Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Apr, 2022

By Umer Khan

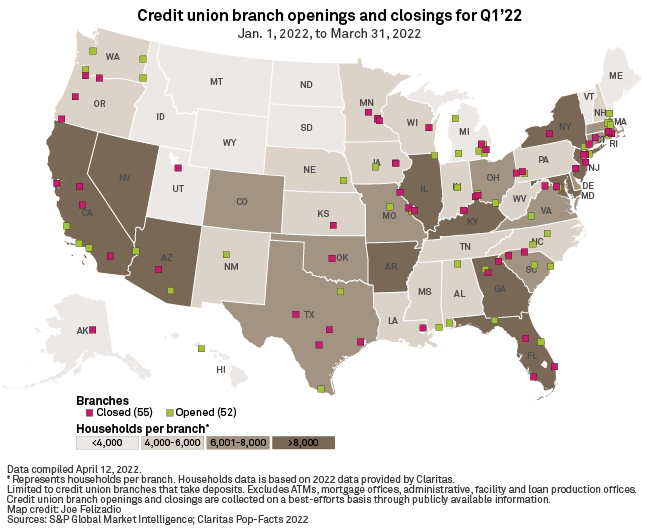

U.S. credit unions closed 55 branches and opened 52 in the first quarter, dropping total credit union branches to 20,233 at the end of March, according to S&P Global Market Intelligence data.

By comparison, U.S. credit unions added a net 46 branches across all of 2021.

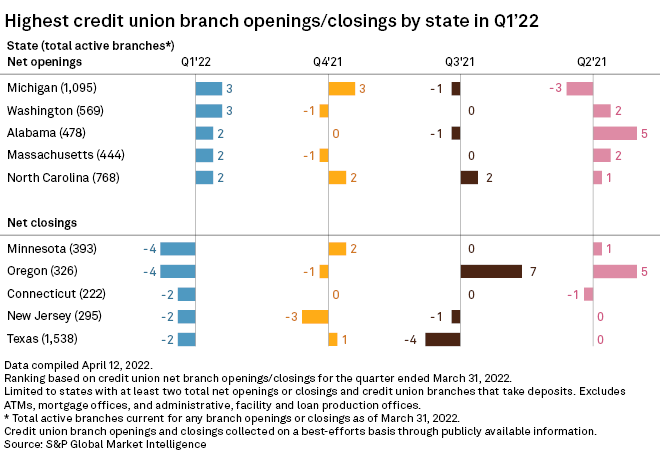

Top credit unions by openings and closingsChelsea, Mass.-based Metro CU was the largest net opener in the industry during the first quarter, with three openings and zero closures. Meanwhile, Chubbuck, Idaho-based Idaho Central CU; Smithfield, R.I.-based Navigant CU; and Raleigh, N.C.-based State Employees CU tied for second, with two net openings apiece.

Coquille, Ore.-based First Community CU and Falcon Heights, Minn.-based Spire CU led the country last month, with three closures each, followed by New Providence, N.J.-based Advanced Financial FCU; Cedar Rapids, Iowa-based Collins Community CU; Atlanta-based Georgia's Own CU; Lakeland, Fla.-based MIDFLORIDA CU; and New York-based University Settlement FCU, with two net closures.

University Settlement FCU is winding down operations and reported only $11,000 in assets as of September 2021, down from $751,000 at the end of September 2020.

At the state level, Michigan and Washington had the most net openings in the first quarter at three, while Minnesota and Oregon both had four net closures.