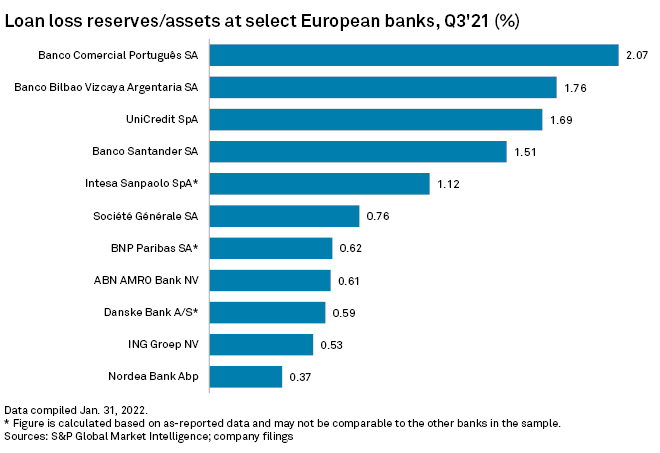

* Europe's banks urged to wait and see before cutting loan loss reserves

The money banks set aside against future bad loans include so-called management overlays, which the European Central Bank is scrutinizing.

* European fintech unicorns more than double in 2021

Europe is home to 45 private financial technology companies that have a post-money valuation of at least $1 billion, with Sweden-based Klarna leading the way.

Latin America

* Q&A: BTG's Landers betting on LatAm banks, commodities in 2022

Will Landers, head of Latin American equities at BTG Pactual Asset Management SA, spoke with S&P Global Market Intelligence about the outlook for Latin America, saying he favors banks with strong balance sheets and commodities that are in short supply over consumer and tech.

Asia-Pacific

* Japanese megabanks cautious about outlook beyond strong FY'22 profits

Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. are all on course to achieve, or even beat, their full-year earnings estimates, helped by write-backs of prior loan loss provisions for pandemic-related bad loans and stronger operating income.

* Indian government plans debut green bond sale, digital assets tax

India will issue green bonds for the first time as part of the government's borrowing plan to mobilize resources for green infrastructure after the nation committed to a net-zero emissions target by 2070.

* Indian banks ready to support world's fastest-growing economy – government

India's banking sector is ready to support private investment, with an expected increase in private consumption that will propel capacity utilization, according to a government report.

Global Insurance

* Merck case leaves cyber insurers wanting for clarity on war exclusions

The pharmaceutical giant's court battle over coverage of its NotPetya claims has not led to hoped-for guidance on the attribution of attacks, according to cyber insurance brokers.

* Kemper, others in Calif. private auto rate push warn of 'historic' severity rise

Concerns about adverse claims severity trends have ended a historically inactive stretch for private auto rate increases in California, with one carrier warning that inflation would push loss costs to "an all-time high."