S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Jul, 2021

By Michael O'Connor and Charlsy Panzino

U.S. investment-grade corporate bond sales are on track for a near-record year, as companies look to lock in low-cost funding before the expected easing of Federal Reserve support.

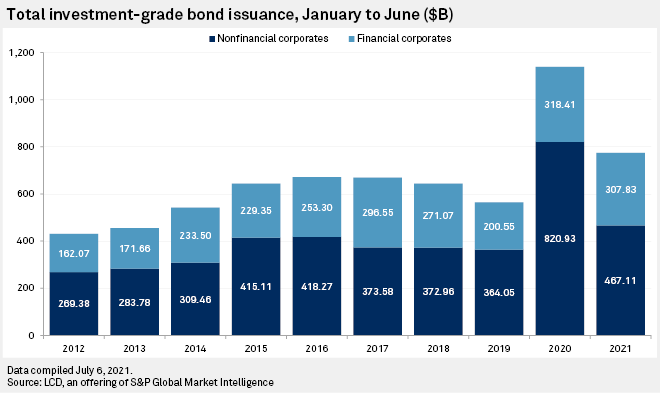

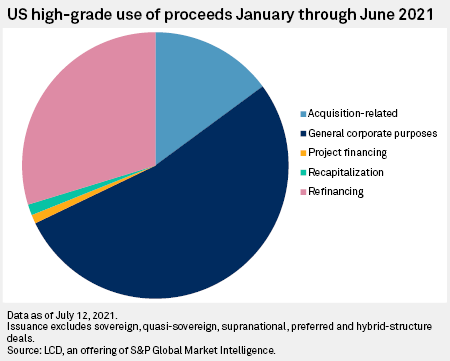

Issuers such as Amazon.com Inc. and Verizon Communications Inc. sold $774.94 billion of bonds in the first half, a total only surpassed by last year's coronavirus debt deluge, according to data from LCD. M&A-related issuance surged 50% over the same period in 2020 to $115.48 billion. LCD has tracked investment-grade issuance since 2009.

Sales may also be comparatively busy in the second half of the year, as borrowers will likely want to raise funds for refinancing and near-record levels of M&A before the Fed starts to step back from bond buying. Treasury yields have already crept up from their 2020 lows as a rebounding economy and waning pandemic weaken the argument for central-bank support.

"It is smart for corporates to continue to issue and refinance higher coupon debt," said Rob Daly, director of fixed income at Glenmede Investment Management. "I think we could see more issuance than our initial expectation, given the strength of the financing environment."

Second-half bond issuance should be "fairly robust," Stacey McAllister, director of investment-grade fixed-income research at financial services firm Eaton Vance, said in an interview. "The all-in cost of debt for companies is very low. Could it go lower? Potentially, but at some point, it probably has to go higher."

Corporate bond issuance typically slows in the second half of each year compared to the first half.

Possible jump in borrowing costs

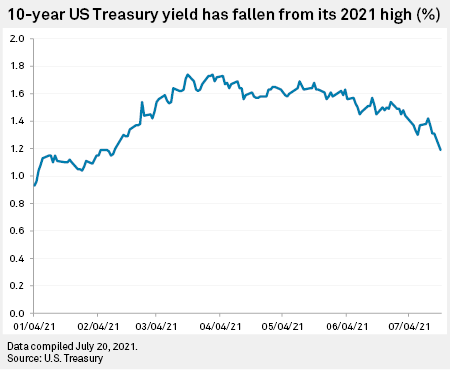

The 10-year U.S. Treasury yield — a key measure of long-term borrowing costs — hit 1.30% on July 23, down 58 basis points from the start of 2020 before the pandemic hit the U.S. The yield, which moves opposite to price, has also retreated from its 2021 high of 1.74%.

Borrowing costs may start to climb again later in the year and into next year amid resilient economic growth and the possibility of the Federal Reserve pulling back on quantitative easing, according to Tim Warrick, a managing director and portfolio manager at Principal Global Fixed Income. That is encouraging issuers to jump into the market and take advantage of low rates and thin spreads, he said.

"Some of those borrowers are concerned that not only rates may go higher, but the risk premiums may go higher later in the year and into 2022, as well," he said.

The economic rebound has already prompted Fed policymakers to start considering when to cool the pace of market support as inflation rises.

The emerging threat of the COVID-19 delta variant and resistance to vaccination efforts are also likely contributing to lower Treasury yields, according to Eric Peiffer, managing director and head of high-grade and high-yield capital markets at KeyBanc Capital Markets.

M&A, refinancing in the mix

Companies are taking advantage of the low rates and improving economic outlook to resume acquisitions after a slump in activity last year. Borrowers such as AT&T Inc. and salesforce.com inc. helped investment-grade bond issuance for acquisition-related purposes surge back in the first half after 2020's pandemic plunge. M&A sales tumbled to $76.85 billion in 2020 from $108.73 billion in 2019, according to LCD.

"We have seen a material uptick in M&A financing this year," said Marc Fratepietro, co-head of investment-grade debt capital markets at Deutsche Bank.

Continued low-interest rates will help fuel M&A, said Gary Lembo, a partner at advisory firm Paladin, in an email. The status of the pandemic remains key.

"If COVID does not reemerge, high-grade bond issuance should remain strong in the second half of 2021," Lembo said. "If COVID does reemerge companies will likely slow their M&A activity until such time COVID goes away."

LCD is an offering of S&P Global Market Intelligence.